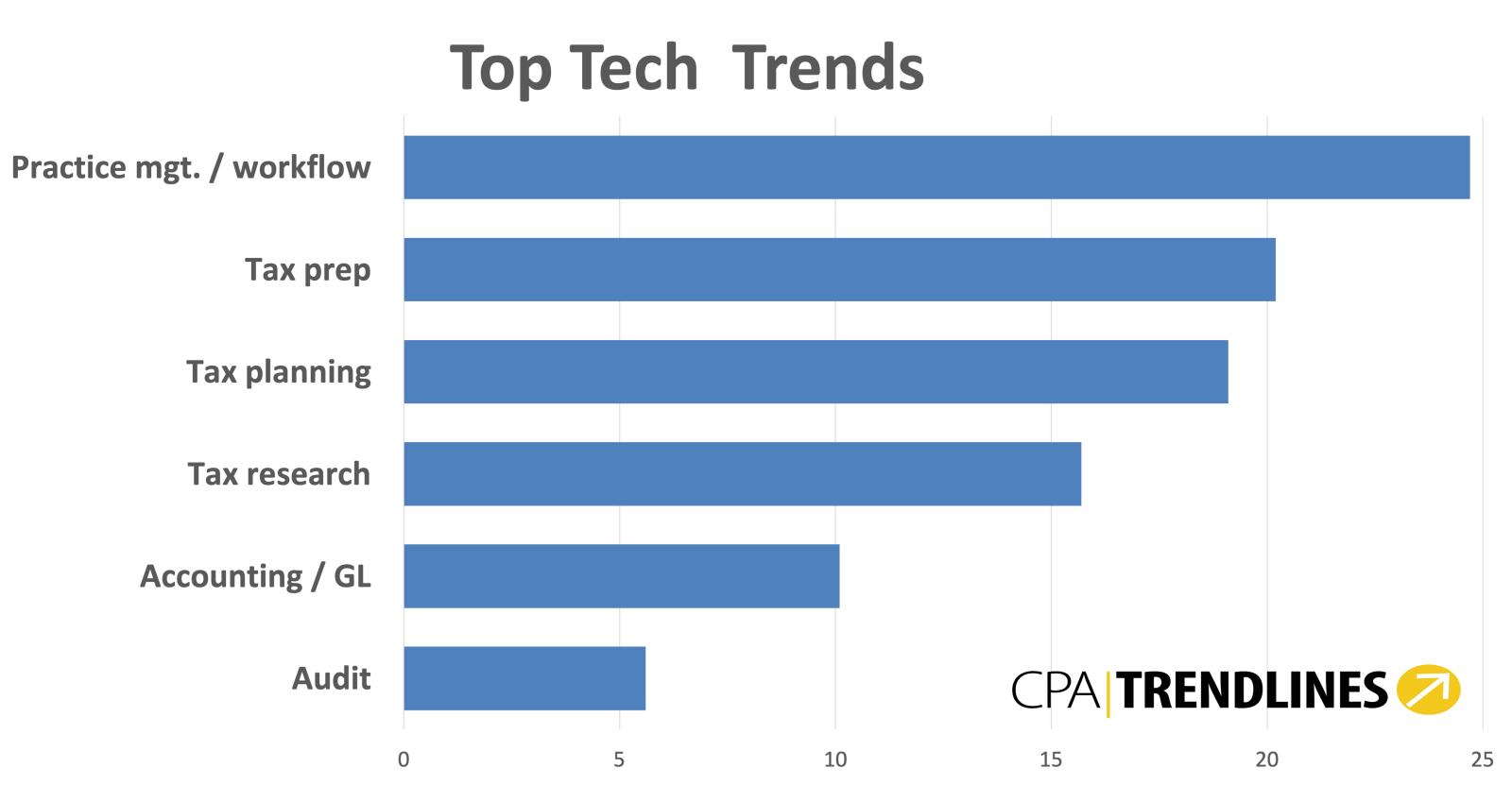

Top Tech Trends for Tax Season 2026

Holding Steady, Tuning Workflow, and Testing AI.

By CPA Trendlines Research

With the 2026 filing season approaching, most accounting firms are not racing to rip and replace their technology stacks. Instead, they are making selective adjustments, tightening workflows, and cautiously experimenting with artificial intelligence — all while keeping a close eye on staffing limits, client behavior, and return on investment.

JOIN the Busy Season Barometer survey here.

MORE TAX, PRICING, PAY, HIRING, and THE 2026 OUTLOOK

That restrained approach comes through clearly in CPA Trendlines’ Busy Season Barometer, which shows a profession that is less focused on transformation than on execution. The dominant theme across survey waves is not disruption, but discipline.