Startups have different needs than mature businesses, so the messaging must be different.

By August J. Aquila

Price It Right: How to Value Accounting Services

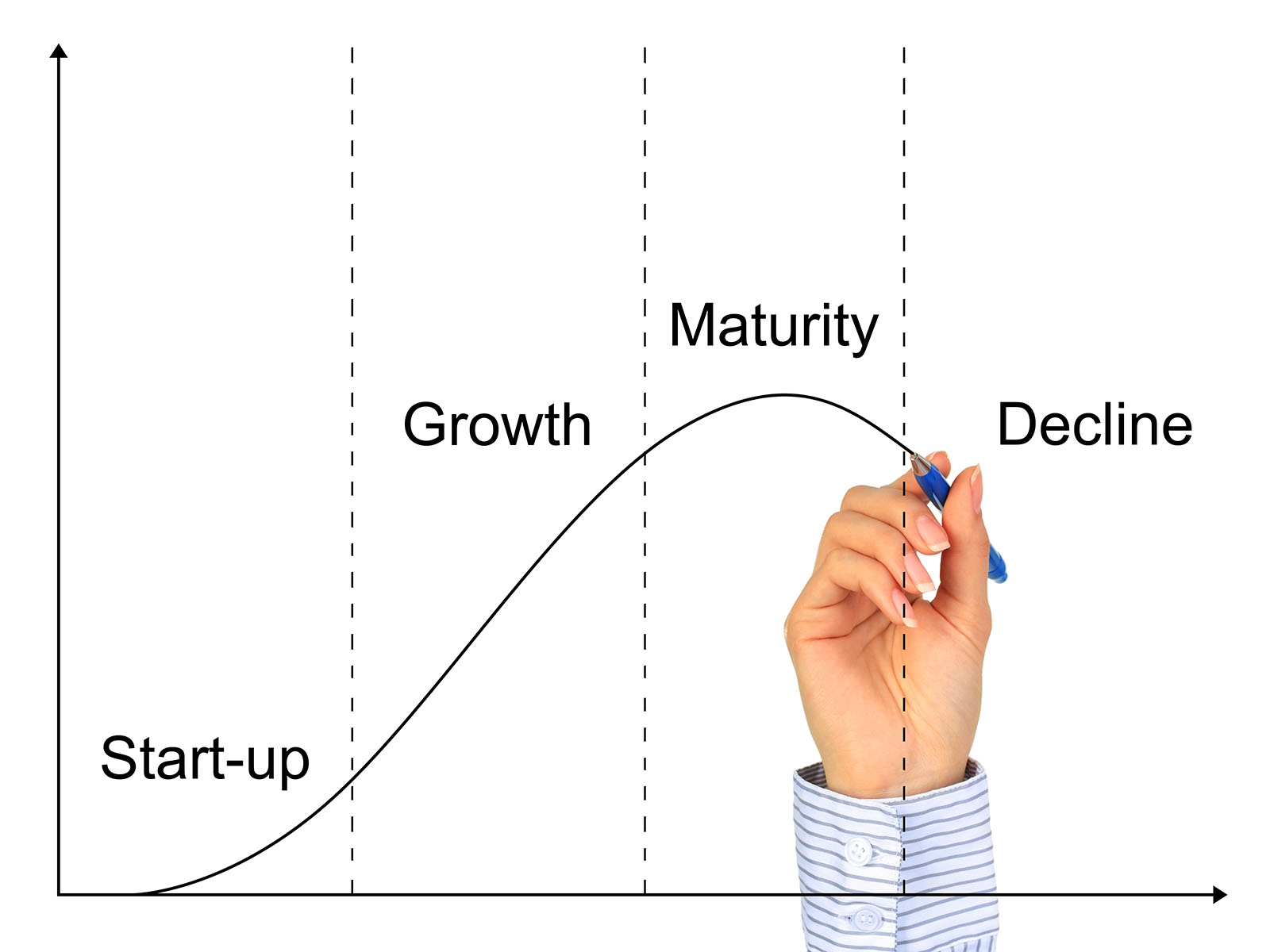

The business life cycle refers to the stages that a business goes through from its inception to its eventual closure or exit. Each stage presents unique challenges and opportunities, and it is essential for accounting firms to adapt their marketing strategies accordingly.

MORE: Eleven Possible Pitfalls of Mergers | Dodge the Four Curses of a Production Orientation | Client Acquisition Never Stops | ‘Sales’ Is Not a Four-Letter Word | Maybe What You Need Is a Marketing Audit | Three Types of Marketing Message, and Which Is Best | Why You Need Progress Billing | Five Tips for Cross-Selling and Upselling | Five Keys to Successful Marketing | Twelve Fundamentals of Planning | One Question to Guide Your Growth Plans | Four Ways to Prepare for New Business Development

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Here are some marketing strategies that can be effective during different stages of the business life cycle. Take a fresh look at your existing clients, and sort them according to their business life cycle: startup stage, growth stage, mature stage and transitional/decline. You want to make sure that as your clients go through these different cycles, your marketing messages and services change and address the right business concern.

Depending on your client’s life cycle, she may have specific concerns that you should be addressing. If your service is better suited for the mature stage and the client is in a startup or survival mode, your marketing will be ineffective. Here are some specific services to market to each life cycle:

- Startup Stage. For startup businesses, your marketing should focus on four key areas:

- Determining the proper business structure to maximize tax savings, increasing liability protection and controlling the future ownership of the business

- Helping the business develop a written business plan

- Developing cash flow scenarios by showing them how to maximize A/R and inventory turnover, assisting in creating a realistic budget and financial projections

- Creating a tax management strategy

- Bookkeeping: Setting up an accounting system, designing a chart of accounts and implementing bookkeeping processes

- Tax registration: Assisting with tax registrations such as obtaining an employer identification number (EIN)

- Growth Stage. Clients in the growth stage of the life cycle may want to protect their business against unplanned financial events. This is the time to discuss key person insurance. You can also help clients develop employee benefit programs and executive compensation programs such as deferred compensation plans, executive bonus plans and qualified plans. Also, during this stage, you can help your clients increase distribution channels by exploring partnerships with distributors, retailers or online platforms to increase the availability of their product. And don’t forget to offer:

- Financial statements: Preparing regular financial statements (income statement, balance sheet, cash-flow statement) to track business performance and identify areas for improvement

- Tax compliance: Ensuring compliance with tax regulations, preparing and filing tax returns, and providing tax planning strategies to minimize tax liabilities

- Management reporting: Developing customized reports and key performance indicators (KPIs) to monitor operational efficiency and financial health

- Budgeting and forecasting: Assisting in developing annual budgets and forecasts and analyzing actual performance against projections

- Financing options: Providing guidance on financing alternatives and assisting with loan applications or fundraising efforts

- Mature Stage. Now is the time to market business valuation services, buy-sell agreements and succession planning.

- Auditing and assurance: Conducting independent audits or reviews of financial statements to ensure accuracy and reliability

- Compliance services: Assisting with regulatory compliance, including preparing reports for government agencies or industry-specific compliance requirements

- Succession planning: Helping business owners develop a succession plan, exit strategy or transfer of ownership

- Cost analysis: Analyzing costs and profitability by product, service or department to identify areas for cost reduction or efficiency improvements

- Risk management: Evaluating financial risks, implementing internal controls and advising on insurance coverage

- Transitional/Decline Stage. Sooner or later the founder retires, or an unplanned event (death or disability) occurs. Your marketing needs to address these events and your role is to protect the value that the business owner has developed.

- Liquidation support: Assisting with the orderly liquidation of assets, closure of accounts, and settlement of liabilities

- Tax implications: Advising on tax implications related to business closures or asset sales

- Financial consulting: Offering financial advice and guidance during the transition period, helping clients make informed decisions

Make “life cycle marketing” an integral part of your marketing efforts for the coming year. You won’t regret it.