Visits to IRS.gov top half a billion.

By Beth Bellor

CPA Trendlines Research

The tax season has overcome its later start, with all the IRS’ weekly markers surpassing 2023 figures except for the total numbers of refunds and direct deposit refunds.

MORE: Tax Pros Own 53% of E-filings | Tax Stats Still Playing Catchup | Tax Pros Take the Edge in E-Filings | Tax Pros Gain Ground, and DIYers Maintain Lead | Tax Pros Handle 46.4% of E-filing | Tax Refunds, Tax Pro Market Share Trending Up | Refunds Up as Tax Pros Tackle 41.5% of E-filings | Tax Pros Handle 37.7% of E-filings | Tax Pros File 33% of Early Returns

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

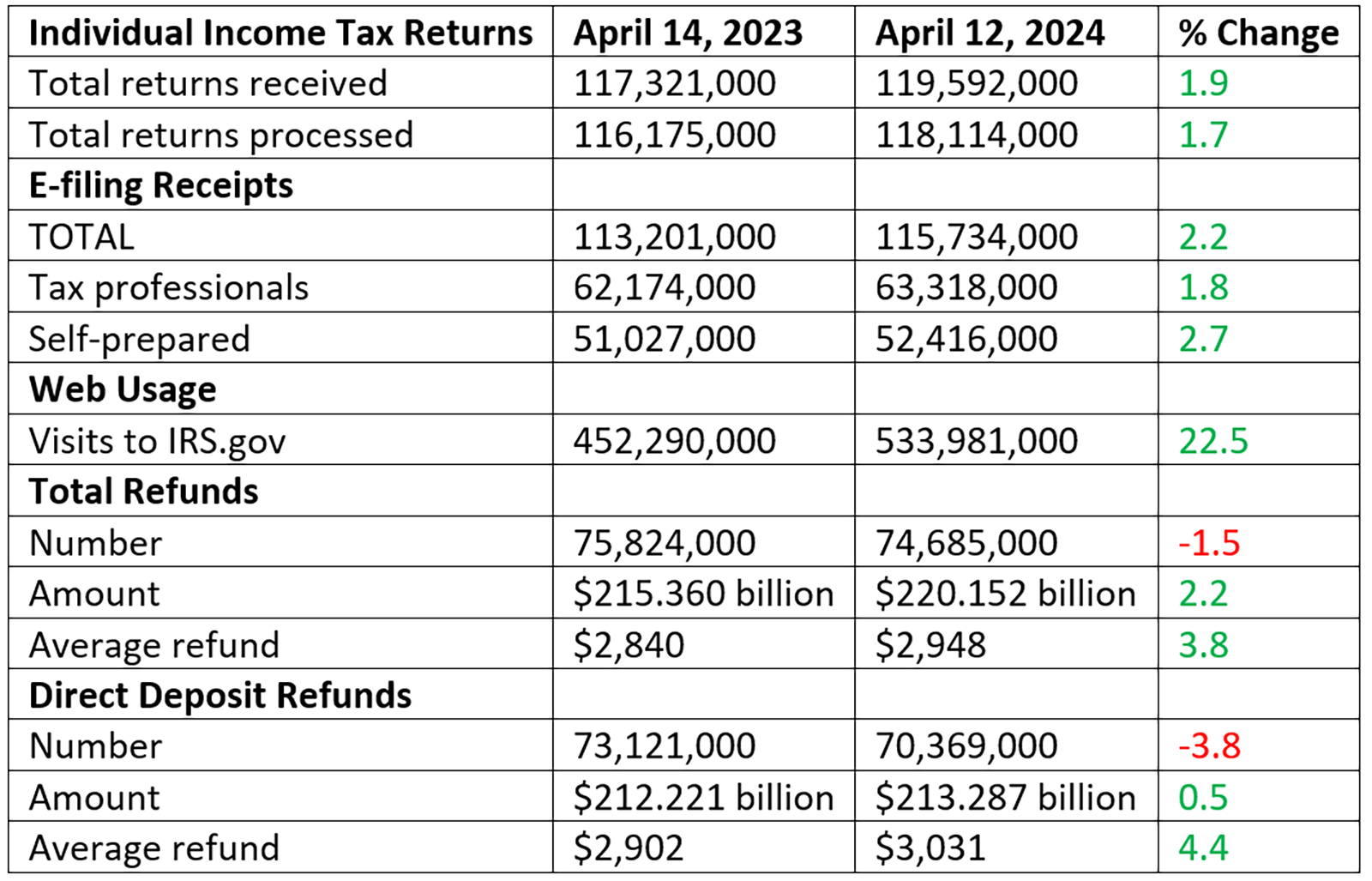

As of April 12, the latest data available, the agency had received 119.6 million individual income tax returns, up 1.9 percent from the same period one year ago. It had processed 118.1 million returns, up 1.7 percent.

E-filings

Electronic filings totaled 115.7 million, up 2.2 percent. Tax professionals submitted 63.3 million, up 1.8 percent, and self-preparers handled 52.4 million, up 2.7 percent.

Tax pros were responsible for 54.7 percent of e-filings.

Website Visits

Visits to IRS.gov numbered 534 million, up 22.5 percent.

Refunds

Refunds totaled 74.7 million, down 1.5 percent, in the total amount of $220.2 billion, up 2.2 percent. The average refund of $2,948 was up 3.8 percent.

Direct deposit refunds totaled 70.4 million, down 3.8 percent, in the total amount of $213.3 billion, up 0.5 percent. The average direct deposit refund of $3,031 was up 4.4 percent.