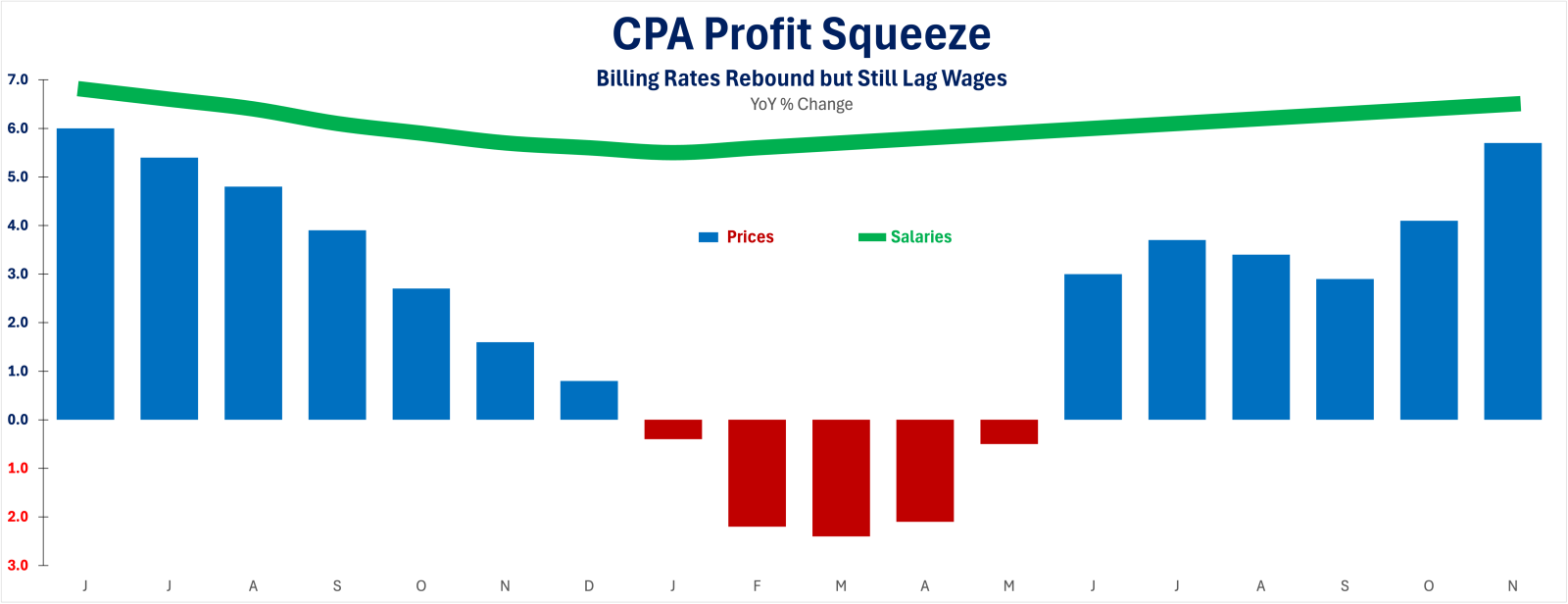

Profit Squeeze: Billing Rates Rebound, but Staff Costs Are Rising Faster

Accountants show renewed pricing power as rates gain 5.7%.

By CPA Trendlines

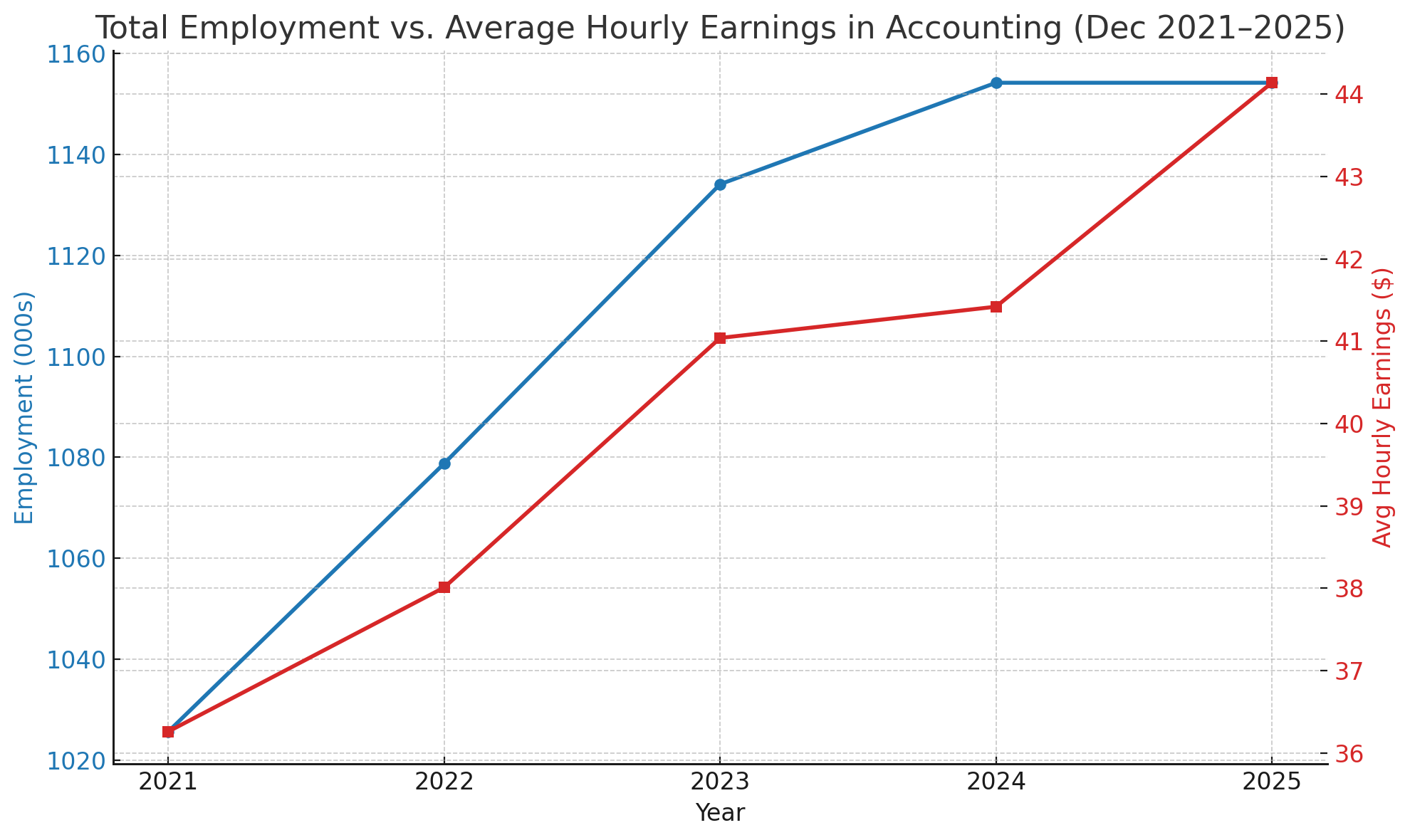

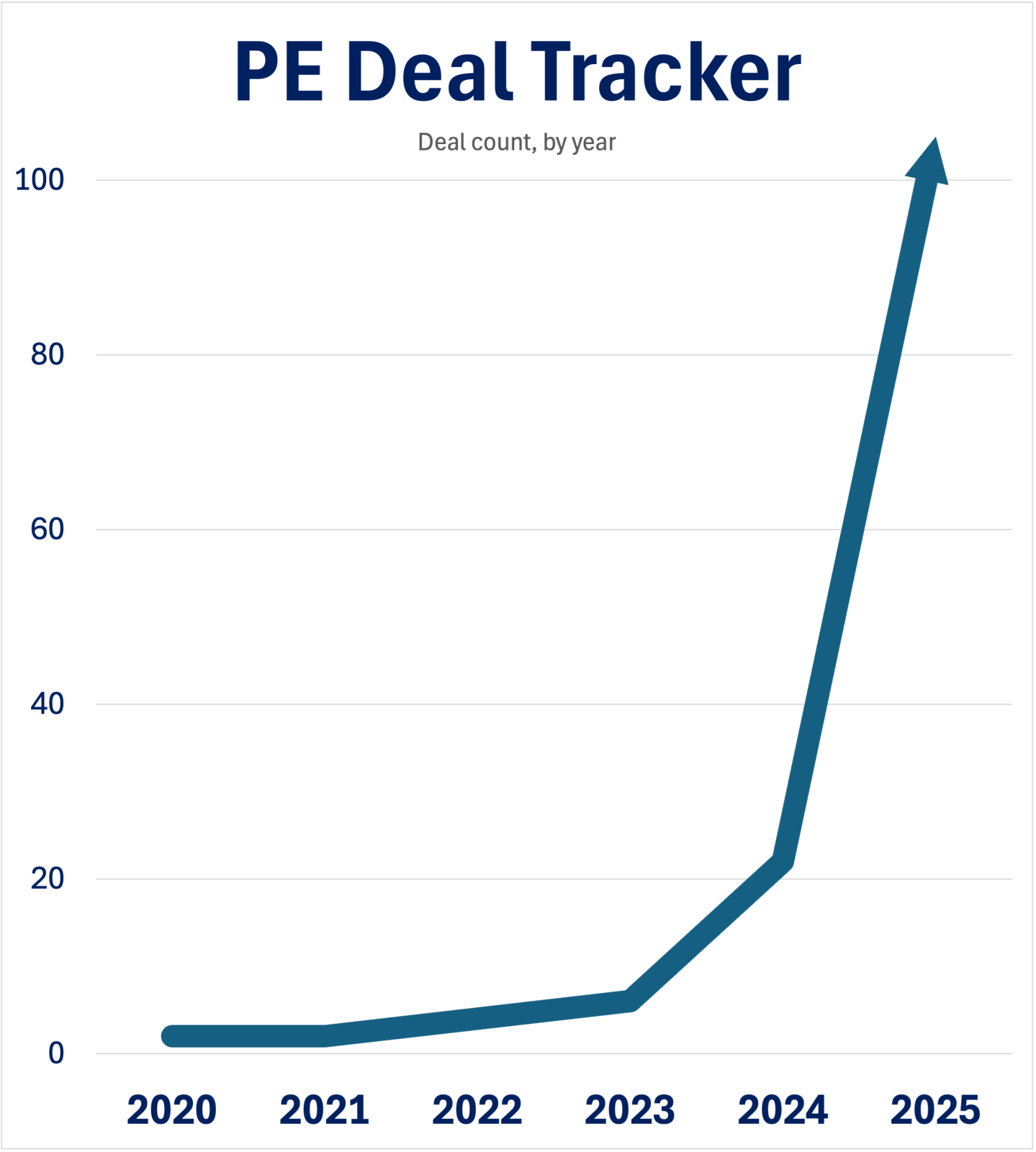

CPA firms are raising prices again as they enter 2026, even as hiring remains weak and wage pressures show little sign of easing. The combination is tightening margins across the profession.

MORE Outlook 2026, Pay, Hiring, Pricing

A CPA Trendlines analysis of new pricing data shows that billing rates for core CPA firm services are rebounding sharply, reversing an earlier soft patch and vaulting fees to near record highs. At the same time, employment growth across accounting firms has stalled, while wage growth remains elevated, underscoring the growing imbalance between pricing power and labor costs.

Taken together, the data point to an industry that is regaining some pricing power but still struggles with structural labor pressures that pricing alone cannot fix.

Expect strong demand for tax planning, business advisory and bookkeeping cleanup work.

Expect strong demand for tax planning, business advisory and bookkeeping cleanup work.