Tax and Accounting Pay Advancing at 5.9% Pace

Payroll services hours take some wild swings.

By Beth Bellor

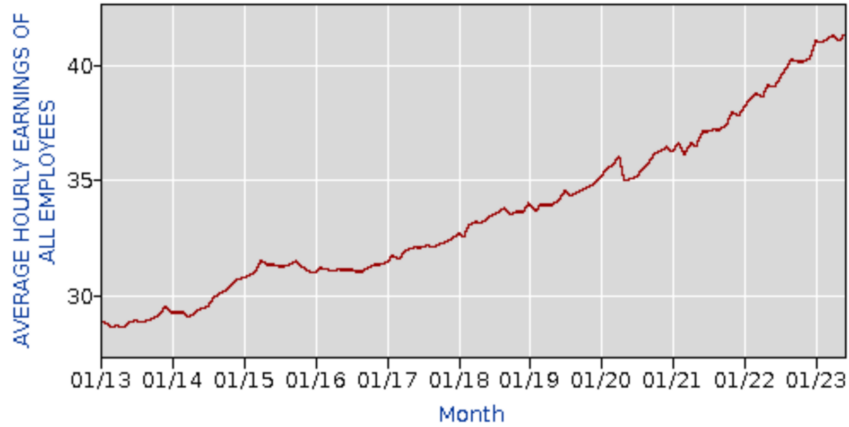

What would help recruit more people to the accounting profession? How about that trusty standby, more money?

Most accountants are bringing home more in hourly earnings, according to the latest available data.

MORE on JOBS: What an A.I.-Powered Workforce Means for Accountants | New Businesses Mean New Business | Accounting Jobs Up 4% for Year |

Exclusively for PRO Members. Log in here or upgrade to PRO today.

For the accounting profession overall, hourly earnings hit a new high at $41.39, up 35 cents or 0.9 percent for the month and $2.32 or 5.9 percent for the year. Staff earnings hit a new top mark at $31.76, up 20 cents or 0.6 percent for the month and $1.64 or 5.4 percent for the year.

READ MORE →

Its average score was 85.1.

Its average score was 85.1.