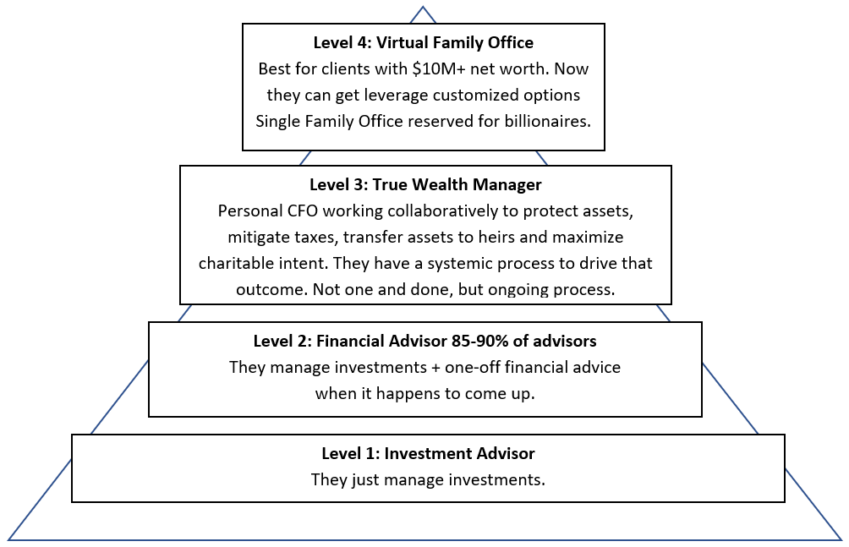

How complex is your client’s financial security?

How complex is your client’s financial security?

By Anthony Glomski

Uberwealthy families like the Vanderbilts, Morgans and Rockefellers realized several centuries ago that managing all of their vast wealth and resources was extremely difficult. Sure, they had scores of advisors working exclusively for their families. Still, when each of those advisors was toiling away in their silo, there was no coordination of their efforts and lots of waste and inefficiency.

MORE: Maximize Your Client’s Charitable Giving | Plan for Your Client to Exit Their Business | Enhance Wealth by Mitigating Taxes | What Clients Need to Know | What Level of Advice Do Entrepreneurs Need?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

So, they established formal office headquarters where all financial experts working on their behalf could meet in one place to make it easier to oversee and coordinate everything important to the extended family – their taxes, asset protection, wealth transfer, and their legacy planning, etc.

TO READ THE FULL ARTICLE