Top Tech Trends for Tax Season 2026

Holding Steady, Tuning Workflow, and Testing AI

By CPA Trendlines Research

Join the Busy Season Barometer survey here.

Holding Steady, Tuning Workflow, and Testing AI

By CPA Trendlines Research

Join the Busy Season Barometer survey here.

Decode energy signals & stay sharp even when you’re running low.

Accounting ARC

With Liz Mason and Donny Shimamoto

Revenues and client rosters outpace profit gains as firms battle cost pressures.

By CPA Trendlines

CPA firms heading into the 2026 tax season expect revenue gains driven primarily by higher prices, not by adding clients, even as a majority anticipate another heavy extension season.

JOIN the Busy Season Barometer survey here.

MORE TAX, PRICING, and THE 2026 OUTLOOK

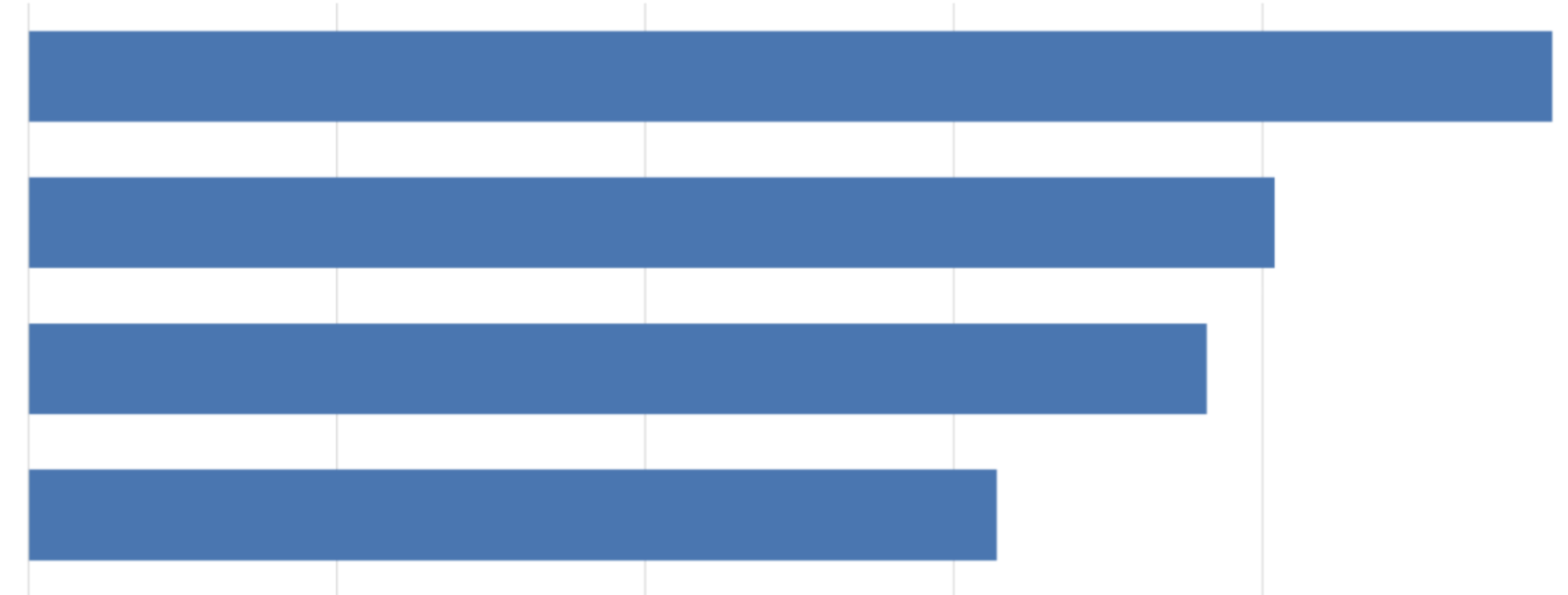

According to the CPA Trendlines Busy Season Barometer, about 6 in 10 firms expect total revenue to increase this year, while roughly one-third expect revenue to hold steady. Profit expectations trail revenue slightly, a pattern that points to continued cost pressure even as clients and would-be clients clamor for more, and more high-end, services

The silver bullet technique can transform messaging and persuasion.

The Concierge CPA

With Jackie Meyer

For CPA Trendlines

Most accounting professionals do extraordinary work—and still struggle to explain why it matters.

That tension sits at the heart of a standout episode of The Concierge CPA, where host Dr. Jackie Meyer is joined by messaging strategist Neil Gordon for a wide-ranging conversation on persuasion, clarity, and the future of tax advisory in an AI-driven world.

The result is an episode that feels less like a marketing lesson—and more like a wake-up call for tax professionals who know their value but haven’t quite figured out how to communicate it.

Early in the episode, Meyer names a frustration that resonates across the profession: most tax professionals create real value, yet struggle to articulate it in a way that inspires action.

That gap isn’t about intelligence or effort. It’s about messaging.

IRS dysfunction replaces OBBBA as top concern.

By CPA Trendlines

With only a week to go before the opening of filing season 2026, tax practitioners are focusing on IRS dysfunction as their biggest potential problem this year

And no wonder. The agency was already chronically underfunded, buried under a mountain of overdue paperwork, and crippled by ancient computer systems when it lost 25% of its workforce in early 2025.

JOIN the Busy Season Barometer survey here.

MORE TAX, PRICING, and THE 2026 OUTLOOK

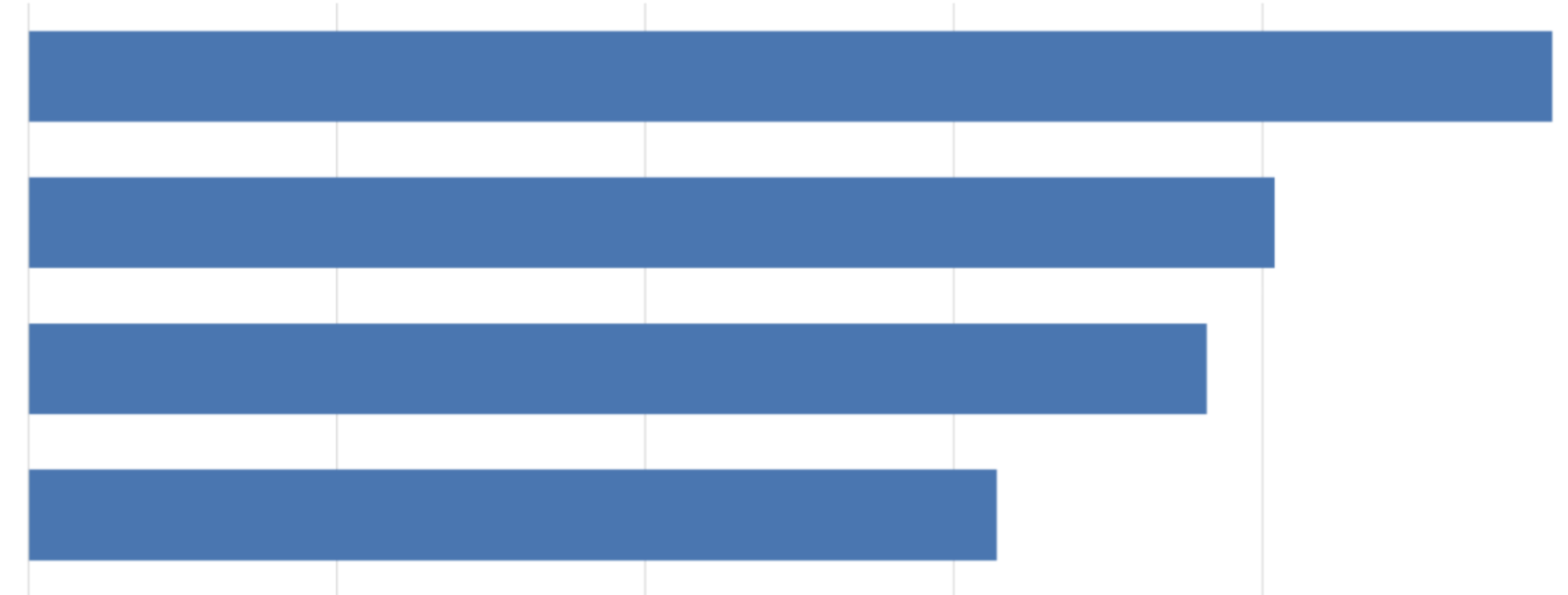

Today 63% of tax professionals say a beleaguered IRS poses the single biggest risk to this year’s tax season, up from 54% just a couple of months ago, according to the CPA Trendlines Busy Season Barometer.