Outlook 2026: The Painful Paradigm Shift in Staff Pay and Hiring

New jobs data signal fundamental pivot for accounting firms.

By CPA Trendlines Research

The year 2026 may be long remembered as the paradigm-shifting moment when accounting firms were forced to pivot everything from their business models to their budgets.

MORE Outlook 2026, Pay, Hiring

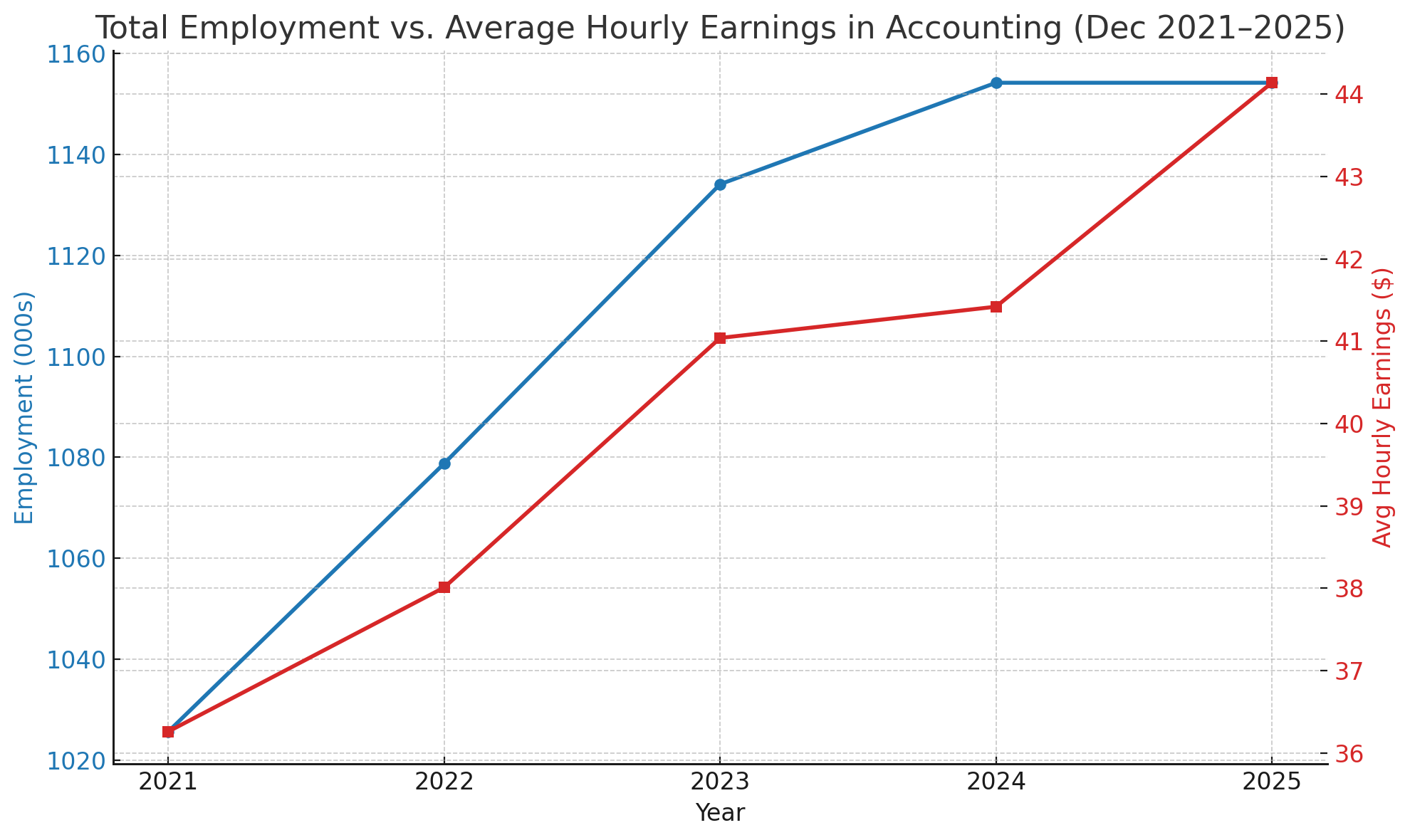

The reason: Salary and pay increases are accelerating even as hiring momentum stalls.

Going into 2026, labor costs have been cleaved from labor supply. The new, structurally higher staffing line is forcing firms to rewrite their budgets as well as business models.