Ask CPA Trendlines

Now, with smarter search, deeper analysis, more detailed responses (v.2.7).

Now, with smarter search, deeper analysis, more detailed responses (v.2.7).

Exclusively for PRO Members Only, here

By CPA Trendlines Research

The accounting profession is changing faster than at any time in its modern history—and private equity is driving the shift. More than $30 billion in new capital has entered CPA firms since 2020, igniting a powerful wave of consolidation, modernization, and strategic reinvention. Firms that once relied on incremental growth and traditional partnership structures are now operating as high-performance platforms built for scale, technology adoption, and national reach.

The CPA PE Playbook is the most comprehensive analysis available today on this historic transformation.

If you want to know where the profession is heading, how PE-backed firms are competing, and what it will take to thrive in the next decade, this is the report you need.

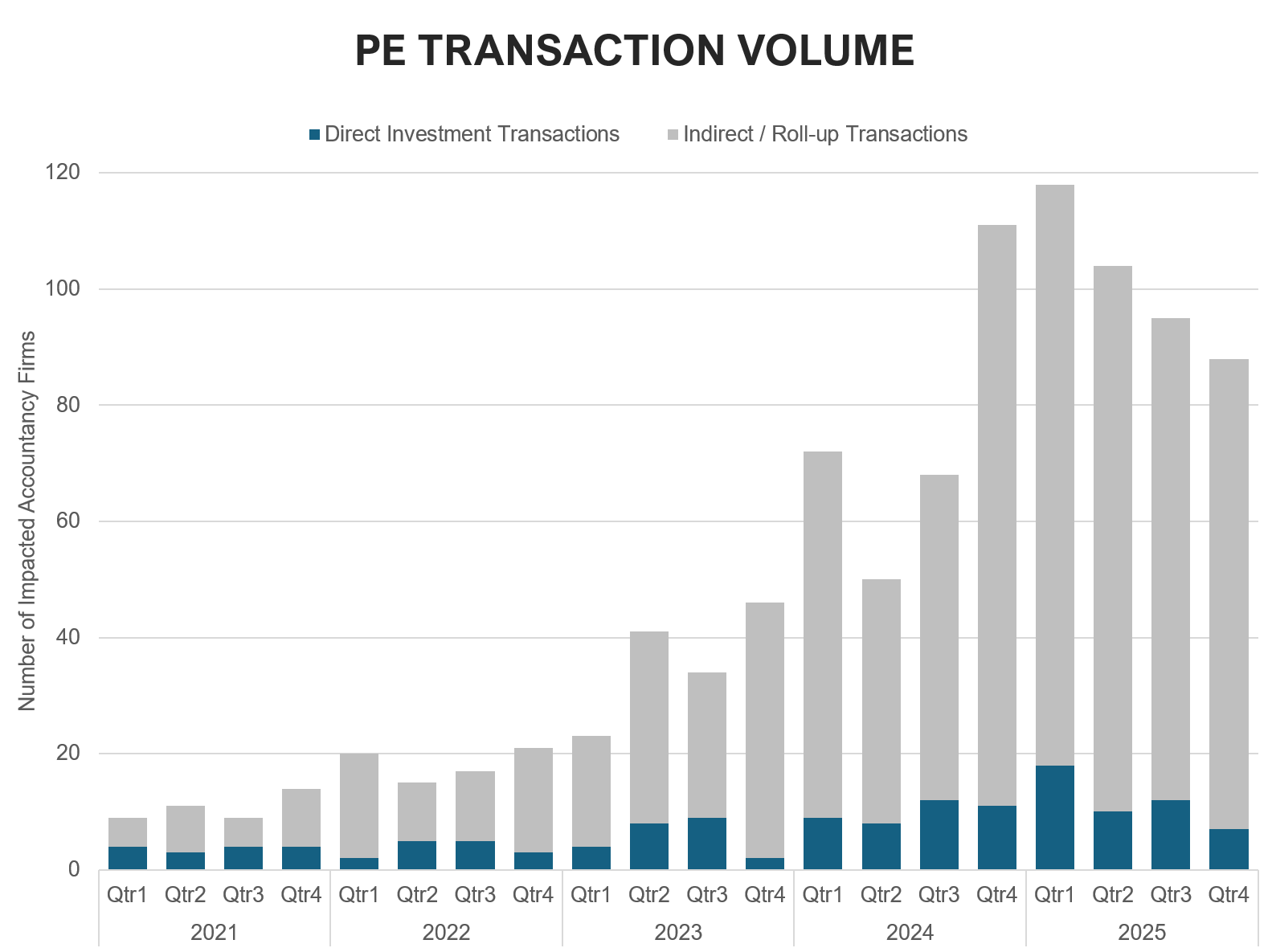

Fewer than 200 investors triggered almost 900 acquisitions.

By CPA Trendlines Research

A multiplier that has grown fourfold since 2021 reveals a transformation driven not by new private equity entrants, but by platform firms consuming the mid-market at speed.

It belies the notion that PE is taking over the accounting profession. In fact, new global research argues that local and mid-size firms worldwide are taking control of their own futures and using institutional capital to pick up the tab.

MORE Private Equity | Deal Tracker: PE Platforms Accelerate the Grab for CPA Firms | With Apax Sale, CohnReznick Starts Building a National Platform | Unicorns and Funerals: From the Demise of Botkeeper to the Rise of Basis.ai | Jeremy Dubow: Raising the Bar for Talent | Big 4 Transparency | Twelve Great Reasons to Merge In a Smaller Accounting Firm

The numbers that define private equity’s advance into accounting do not look the way most people expect. The headlines feature the big firms and the brand-name investors — TowerBrook Capital and EisnerAmper, New Mountain Capital and Grant Thornton, Ares Management and Baker Tilly. But the actual architecture of the transformation is being built one level below: in the relentless, largely unnoticed roll-up of smaller practices into PE-backed platforms.

How AI Accounting Went From Pioneering to Inevitable in 1 Month and 11 Years.

By CPA Trendlines Research

In a matter of days, AI in accounting produced its most celebrated funding round and its most instructive collapse. Both developments were years in the making. Neither was a surprise to anyone paying close attention.

The leap from Botkeeper’s machine learning to Basis.ai’s agentic AI didn’t just change the technology. It changed which companies survive.

MORE AI | Outlook 2026: Agentic AI Reaches the Tipping Point in Tax and Accounting Firms | Gen AI in Accounting: Epic Transformation, or Overheated Hype? | AI Tax App Crashes Financial Stocks on Wall Street | The $125 Billion Challenge: Intuit’s AI Platform Redraws the Accounting Map | Bot Wars: Wolters Kluwer, Intuit, Thomson Reuters Battle for AI Dominance in CPA Firms | How TaxDome and Juno Just Changed the Tax Tech Game | Meet Basis, the New AI Bookkeeper on the Block

The juxtaposition is not just ironic. It is clarifying.

What happened in February 2026 was not a story about whether AI works in accounting. The research says it does.

It was a story about which business models survive the moment when AI actually arrives — and which ones get caught between the old world and the new one, having spent years and tens of millions of dollars building toward a future that materialized faster, and harder, than anyone expected.

The profession talks too much about deadlines and not enough about impact. Students are listening.

MOVE Like This

With Bonnie Buol Ruszczyk

For CPA Trendlines Research

The CPA profession has only itself to blame for a talent shortage.

A list of 21 issues to consider.

By Marc Rosenberg

CPA Firm Mergers: Your Complete Guide

When considering a merger of sole practitioners, there are numerous critical issues to negotiate. Twenty-one, in fact.

1. Method/system for splitting the profits. Keep in mind that if you devise a system that essentially revolves around making each solo a profit center, as if they still had their own firms, it will tend to discourage the two of you working together as one firm.

READ MORE →

The convergence of trends makes pricing changes imperative.

By Jody Padar

Radical Pricing – By The Radical CPA

The speed of change is faster than ever. How are you going to react to it? That’s what I’m really preparing you for – redesigning your entire business model to become a more client-centric advisor. Value-based pricing models are the key component but not the whole story.

Today’s automation, new competitors, staffing challenges and new technologies are conspiring to bring clients more value than they could have enjoyed before. All of it is shifting the way you need to think about your services, what clients value and how you get paid fairly for the expertise you bring to the table.

READ MORE →