Outlook 2026: AI, Not Layoffs, Powers PE Valuations

How CPAs are using AI to boost EBITDA multiples.

By CPA Trendlines

Private equity investors are paying higher prices for CPA firms that deploy artificial intelligence to expand capacity, deepen professional benches, and systematize growth—rather than cut headcount.

MORE TaxDome | MORE Private Equity

“If AI were about to replace accountants and advisors, private equity wouldn’t be pouring billions into the sector,” TaxDome founders Ilya and Victor Radzinsky say in a public letter to stakeholders.

As dealmaking accelerates into 2026, the shift helps explain why valuation multiples for accounting firms continue to rise even as automation spreads through tax, audit, and advisory workflows. Private equity sponsors and strategic consolidators have completed hundreds of acquisitions of CPA firms since 2020, often at valuation multiples that would have been rare a decade ago.

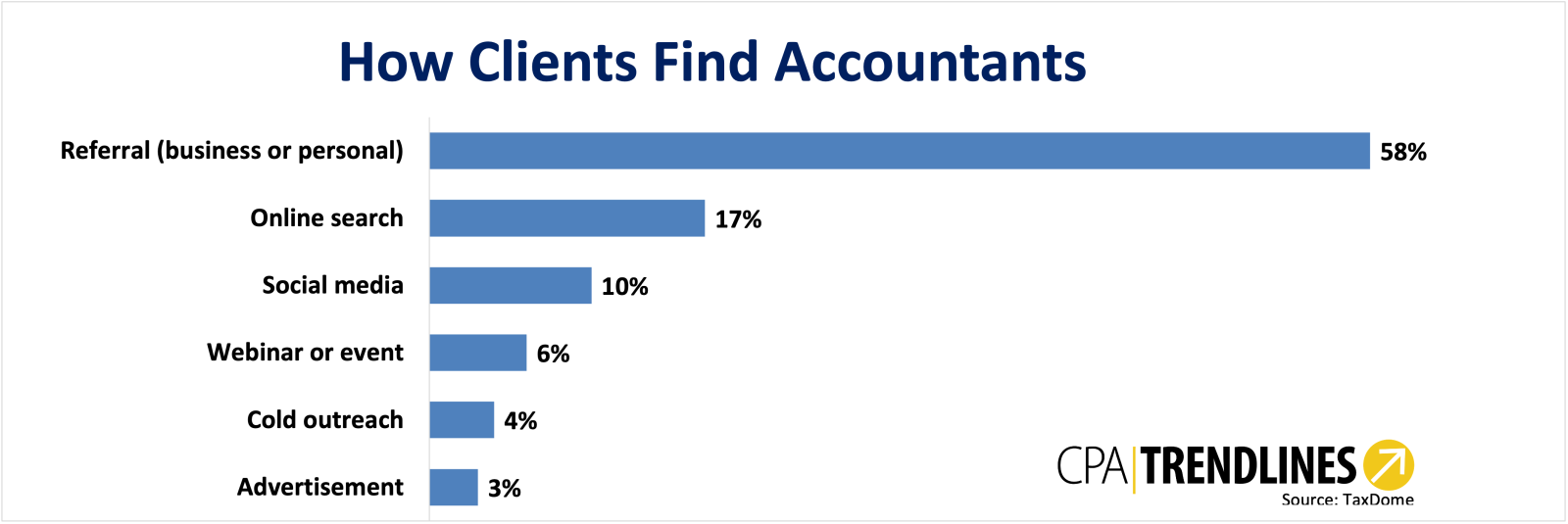

Brands matter: Clients rely on business or personal referrals to find their accountants.

Brands matter: Clients rely on business or personal referrals to find their accountants.