Your Entrepreneurs Need Advice, but Which Kind?

The collaborative wealth management process outlined.

By Anthony Glomski

The financial services industry has failed some of your clients who are entrepreneurs. A big gap can exist between what they pay (and the services delivered) versus what they need.

MORE: Three Ways to Work Together on Wealth | Target the Family CEO | How to Implement Collaborative Wealth Management | Five Challenges of Liquidating a Business

Exclusively for PRO Members. Log in here or upgrade to PRO today.

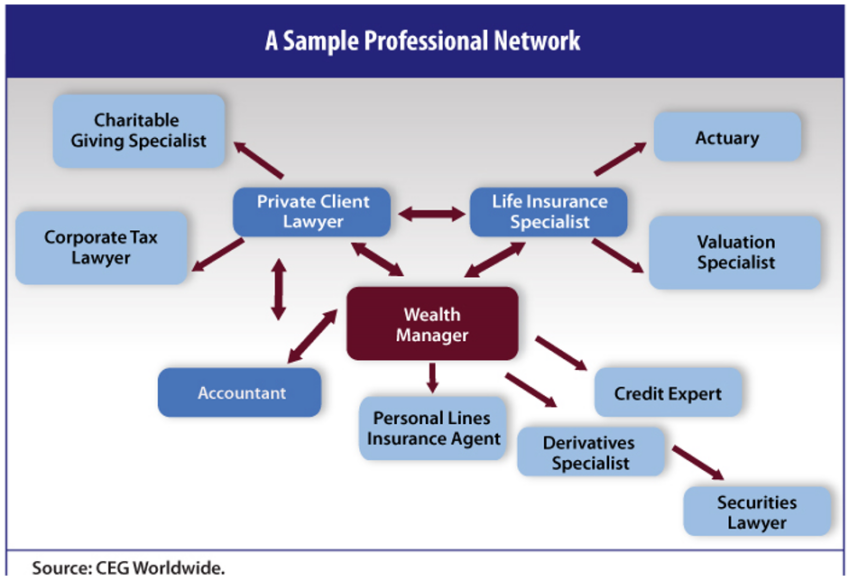

We can agree that your clients will usually need an investment management solution. But how can you help your client sort through the different advice options to get them aligned with the right professional? How can you determine who is the right fit for your practice to develop a working relationship? The diagram below is the hierarchy of advice available:

READ MORE →