Why estate planners may now need to re-think an uncountable number of revocable trusts in at least 30 jurisdictions.

Why estate planners may now need to re-think an uncountable number of revocable trusts in at least 30 jurisdictions.

By Seymour Goldberg, CPA, MBA (Taxation), JD

The Practitioner’s Guide to the IRA Distribution Rules under the SECURE Act

A Kansas court case may make it necessary to redo many IRA trusts and change them from revocable trusts to irrevocable trusts, affecting an untold number of estate plans in at least 30 jurisdictions. The case revolves around a woman named Wand and a $93,314.48 promissory note to a bank.

Wanda was living in a retirement home and getting by on Medicaid when she died in 2003, leaving an estate that owed more than it owned. Wanda’s IRA accounts were set up to be payable to her revocable trust. But the court ruled that, because the estate’s assets were inadequate, the bank could seize Wanda’s IRA accounts.

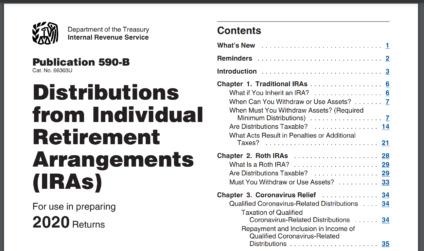

MORE: Why You Really Need a Protective Trust | IRS Updates Pub. 590B on IRA Distributions | IRS Pledges to Fix SECURE Act 10-Year RMD Rule

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

So, from an asset protection point of view, it may be worthwhile to use an irrevocable standalone trust, instead of a revocable standalone trust, as the beneficiary of an IRA account. This may be especially true in jurisdictions that have adopted versions of the Uniform Trust Code.

The reason this case is so important is that during an IRA owner’s lifetime, IRA accounts are protected from creditors, except the IRS, of course. But there has never been a case prior to the Kansas case in which the deceased IRA owner’s creditors – other than the IRS – could collect from a beneficiary of a deceased IRA owner’s IRA account unless the beneficiary the IRA account of the deceased IRA owner was his or her estate.

Since many attorneys in the U.S. use revocable trusts in estate planning and not irrevocable trusts, there may be many revocable trusts that have been selected as the IRA owner’s beneficiary of his or her IRA account. Based on the Kansas case, it may be necessary to review an uncountable number of trusts and change them from revocable to irrevocable trusts.

READ MORE →

Why estate planners may now need to re-think an uncountable number of revocable trusts in at least 30 jurisdictions.

Why estate planners may now need to re-think an uncountable number of revocable trusts in at least 30 jurisdictions. Extract from forthcoming update to

Extract from forthcoming update to