In the war for talent, “local” CPA firms face new threats from distant, bigger rivals – worldwide

In the war for talent, “local” CPA firms face new threats from distant, bigger rivals – worldwide

By Rick Telberg

CPA Trendlines

The traditional business model of the so-called “local” CPA firm is being challenged anew by the emergence of a single, unified coast-to-coast talent market that’s undermining the pay differences between big-city and small-town firms.

That’s bad news for traditional firms trying to control staffing costs. But great news for a new generation of top talent.

MORE on TALENT MANAGEMENT: SURVEY RESULTS: Firms Face Staff Turnover Tsunami | Global Tax Talent Shortage Mounting into ‘Perfect Storm’ | Accountants without Borders: Tight Talent Pool Drives Salary Increases Nationwide | Are You an Ostrich or a Giraffe? | Your Firm’s Biggest Assets Walk out the Door Every Day | So Much to Do and So Little Time: Achieving Success in the C-Suite |

Exclusively for PRO Members. Log in here or upgrade to PRO today.

The study shows that salaries are increasing faster than inflation throughout the American market, and they aren’t always limited by the local cost of living. The average salary for a tax professional in New York City, for example, has risen to $77,660 this year, up from $75,400 last year. Importantly, the numbers ($77,660 this year, up from $75,400) are the same in Des Moines, Iowa, where the cost of living is substantially lower – along with the pricing sensitivity of Des Moines clients. This augurs new pressures on billing rates and profitability across the nation.

For firms, it means they are vying as fiercely for staff in New York as in Peoria, a blow to the traditional business model of the so-called “local” firm. The new and emerging business model must face up to a mobile, borderless workforce that is coming to expect big-city pay even at small-town firms.

“A major trend from last year has been the significant increase in salaries,” says Jodi Chavez, president of Randstad Professionals. “This is mostly due to strong economic growth in the past several months as well as the baby boomer generation moving into retirement. Organizations are more comfortable spending money, and they are willing to spend to get the best talent.

The survey finds that salary and benefits are still the top of priorities of job candidates, ahead of such ancillary offerings as training opportunities and work-life balance.

Tax accountants in Phoenix, Ariz., on the other hand, expect to make an average of $91,567 this year, up from $88,900 last year. In San Francisco, the upper range would be $91,567 to $113,248, though the low end of the low range would be as low as $64,602.

Chief financial officers are pulling down the biggest numbers. Mid-range salaries in San Francisco range from $215,903 to $350,506. New York CFOs in the mid-range are looking at $232,080 to $377,468.

Los Angeles

.

Chicago

New York City

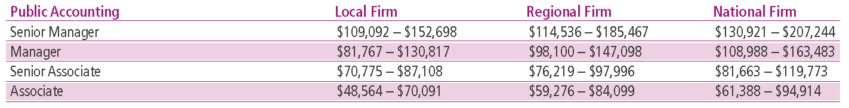

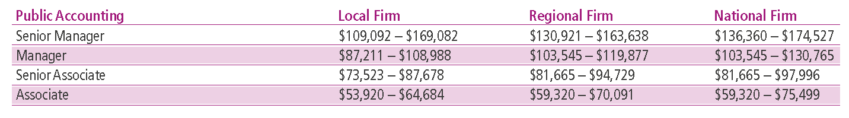

The survey presents salaries for 48 areas and levels of the profession, from accounting clerk and bookkeeper through controller and CFO. Generally, the survey does not isolate salaries by the size of the company. But in public accountancy, it separates out the salaries for local, regional, and national firms. It finds that the larger the firm, the higher the salaries of everyone from associate to senior manager.

Salaries are rising across the board, regardless of geographic or professional area. A bookkeeper at a small company in the Raleigh-Durham area of North Carolina was making a minimum of $33,950 last year but $34,968 this year, perhaps as much as $43,054. The same job in the Boston area brings in just a little more—$35,535 at the low end, $47,277 at the top.

Chavez says that the talent pool continues to shrink. The number of incoming professionals at the post-collegiate level is remaining steady while the number of retiring baby boomers is increasing. The retirements are causing salaries to rise because retirees are being replaced by new candidates who are offered higher entry-level salaries.

The desperation for talent means that companies are looking farther to find new personnel. The result is a disconnect between salaries and local costs of living.

“We see companies increasing their search for finance and accounting talent in some of the rural and smaller markets, whereas a few years ago, they weren’t as excited or had much of an appetite to relocate talent that was below, say, the $75,000 level,” Chavez says. “But now we’re seeing an uptick in companies willing to relocate professional at that mid-level manager position because the demand for talent is continuing to get stronger while the talent pool is continuing to shrink.”

Consequently, the CPA in Des Moines can earn just about as much as one in a major business and financial center—less, yes, but nowhere near the differential in housing costs.

But the talent shortage is hardly limited to the United States. It’s a global problem for the profession.

The global community of local firms shares common aspirations, expectations, challenges, and opportunities.

In fact, CPA Trendlines research finds that the talent shortage plaguing Unites States firms is now turning into a global problem. That is, by no means, a good thing. But it is another item all firms across the globe can share.

And it is another chink in the armor of the so-called traditional business model of the owner-operator accounting firm because most of the issues flow from two overriding factors: Rampant underpricing or owner greed (or both) that fails to build up capital reserves for re-investment in the business, and the lack of access to other sources of funding.

It’s enough to make us wonder if solutions to global problems are beyond the ability for individual nations to solve alone. Instead, multi-national worldwide strategies may be required. Maybe that’s part of the reason the American Institute of Certified Public Accountants (AICPA) and the Chartered Institute of Management Accountants (CIMA) created a new association they both belong to called the Association of International Certified Professional Accountants (the AICPA).

But today, owning, operating or working in a perfectly “average” firm is not necessarily a sign of success. Instead, “average” seems doomed to obsolescence in irrelevancy – and on a global scale never seen in the profession.

Recruiting and retaining qualified employees leads the list of chief challenges, by size of firm, worldwide. A new survey of more than 5,000 firms in 164 countries and 23 languages by the International Federation of Accountants (IFAC, for short) shows that for the first time in six years small and mid-size accounting firms around the world consider labor supplies a major issue. Not to mention, keeping up with technology is getting even tougher.

Despite these challenges, 45% of the world’s local firms are predicting growth in advisory and consulting services this year, with 44% seeing new fees in accounting, compilation, and other non-assurance services. To be sure, only a slight majority of 52% reports an overall increase in practice fee revenues, with 31% reporting declines, and 17% with no discernible change.

“The ever-increasing pace of technological change represents both a challenge and opportunity,” says IFAC CEO Fayez Choudhury, adding that local firms “need to consider how they can best leverage technological advances to reduce costs and offer value-added services.”

Perhaps unsurprisingly, moving to the cloud emerges as a major global issue, with 38% of firms expecting a high impact on their competitiveness. Following close behind are the shortage of time and money to keep up with software and hardware.

Further, the study weighs eight trends that will have the heaviest impacts over the next five years. For the third year in a row, the regulatory environment emerges as the most important, cited by 56% of firms. Technology follows, at 52%, up from 43% last year. Third, at 45%, firms cite “adapting to new client needs” as a major concern, up from 36% last year. Next, the “perceived trust and credibility of the profession” is cited by 43%, up from 35%.

With globalized competition for both staff and clients, and new investments looming for both talent and technology, the merger frenzy that United States firms are now so familiar with figures to become a planetary phenomenon, as well.

The merger frenzy is increasing measurably in Europe, rating concern from 32% of firms this year, up 6 percentage points from last year.

Accountants from Asia anticipate that mergers, acquisitions, and consolidation will have a major impact on their practices, at a rate 38%, followed by firms in Africa, at 37%, and Central and South America and the Caribbean, at 35%. The impact of consolidation rates lowest in Australasia and Oceania, at 15%.

Clearly, size matters. Only 47% of sole practitioners report revenue gains, compared to 62% of the largest firms. And one-third of the smaller practices report revenue declines, compared to only 22% of the largest practices.

The largest firms are also the most optimistic regarding fee increases this year. Sole practitioners are the least optimistic.

An analysis by region reveals considerable variability in expectations regarding fee revenue growth projections for 2017. In general, a larger percentage of respondents from Africa and Central and South America/Caribbean anticipate fee revenue increases for all service lines. Accountants in Europe and the Middle East are, in general, less optimistic.

Some two-thirds of accountants in Africa and 53% in Central and South America/Caribbean are forecasting fee increases in core accounting, compilation, and other non-assurance services. But only 36% in the Middle East and 37% in Europe anticipate gains.

Tax is another story. Some 62% of accountants in Africa, 54% in North America, and 54% in Central and South America and the Caribbean projected increases in tax fees. Respondents from the Middle East, at 34%, and Europe, at 31%, are less optimistic.

The year 2017 will be a candidate-driven market, even more so than in 2016. This is due to several factors, including the large number of open positions as a result of Baby Boomers retiring and increased pressure on compensation causing unexpected turnover.

“The upcoming tax reform is still unknown but will likely result in tax professionals needing to quickly change and adapt to new rules and regulations,” say the authors of the “2017 Global Tax Market Assessment” from Tax Talent, a global search agency.

Non-technical skillsets continue to be in high demand in 2017 and it will now be essential for tax professionals to be able to effectively communicate within tax, cross-functional groups, business units, at the C-level, and with outside advisors.

Taken together, the lessons from the vast global survey shows eight maneuvers that firms must make today to win tomorrow’s competitive battles:

- Invest in talent

- Invest in technology

- Shift out of low-margin commoditized services

- Embrace high-value advisory and consulting work

- Restrain partner greed…

- …Allowing more profits to be plowed back into the firm

- Mergers are one strategy

- Repositioning the profession to allow external funding and ownership is another.

None is easy. Few firms can do all at once. Some can do a few at a time. The ones that can do none, may simply disappear.

3 Responses to “Global Talent Wars Hit Home for Local Firms”

Martin Bissett

I still see the business model of recurring fees as the issue here.

On the one hand, it’s the reward for building relationships of trust over the years.

On the other, its the Chief Apathy Officer in nearly every firm.

This is why ‘attracting new clients and attracting new people’ will remain the top two issues for firms for the foreseeable future.

It’s very difficult for firm leaders to get their firms to attract Grade A clients and Grade A talent when there’s been little need to be ‘attractive’ historically.

If we removed recurring fees, referrals and walk ins from the revenue column, I’d be interested to see how much money was made by any given firm proactively last year.

If we looked to see which firms are offering career maps and mentor-ships to their rising stars, we’ll find that they exist, but they are a minority of the whole.

The profession remains sleepy/indifferent to these issues because there’s STILL no immediate need for them to be anything else.

The removal of recurring fees, although it won’t happen, would have everyone wide awake (or bust) almost instantly.

Tom Hood

Rick, The reality is that this talent war has been building for the past five years and is on track to only worsen due to the hard trends of demographics. Gen X represents the biggest shortage which is the generation to take the reigns from the retiring baby boomers. Your eight strategies are on point, however few can muster even a combination of several if they did not already start. Investing in your talent with leadership development nd a pivot to high value consulting type services are definitely the place to start.

Garrett Wagner

Sounds like another sign of the death of the accountant. Firms are too slow to address these issues and they are feeling the resulted pain in staffing challenges and more. If your talented people want to provide more consulting services and your clients want the same thing we have perfect alignment. We’re just waiting on firm leaders to catch up.