With Congress Stalled, Tax Professionals Take Control of Preparer Standards

Why Tax Pros Are Imposing Standards on Themselves.

By CPA Trendlines Research

As the 2026 filing season begins, the National Association of Tax Professionals is launching a formal credentialing program for taxpayer representation.

MORE Tax, Busy Season, The Next Circular 230

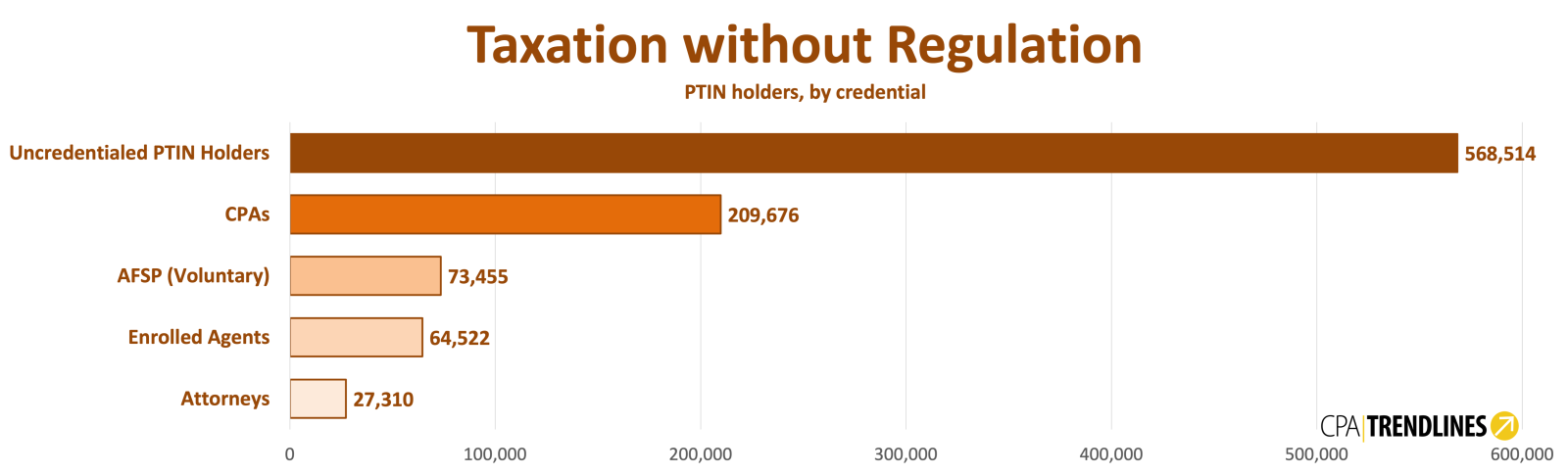

The NATP is stepping into a regulatory void left by years of congressional inaction, leaving more than 500,000 paid preparers operating without national standards, even as IRS and GAO data show higher error rates on paid-prepared returns than on do-it-yourself filings, and Congress is delaying action.

Less capacity, more obligation.

Less capacity, more obligation.