Privacy, intellectual property concern many survey respondents.

By CPA Trendlines Research

Small businesses are getting more comfortable with artificial intelligence, according to a survey-based report from FreshBooks.

“Small business owners are less convinced that AI is coming for their jobs and/or the jobs of their employees,” the report says, “with two-thirds disagreeing that AI will replace them.”

MORE: Revenue Growth Is Top Priority for Small Firms | Survey Shows Challenges, Priorities Shifting | Survey Shows That Tech Remains the Great Divide | Is the CPA Business Model the Clog in the Pipeline? | Can Big Data Spot Financial Fraud? | Will Unclogging the Accounting Pro Pipeline Kill Mobility? | Accountants Bullish on Income | 42% of Accountants Turn Away Work Over Staff Shortages | Accountants Hopeful, Concerned and Confused about AI

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Still, in a bit of a contradiction, 44 percent of owners say they expect to hire fewer people in the future thanks to expected AI capabilities. And the larger the business, the more likely they will use AI to reduce payroll.

Mara Reiff, chief data officer at FreshBooks, says, “Anxiety over AI has been growing lately, with workers in certain industries expressing concerns that their jobs will be replaced. In the world of small business, it appears that owners don’t feel particularly threatened and don’t believe artificial intelligence can do their jobs just as well as they can.”

The Fog of the Future

These hopes and fears are still in the fog of the future. Small businesses don’t yet know what AI can do for them (or to them), nor do they know the future capabilities of AI.

A quarter of the survey respondents say they are already using or testing generative AI tools.

Among current non-adopters, 46 percent say it isn’t clear how AI could benefit their business. The second most common reason was lack of knowledge, with 32 percent saying they weren’t sure how to get started.

But most seem to be ready to start fooling around with it. Only 16 percent were refraining because they thought it beyond their technical capability.

Two out of three survey respondents say they will take a crack at AI within the next 12 months. Sixty percent figure AI will dramatically change their business within five years. Those with employees are even more likely to see their business change.

But there’s still some reluctance because of uncertainty. Eighty percent are concerned with privacy, ethical and intellectual property issues.

A Staggering Opportunity for CPAs

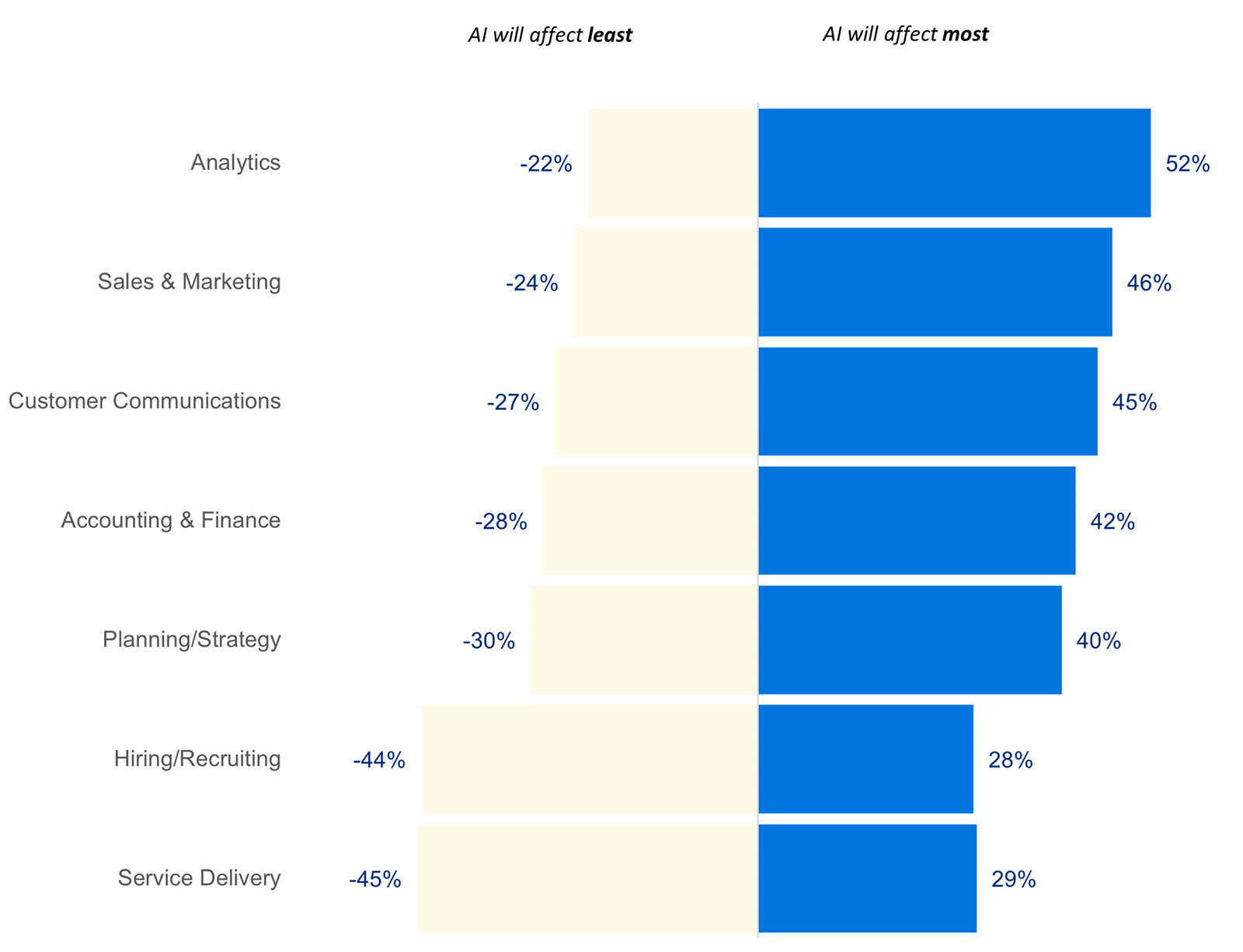

Nobody’s sure what AI will look like in five years, but 52 percent of small business owners think it will most affect their business’s analytic capabilities. Sales and marketing is second in foreseen use of AI, cited by 46 percent. Customer communication is close behind at 45 percent.

A good 42 percent think AI will most affect accounting and finance. That’s a staggering opportunity for CPA firms looking for new advisory services to offer.

So far, most of small business AI experience is with relatively simple mainstream tools, primarily

- ChatGPT

- Google Bard

- Microsoft Bing

- Dall-E 2

Those apps are fine for breaking down resistance to AI, but functionality is still limited. More sophisticated and proprietary apps may require the help of outside specialists.

A large majority of adopters are tapping AI for text, often for websites and social media platforms. A slim majority are using it to create images or even conduct general business research. Slightly fewer are already using AI content for customer support.

While small businesses can wait to see what AI can do for them, CPA firms intending to offer AI services will need to stay on the cusp of developments. The changes will be continuous and quick, and starting later may be too late.