By CPA Trendlines

We all know how the IRS works. They send a letter to a possibly delinquent taxpayer who, in quivering fear, returns a response that is slipped through the mail slot in the IRS door, where it falls into a shredder that feeds into a massive onsite incinerator. The letter’s ashen remains are then loaded onto a rocket and shot toward Alpha Centauri, never to be seen again.

MORE: Hunker Down: The IRS Backlog Isn’t Going Away Anytime Soon | The IRS Studebaker Bomb | Imagine IRS ‘Concierge’ Service. Just Imagine. | IRS Has Recruiting Problems, Too

Exclusively for PRO Members. Log in here or upgrade to PRO today.

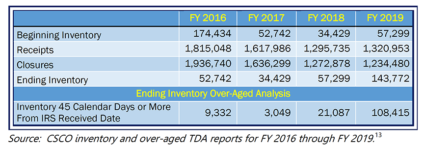

Actually, that’s not entirely true. In 2019, IRS Compliance Services Collection Operations managed to respond to 25 percent of its “inventory” of Taxpayer Delinquent Account correspondence. The other 75 percent was considered “over-aged” after not being dealt with within 45 days of receipt.

TO READ THE FULL ARTICLE