Tax-pro efiling lags 40%. New due date: May 17. Details to come.

What’s the word on Tax Season 2021?

The Tax Season from Hell:

What’s the word?

Join the survey. Get the answers.

By CPA Trendlines Research

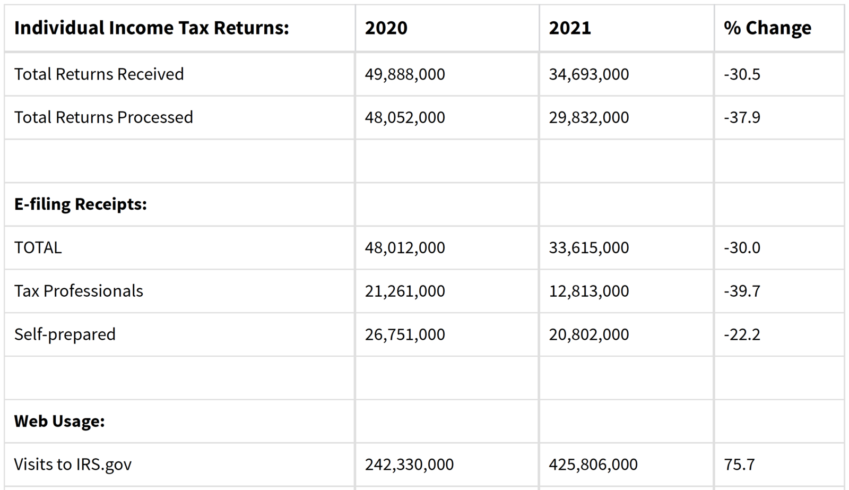

The IRS is reporting that efiling is running 30 percent behind last year’s rate, with DIY’ers down by 22 percent and tax professionals trailing year-ago by 39.7 percent for the week ended Feb. 19.

And tax-pro market share of all efiling has slipped to 38 percent, down from 44 percent the last time we checked.

MORE TAX SEASON: Hunting the Amended Return | Pros Process 44% of Tax E-filings | The IRS Studebaker Bomb | Make Your Firm Faster, Smarter, Richer … with Millennials | Tax Professionals Report Tough Slogging | 50 Ways to Make More Money in Busy Season | Stop Beating Up the IRS – Really | Imagine IRS ‘Concierge’ Service. Just Imagine. | IRS Has Recruiting Problems, Too | Team Expectations: A Checklist for Busy Season | You’re Not JUST Taxes | The Happier, Saner, Richer Tax Firm | SURVEY: A Glint of Optimism for 2021 | PPP Traps: 1 in 5 Accountants Report Shady Dealings

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Meanwhile, Treasury and the IRS announced that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15 to May 17. The IRS promised to provide details “in the coming days.”

Among the accountants reporting more problems this year, the comments are stark:

- Returns held up because of law changes regarding unemployment. Clients not letting us know about their stimulus payments they received in January 2021 and then having to contact them to see if they got a payment.

- Severe legislation on two occasions with retroactive changes signed in law in the middle of tax season.

- Stimulus requirements, tax planning with the RMD situation of 2020 vs. 2021

We have to help clients with new PPP loans, understand stimulus check questions, get new grants available to small business, new tax rules, employee retention credit info, etc. etc. in addition to normal tax work this time of year.

We have to help clients with new PPP loans, understand stimulus check questions, get new grants available to small business, new tax rules, employee retention credit info, etc. etc. in addition to normal tax work this time of year.- Professional staff sick with Covid, PPP #1, PPP#2, PPP Loan Forgiveness, Employee Retention Credit, IRS sending out erroneous Levy Notices since they have not opened the mail sent in October 2020 and cashed the check, American Rescue Plan 2020 tax provisions have to redo returns with Unemployment benefits since not taxable.

- Delay in the start of filing season from IRS

- PPP Loan Forgiveness Apps due in the middle of the season

- Questions of states treatment of PPP funds (California)

- New form 1099-NEC

- I lived through the tax season from Hell back in 2013. Anyone remember “the fiscal cliff”? This is worse. Worse than last year and I thought that was bad. This is another tax season from Hell, but worse.

- PPP 2nd round confusion – including net vs. gross pay for Schedule C Filers and requirement documentation for eligibility.

- Refinance paperwork requests due to low-interest rates

- Client conferences to go over all the above and explain what’s going on

- Stimulus Check questions and return prep for stimulus qualifications

- New security implementation by Intuit

- Dealing with IRS delays and letters that are outdated

- Dealing with false 1099’s

- In 38 years, this is my worst season ever. IRS unresponsive, firms still not ready, software not working properly (still), confused clients, constantly shifting explanations on how to handle tax issues, PPP BS.

- last-minute changes

- We went into busy season still in catch-up mode from last year. Many staff worked from home but productivity and client ability to supply timely data were impacted. Difficulty in finding qualified candidates to expand staff is an additional issue. Our efforts related to PPP have diverted staff time in a significant way.

- CAA, ARP, PPP2, ERC, PPP Sch C&F, IRS backlog, Partnership tax basis capital accounts, etc.

- IRS delays. IRS lack of response. Retroactive tax law changes by Congress. Late legislation by Congress. Late broker statements. PPP Loans

- PPP, ERC, Unemployment, forms change

- PARTNERSHIP CHANGES, CLIENTS HAVE FINANCIAL OPERATIONAL PROBLEMS

- Tax code and law changes; client angst, staffing

- Both IRS and FRANCHISE TAX BOARD have not decided on 2020 rules as of March 9, 2021

- Can’t find preparer help. Our gov has hired them away with enhanced unemployment!!!

- Just a lot of different issues. Many taxpayers slow to get their stuff together.

- Clients are late to bring in their work, which has put us way behind. And we’re having to focus on changing laws, additional PPP funding applications, and other funding applications to help businesses stay afloat.

- Where to begin…. hmmm. First, this is my 38th tax season so I’m no rookie. There are tax returns rejecting because fraudulent tax returns have already been filed with taxpayers’ information, especially those who had fraudulent unemployment claims filed with their information. So we have to address the rejects… Older clients are very overwhelmed with collecting their tax documents. IRS just issued notices for the 2nd EIP payments to clients and clients are confused about them, thinking it’s the 3rd one that is coming. Why issue those notices NOW.. 2 months after clients received the money??? So there are more phone calls/emails about those… Staff have issues with kids being home learning remotely so that is an issue for us. We don’t have the staffing we need… And now the IRS will have to re-tool to incorporate the change in the taxation of 2020 unemployment benefits which means our software provider will have to make changes so that will delay us in filing… Just WAY too many issues.. and then there is the whole tax season fatigue. staff does not want to work 7 days a week; who does but that’s what it takes with this antiquated way of our tax system!! Congress needs to actually work this year and revamp our tax system… No young people are coming into this profession so there is going to be a “silver tsunami” when we all retire.

- 1/4 less clients

- Way too much to do in too short amount of time.

- IRS inability to keep up with processing of returns and needed correspondence.

- Inability to make contact with IRS in a reasonable time frame and resolve any issues

- Lack of clarification on new tax laws

- Questions on PPP Loans 1 and 2

- Stimulus payment questions 1 and 2 and now 3

- Reduced timeframe in which we can process returns

- Last minute changes in tax law

- Tax law changes after the NEXT YEAR BEGINS!!!!!

- I am so tired of the IRS holding me and my firm and clients accountable to get it done by the deadline or pay a penalty, and when they are not able to meet deadlines, it’s ok. Very frustrating for many reasons on many levels!

- Software issues and many more clients came in very early this year creating a backlog right out of the gate.

- Safe Send (f/k/a cPaperless) dropped Signature Flow in July. We were slow to find an alternative (Adobe Sign over DocuFlow) and even slower to update and test our engagement letter package to work with Adobe Sign. This caused a delay in getting out engagement letter packages for e-signing. Totally our fault.

- The tax changes for covid, the software can’t keep up and has to be updated before we can file returns, third round of EIP holding up filing.

- We have great processes set up and were able to pivot to most of us working remotely, but as we are working closely with our business clients advising them and assisting them with stimulus support we are experiencing severe work overload – we try to remind ourselves daily that we are grateful to be able to help our clients this way & to be busy with work when so many are struggling.

- Investment houses JUST getting 1099’s out, and the late start to filing season. Finally, LATE changes by Congress.

- Sickness, slow form rollout, delayed start, unprocessed 2019 returns by the IRS

- Clients emailing multiple documents and changes in tax laws and stimulus check issues

- had 10 people out with covid. Work load is late coming in. 1099 season was way worse than any we have ever seen. irs prevented us from filing. Snow storm shut us down for a week. we need relief from the April 15 deadline. law changes at the Arkansas level changed for 20 affect many 2020 returns. PPP loan assistance and forgiveness has occupied a lot of our time also.

- Covid

- More returns in at once

- Delay in start for filing

- PPP 2nd round and ERTC retro

- Some CARES Act changes not available for filing like COVID related IRA withdraws

- People are more concerned about their stimulus, which we have no control over, than they are their taxes! Furthermore, the IRS announcement of a delay in processing slowed clients from coming in, and then the media urging prompt filing of returns has created the Perfect Storm where stacks of drop-offs and back-to-back appointments are stealing time.

4 Responses to “Another Tax Season from Hell?”

Jon Baron

The IRS was doing pretty well catching up this year through the 12th, down only 13% in volume versus last year. Of course, the new law changes have thrown them some significant curves, which is why the date has been pushed out to May. That will make comparisons difficult.

One thing is very clear in the data. Self-prepared returns continue to far outpace professionally prepared returns. Through the 12th, Electronically filed, professionally prepared returns were down 19.4% this year versus self-prepared returns down only 4.9%.

Note that several of the new changes will also require software vendors to make the changes as well. Again this year, life is not easy all the way around.

Trish Beckwith

Wow – this really sums it up….and here I was thinking it was just me not being a good enough CPA!

George D Hodge

I agree with everything you said in triplicate, and now the stupid filing season has been extended until May 15th which means the April 14th people will wait until May 14th. After 55 years in this business retirement is looking better every day!

Jackie Compton

Don’t forget state unemployment fraud…it is rampant and bogging down tax season.