Why Chaos at the IRS Spells New Work for Tax Professionals

The three key IRS tools every pro must learn today.

The three key IRS tools every pro must learn today.

By Eric L. Green, LLM

Between all of the back-and-forth between DOGE and the IRS, not to mention travel and credit line reductions, it raises questions about what exactly the fate of the IRS will be.

MORE: The IRS Tidal Wave Is Here | S Corp Clients Beware | Four Ways to Handle Federal Tax Liens | The IRS Is Coming! Get Your Clients into Compliance | Tax Chat: Eric Green Reveals The Tax Rep Guide to Tax Season | What I Wish Clients Knew about Tax Liens | Tax: Explaining the Bad News about Canceled Debt to Clients | Offers in Compromise Aren’t for Everyone

Exclusively for PRO Members. Log in here or upgrade to PRO today.

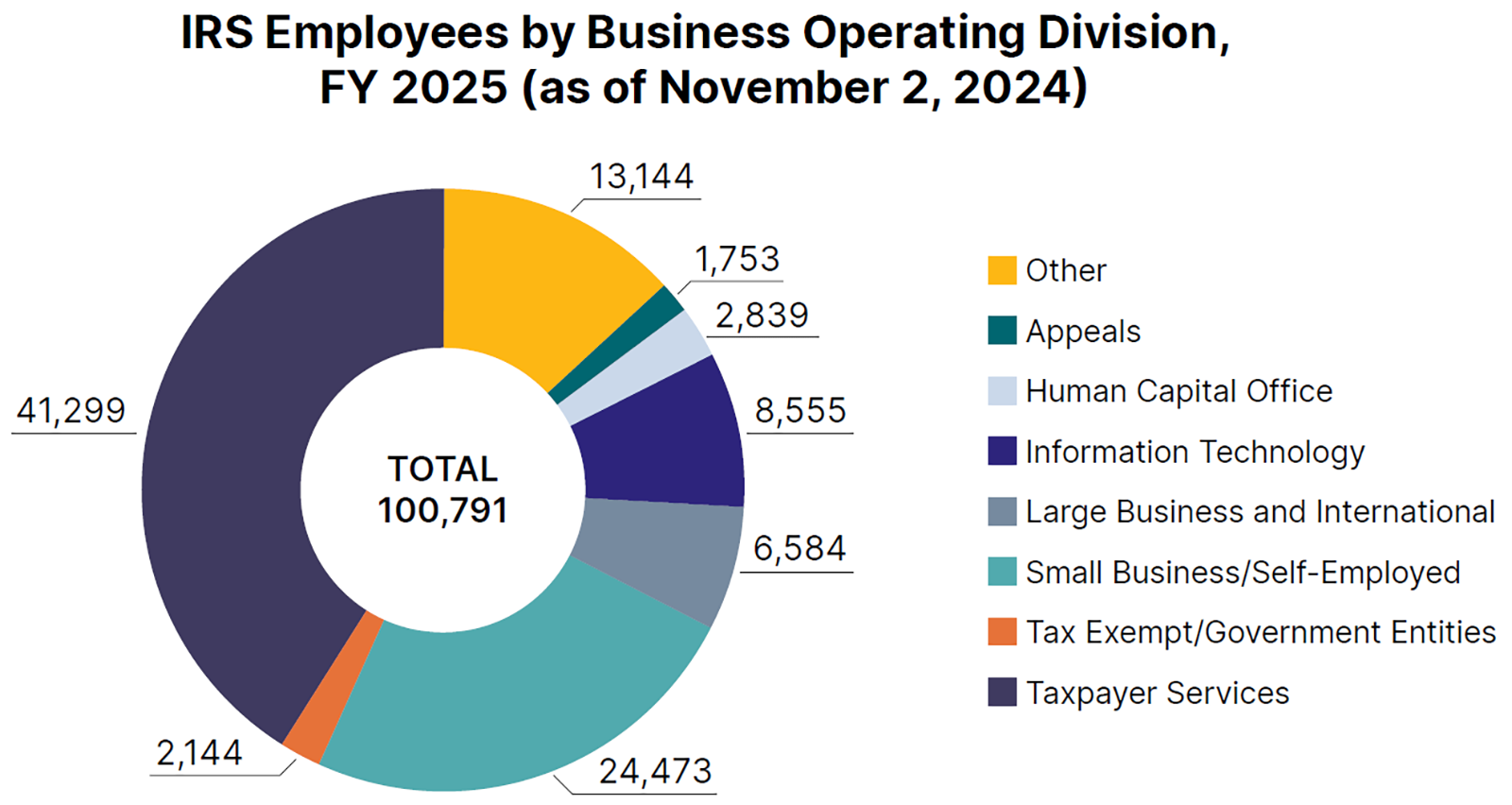

In fact, the latest announcement is to cut the IRS by 50 percent by the end of 2025. So, if you are wondering just what the heck the game plan is, you are not alone. After speaking with close colleagues inside the IRS, I can say it is basically chaos at the moment.