Tax and accounting pros share their thoughts, both negative and positive.

Tax and accounting pros share their thoughts, both negative and positive.

By CPA Trendlines Research

Early results of the CPA Trendlines Outlook 2024 Emerging Issues, Opportunities and Trends survey are finding practitioners cautiously optimistic about the potentials of artificial intelligence.

MORE: Looking for Recent Grads? Good Luck | CPA Biz Is Booming, But for How Long? | Survey Respondents See Exciting Year Coming Up | SURVEY: Accountants Economic Outlook Brightens | Research: Accounting Pros Cautiously Optimistic about Generative AI | How Auditors Can Beat AI | Why the U.S. Must Act Now to Protect Our Online Privacy

Exclusively for PRO Members. Log in here or upgrade to PRO today.

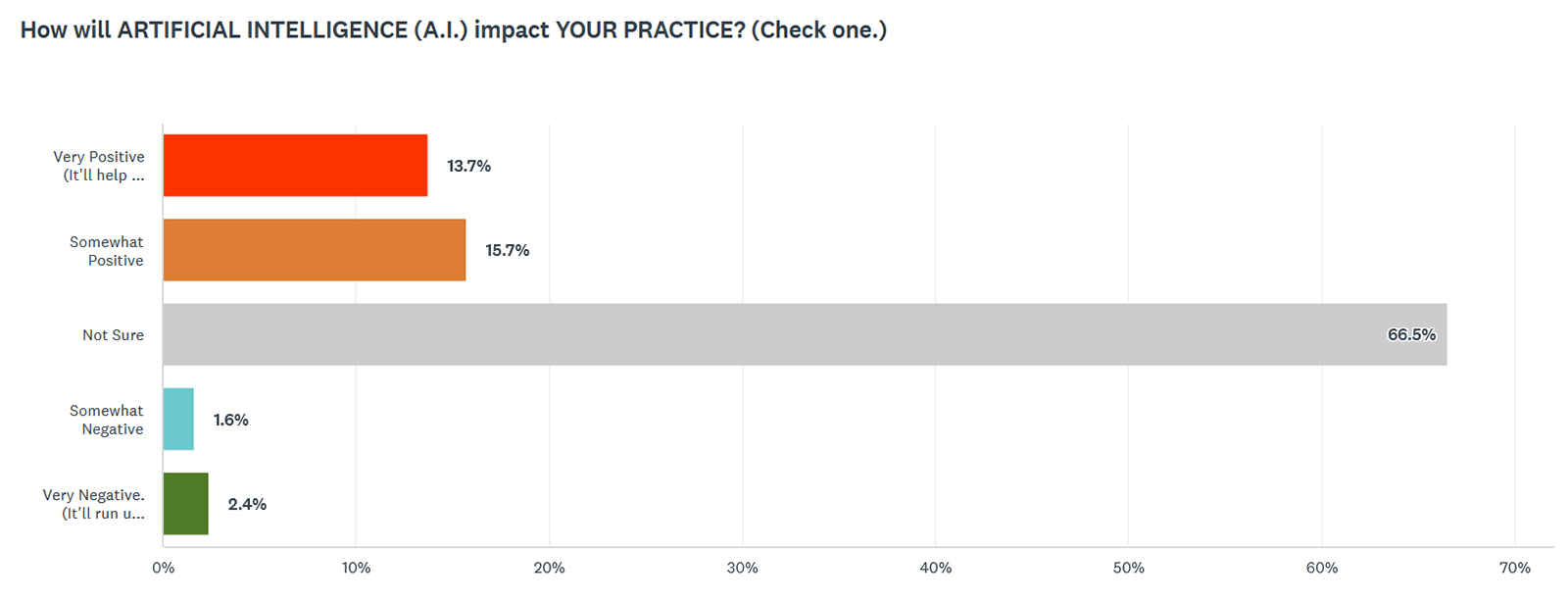

A lot more respondents see AI having a positive impact on their firms rather than a negative impact, but the vast majority – 67 percent – admit that they just aren’t sure.

Twelve percent say the impact will be “very positive” as it increases efficiency, and another 17 percent are pretty sure the impact will be “somewhat positive.” Only 4 percent fear a negative impact.

Even the Unsure Are Imagining

Even the unsure are imagining how AI might help. Here are some unsure thoughts:

- Dean Harloff, owner of a firm in Florida, says AI will help with “mundane jobs and applications.”

- Julia E. Hampton, with a firm in Missouri, says it will make research faster.

- Javier Ibarluzea, a tax consultant in Michigan, wants to see it automate processes.

- Lisa A. Wollersheim, CEO of Heights Financial Management in Illinois, says, “I think it can help with research and with client correspondence.”

- Robert Davidson, president of UK’s Arundel Consulting, says, “Overhyped and not reliable for tax research. OK for marketing materials to keep website refreshed.”

Brian T. Metzger, a principal with Grizzle, Glenn, Adams & Martin in Georgia, isn’t sure, either, but he’s more worried about the downside than the possible upside.

“Could be very disruptive,” he says, “and result in the loss of ‘low-hanging’ clients (e.g., relatively simple returns).”

Kelli K. Cox, a partner with California-based CGC Accountants and Advisors, is in the “somewhat positive” impact camp. She says, “I think AI will make it easier to communicate with clients. I’ve already made some explainer videos that will help me in not having to repeat myself over, and over, and over!”

Billie Anne Grigg, with Profit First Professionals, sees a very positive impact, but she sees the downside, too, predicting AI will “speed up research (positive); pump a lot of incorrect or incomplete information into the world (negative).”

How It Might Help

Sure, unsure, excited or scared, these early respondents offered a host of ways AI might help. Among them:

- Automate mundane and repetitive tasks

- Tax research

- Data entry

- Writing letters

- Communication

- Applications

- Automation of grunt work

- Website management

- More consistency

- Systemize data collection

- Single out essentials in a document

- Identify unreported or underreported transaction in tax returns

- Devise possible strategies

- Automatic email reminders

- Manage document lists

- Help with staffing

- Build workflows

- Eliminate redundancy

- Help write marketing copy

- Minimize risk

There were also a few negative impacts:

- Pumping fake information into the world

- Garbage in, garbage out

- Lulling clients into thinking they can do their own taxes

- Take away the accounting business

- “Replace me”

The CPA Trendlines prediction is that the number of “unsures” will decrease next year as practitioners get a better grasp on this unprecedented and unproven tool. Whether they are more sure about the positive or the negative has yet to be seen.

How will AI impact your firm? Your colleagues across the nation would like to know what you think about AI, new opportunities, Client Accounting Services, the economy and other topics. Click here to be part of the Outlook 2024 Emerging Issues, Opportunities and Trends survey.

How will AI impact your firm? Your colleagues across the nation would like to know what you think about AI, new opportunities, Client Accounting Services, the economy and other topics. Click here to be part of the Outlook 2024 Emerging Issues, Opportunities and Trends survey.