Tax Chat: Eric Green Reveals The Tax Rep Guide to Tax Season

.

Seth Fineberg

With Eric Green

Renowned tax attorney Eric L. Green delivers a roadmap for seizing tax resolution opportunities this tax season in the new video from last week’s first Tax Chat of the year, hosted by Seth Fineberg.

MORE TAX SEASON: FTC Nails TurboTax for ‘Free Filing’ Scam | | Offer Your Tax Clients Other Services | Higher Fees to Start: Ten Ways to Make Your Tax Season Better | Tax Pros Handle 37.7% of E-filings | If Only the IRS’s Tax Pro Were Useful | Can Your Tax Reviewers Answer These 10 Questions? | Tax Pros File 33% of Early Returns | Can’t IRS Online Accounts Be More Useful?

In this live webinar, attendees – and now you – get the fundamentals for catching lucrative tax rep engagements without adding to busy season workloads. With live, real-time Q&A, everyone’s questions got answered.

READ MORE →

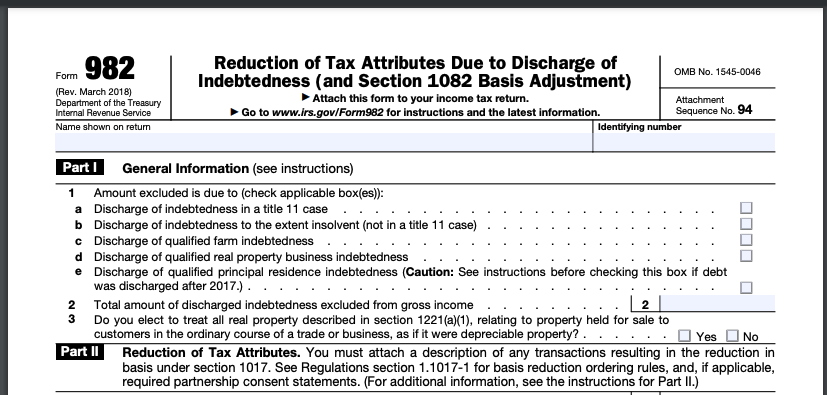

Meet Form 982.

Meet Form 982.