Ask CPA Trendlines

Now, with smarter search, deeper analysis, more detailed responses (v.2.7).

Now, with smarter search, deeper analysis, more detailed responses (v.2.7).

Downsizing and backlogs become national policy.

By CPA Trendlines Research

By CPA Trendlines Research

The Internal Revenue Service is heading into the 2026 filing season with fewer employees, more complex tax law changes, and less capacity to resolve problems when returns go wrong — a combination federal watchdogs say will leave tax professionals managing the fallout even as headline service metrics appear stable.

JOIN the Busy Season Barometer daily pulse check for top trends, best practices, and emerging opportunities

MORE Tax, Busy Season, Outlook 2026

National Taxpayer Advocate Erin M. Collins says most taxpayers with straightforward, electronically filed returns should see few disruptions. But she warned that the true test of the filing season will be how the IRS handles the millions of returns that require human intervention — at a time when the agency’s workforce has been cut by more than a quarter.

Why Tax Pros Are Imposing Standards on Themselves.

By CPA Trendlines Research

As the 2026 filing season begins, the National Association of Tax Professionals is launching a formal credentialing program for taxpayer representation.

MORE Tax, Busy Season, The Next Circular 230

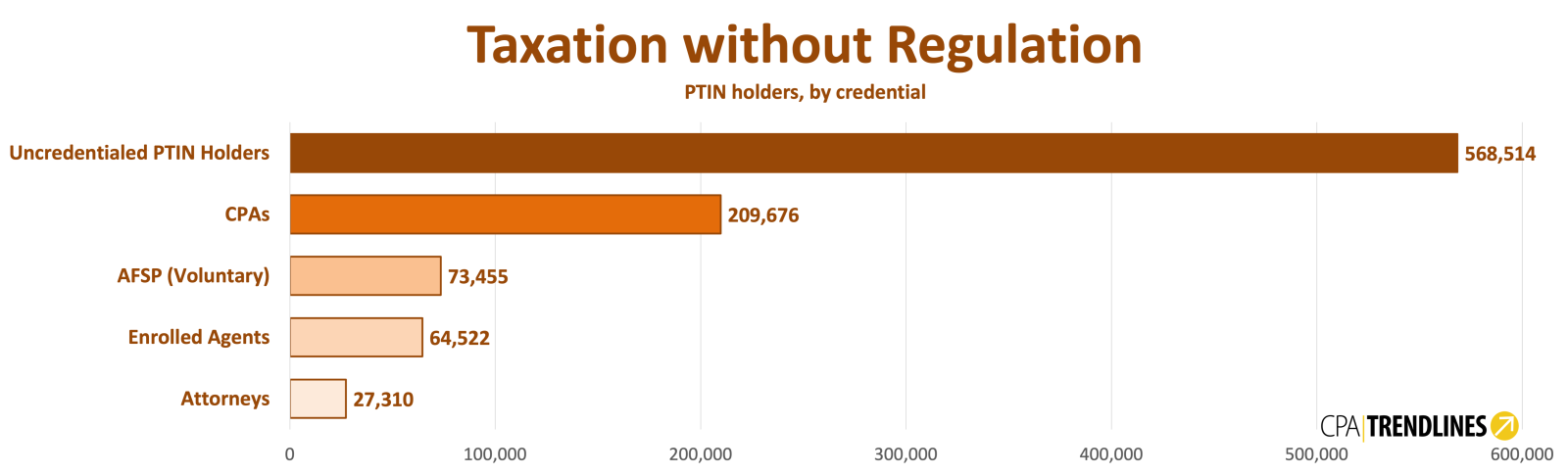

The NATP is stepping into a regulatory void left by years of congressional inaction, leaving more than 500,000 paid preparers operating without national standards, even as IRS and GAO data show higher error rates on paid-prepared returns than on do-it-yourself filings, and Congress is delaying action.

Less capacity, more obligation.

Less capacity, more obligation.

By CPA Trendlines Research

Identity theft is becoming one of the biggest time drains for tax professionals this filing season, and the IRS may be less equipped than ever to handle it.

JOIN THE BUSY SEASON SURVEY. GET THE RESULTS

MORE BUSY SEASON BAROMETER | MORE OUTLOOK 2026

According to the IRS Advisory Council—the body representing tax professionals—identity-theft refund cases now take nearly two years to resolve, as staffing cuts and system limits slow IRS response.

But identity theft is only one of a long list of problems that can only get worse this year. Tax professionals are bracing for prolonged client disputes and frustrating follow-ups with an understaffed, ill-equipped IRS.

Why is the busy season better for CAS accountants?

By CPA Trendlines Research

With busy season 2026, accountants specializing in client accounting services are reaping the benefits of a year’s worth of hard work, in a smoother path to April 15, more compliant clients, and higher fees, according to the CPA Trendlines Busy Season Barometer.

JOIN THE BUSY SEASON SURVEY. GET THE RESULTS

MORE BUSY SEASON BAROMETER | MORE CAS | MORE OUTLOOK 2026

The Busy Season Barometer marks the 2026 tax season as the breakthrough moment when CAS crosses from merely an aspirational experiment to a routine part of the service mix for small and midsize firms.

Holding Steady, Tuning Workflow, and Testing AI.

By CPA Trendlines Research

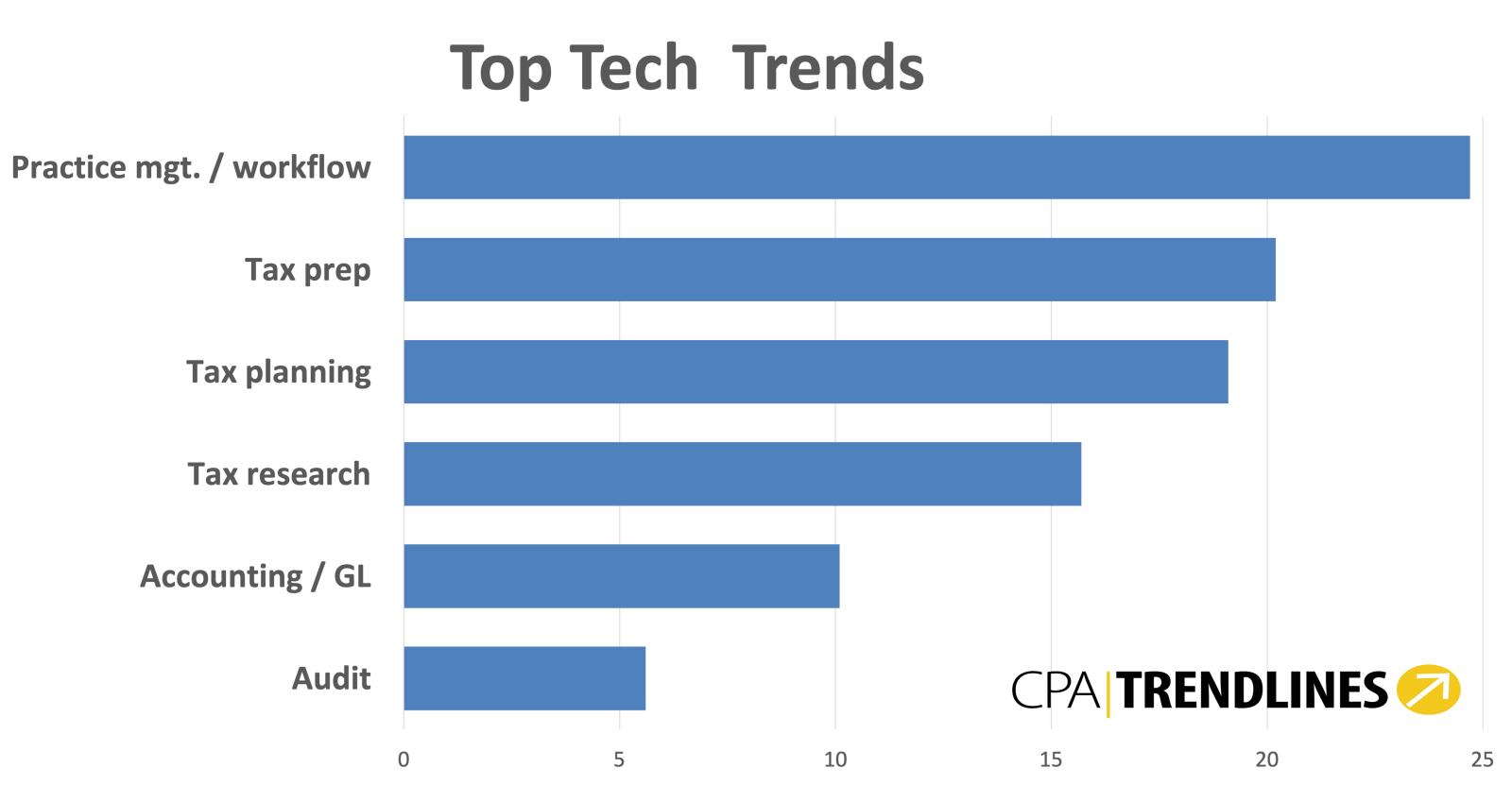

With the 2026 filing season approaching, most accounting firms are not racing to rip and replace their technology stacks. Instead, they are making selective adjustments, tightening workflows, and cautiously experimenting with artificial intelligence — all while keeping a close eye on staffing limits, client behavior, and return on investment.

JOIN the Busy Season Barometer survey here.

MORE TAX, PRICING, PAY, HIRING, and THE 2026 OUTLOOK

That restrained approach comes through clearly in CPA Trendlines’ Busy Season Barometer, which shows a profession that is less focused on transformation than on execution. The dominant theme across survey waves is not disruption, but discipline.

Accountants show renewed pricing power as rates gain 5.7%.

By CPA Trendlines

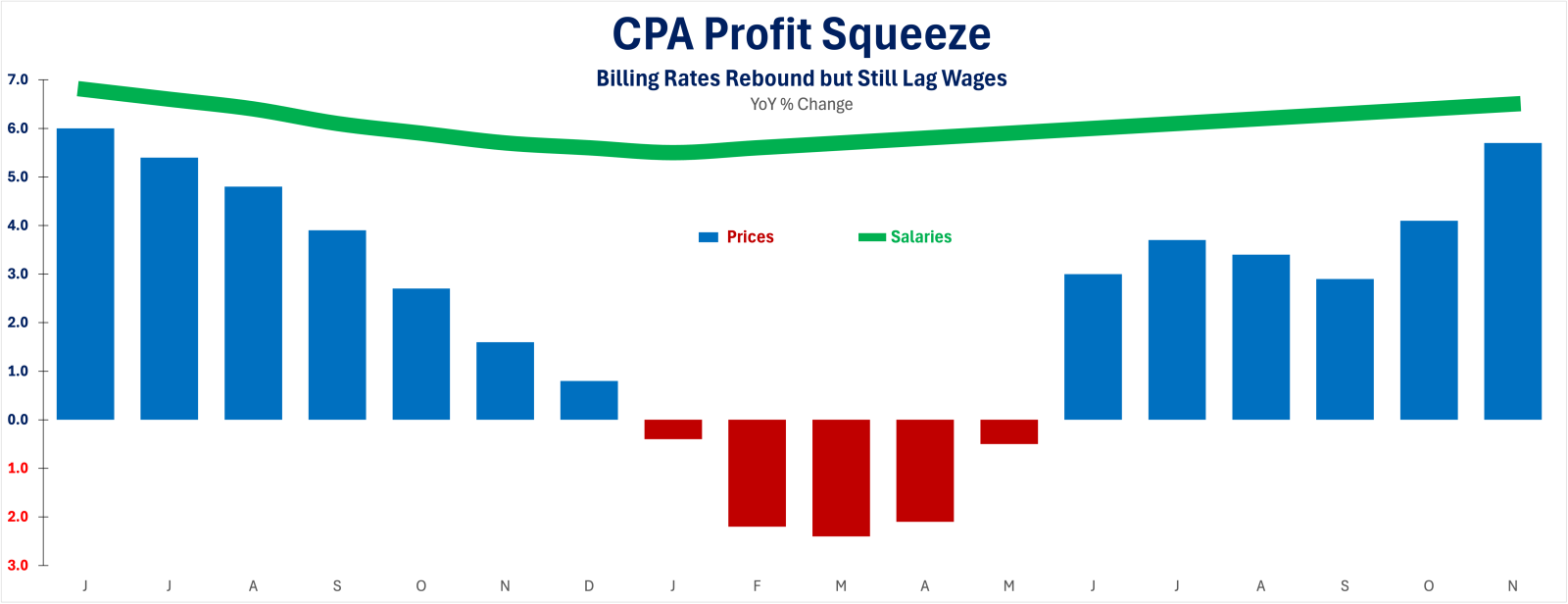

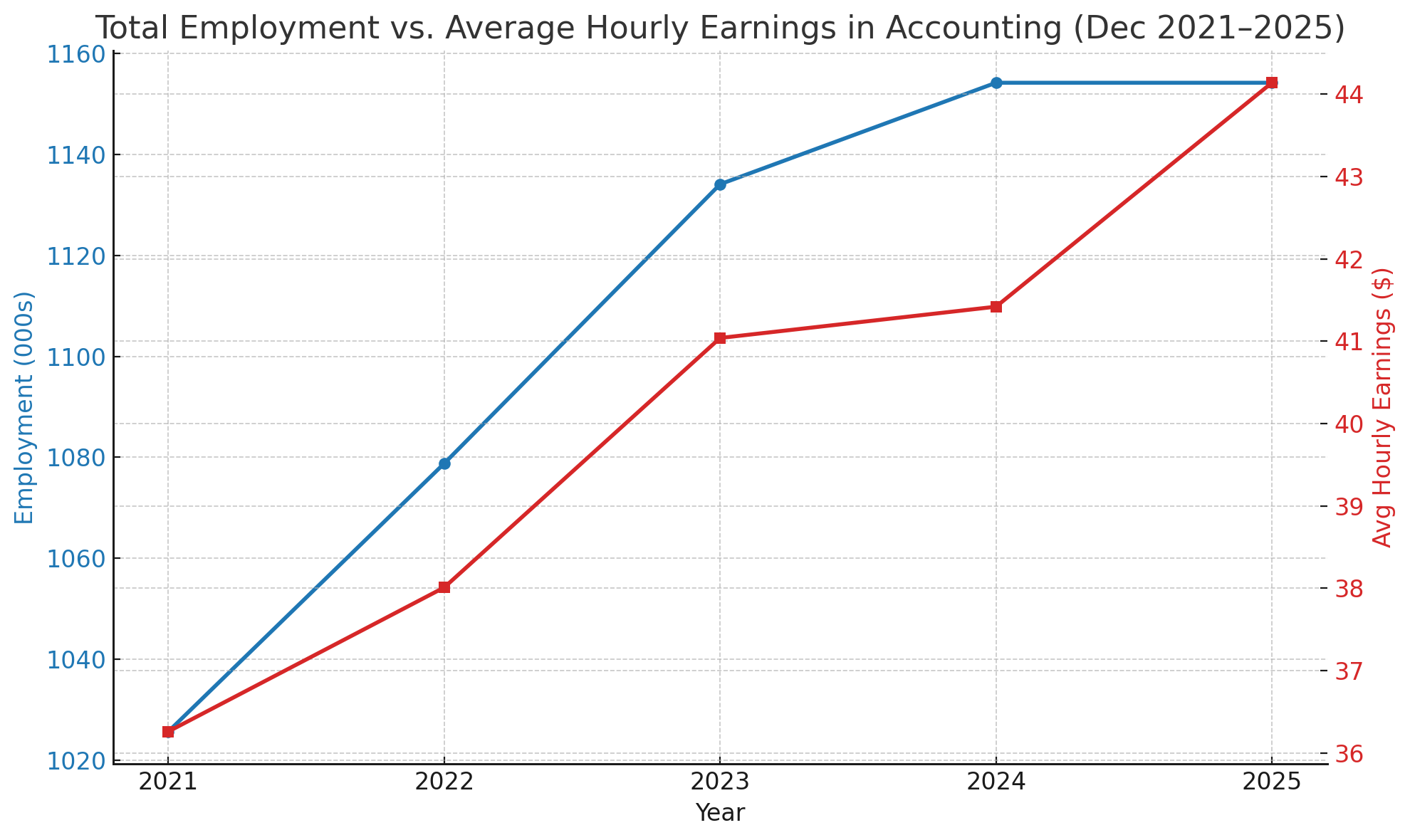

CPA firms are raising prices again as they enter 2026, even as hiring remains weak and wage pressures show little sign of easing. The combination is tightening margins across the profession.

MORE Outlook 2026, Pay, Hiring, Pricing

A CPA Trendlines analysis of new pricing data shows that billing rates for core CPA firm services are rebounding sharply, reversing an earlier soft patch and vaulting fees to near record highs. At the same time, employment growth across accounting firms has stalled, while wage growth remains elevated, underscoring the growing imbalance between pricing power and labor costs.

Revenues and client rosters outpace profit gains as firms battle cost pressures.

By CPA Trendlines

CPA firms heading into the 2026 tax season expect revenue gains driven primarily by higher prices, not by adding clients, even as a majority anticipate another heavy extension season.

JOIN the Busy Season Barometer survey here.

MORE TAX, PRICING, and THE 2026 OUTLOOK

According to the CPA Trendlines Busy Season Barometer, about 6 in 10 firms expect total revenue to increase this year, while roughly one-third expect revenue to hold steady. Profit expectations trail revenue slightly, a pattern that points to continued cost pressure even as clients and would-be clients clamor for more, and more high-end, services

IRS dysfunction replaces OBBBA as top concern.

By CPA Trendlines

With only a week to go before the opening of filing season 2026, tax practitioners are focusing on IRS dysfunction as their biggest potential problem this year

And no wonder. The agency was already chronically underfunded, buried under a mountain of overdue paperwork, and crippled by ancient computer systems when it lost 25% of its workforce in early 2025.

JOIN the Busy Season Barometer survey here.

MORE TAX, PRICING, and THE 2026 OUTLOOK

Today 63% of tax professionals say a beleaguered IRS poses the single biggest risk to this year’s tax season, up from 54% just a couple of months ago, according to the CPA Trendlines Busy Season Barometer.

The answers track firm size and practice focus.

By CPA Trendlines Research

Across the profession, accountants heading into the 2026 Busy Season are not sounding alarms, nor are they celebrating breakthroughs. Instead, they are settling into a steady, almost restrained confidence.

JOIN the Busy Season Barometer survey here.

MORE TAX, PRICING, and THE 2026 OUTLOOK

The latest Busy Season Barometer reveals that firms’ sense of readiness bears a striking resemblance to where they stood a year ago. For some, this signals resilience. For others, it signals stagnation. The portrait that emerges is a profession caught between incremental improvements and persistent operational friction.

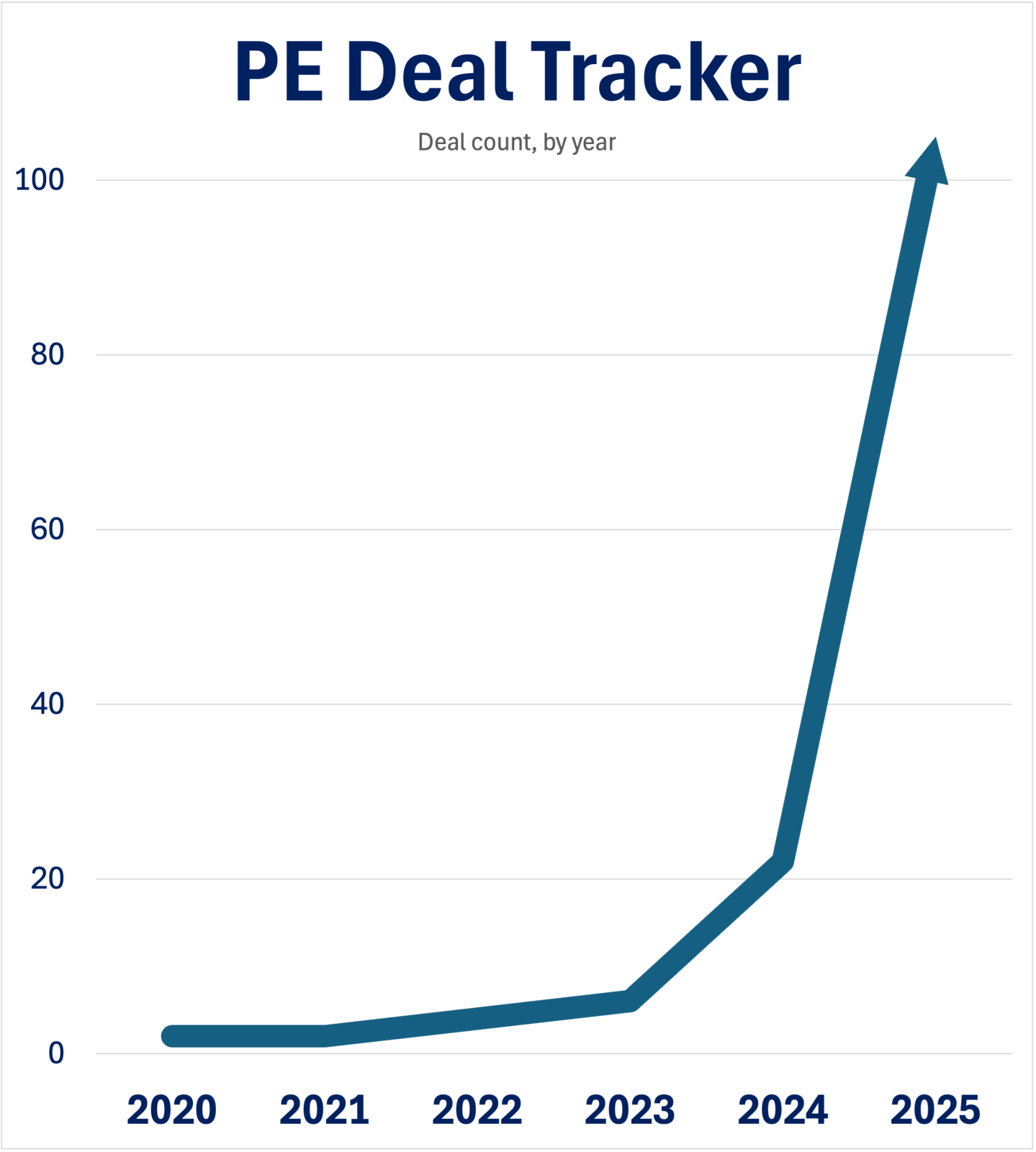

100 deals a year: the new normal?

By CPA Trendlines Research

Cornerstone Report

Private equity-backed and PE-adjacent deals start the new year on a roll, with dozens of new combinations racing to year-end closes, driven by some of the biggest rollup platforms.

CPA Trendlines Research is adding 29 newly captured deals to the tracker, lifting the total to 147 deals since 2020 with more than $10 billion in new funding. The continuation of transactions into early 2026 suggests that 2025 was not a peak but a new normal, with deal flow stabilizing at a higher level than in the pre-2020 period.

MORE Cornerstone Reports | MORE Private Equity

To submit updates, additions, or additional information, contact CPA Trendlines here

CPA Trendlines estimates that today’s private-equity-driven revenue multiples imply an aggregate enterprise value of more than $400 billion for the Top 500 CPA firm sector as a whole — a valuation reset of more than $200 billion. READ MORE →

Expect strong demand for tax planning, business advisory and bookkeeping cleanup work.

Expect strong demand for tax planning, business advisory and bookkeeping cleanup work.

By CPA Trendlines Research

The CPA Trendlines Busy Season Barometer indicates that tax and accounting leaders anticipate growth in their own firms, even as they prepare for anxious business clients, persistent inflation, and a policy environment that keeps planning on edge.

MORE Busy Season and 2026 Outlook

BUSY SEASON BAROMETER: Join the survey. Get the results

About half of all accountants in the survey are bracing for a deteriorating economy, with a third expecting rosier scenarios, for a net negative 17.2 percentage points. For small and mid-sized businesses, accountants are at a negative 9.3 points.

New jobs data signal fundamental pivot for accounting firms.

By CPA Trendlines Research

The year 2026 may be long remembered as the paradigm-shifting moment when accounting firms were forced to pivot everything from their business models to their budgets.

MORE Outlook 2026, Pay, Hiring

The reason: Salary and pay increases are accelerating even as hiring momentum stalls.

Going into 2026, labor costs have been cleaved from labor supply. The new, structurally higher staffing line is forcing firms to rewrite their budgets as well as business models.

AI-powered firms are closing books faster, reallocating staff time to higher-value work, and widening the competitive gap with slower adopters.

By CPA Trendlines Research

Cornerstone Report

As artificial intelligence transitions from a buzzword to a business imperative, CPA firms across the U.S. are quietly beginning to deploy generative AI assistants, machine learning tools, and “agentic” AI platforms to automate audits, prepare taxes, and provide financial insights.

With the astonishing surge in AI adoption, firm leaders say we’ve reached a tipping point where those not investing in AI risk being left behind.

In this Cornerstone Report, accounting firms show how they are leveraging AI to transform their operations, the benefits and challenges they are encountering, and what it all means for the future of the profession, including:

Exclusively for PRO Members Only, here

By CPA Trendlines Research

The accounting profession is changing faster than at any time in its modern history—and private equity is driving the shift. More than $30 billion in new capital has entered CPA firms since 2020, igniting a powerful wave of consolidation, modernization, and strategic reinvention. Firms that once relied on incremental growth and traditional partnership structures are now operating as high-performance platforms built for scale, technology adoption, and national reach.

The CPA PE Playbook is the most comprehensive analysis available today on this historic transformation.

If you want to know where the profession is heading, how PE-backed firms are competing, and what it will take to thrive in the next decade, this is the report you need.

Sometimes “quick and easy” isn’t, but it’s still worthwhile.

By Ed Mendlowitz

Tax Season Opportunity Guide

I keep a few of the one-volume tax guides in my office so I could look up a quick answer when I need to. Recently a golf buddy emailed me a question that I thought I could answer quickly. He wanted to know that if he was in the “zero” percent capital gains tax bracket, did that apply to an unlimited amount of capital gains? Sounds like a simple question.

Well I looked it up online and then in three one-volume tax guides. Only one source had thorough coverage of the issue. I ended up spending an hour on this “simple” question including my emailed response. Nothing is simple anymore.

READ MORE →

Eight questions to check.

By Domenick J. Esposito

8 Steps to Great

To me, all of the planning to become a mid-market sustainable brand becomes a reality through persistent and consistent leadership. In the end this, arguably, is the hardest part of the equation, as mistakes are very costly.

A leader in a CPA firm, be it the CEO, managing partner or a senior partner, is the quarterback. He or she is the one who has to set the tone at the top and has a very big impact on the firm’s culture, behavior and compensation of the other partners in the firm.

READ MORE →

Advisory at Scale Requires Systems, Not Heroics. Plus 5 More Takeaways.

With Rory Henry CFP®, BFA™

For CPA Trendlines

When firms talk about innovation in accounting, they often start with technology. But in my conversation with Nick Pasquarosa, founder and CEO of Bookkeeper360, it became clear that technology was never the starting point for his firm. It was the result of listening closely to small business owners and building systems to solve their most persistent problems.

MORE Rory Henry and The Holistic Guide | BOLT: Bookkeeper360 Launches Mobile and Web App Featuring AI-Powered Virtual CFO

Pasquarosa founded Bookkeeper360 in 2012, long before cloud accounting was the norm. What began as a door-to-door side hustle helping local businesses reconcile their checking accounts evolved into a nationwide cloud accounting firm serving nearly 1,000 small business clients with a team of more than 75 professionals across 26 states.

“I started this in high school,” Pasquarosa tells me. “It really started with an interest in helping small businesses stop running their business off their bank account balance and [instead] giving them timely, accurate books so they could make real-time decisions.”

![]()

How to integrate accounting and advisory technology.

By Hitendra Patil

Client Accounting Services: The Definitive Success Guide

CAS has emerged as one of the most strategic service lines for accounting firms. As CAS has expanded in scope and significance, so has the requirement for robust, scalable and integrated technology solutions. As revealed in our CAS survey, technology serves as the foundation of CAS success, playing a far more critical role than simply enabling processes.

In this article, we will explore the key tools and technologies that drive modern CAS practices. It draws insights from research involving over 300 accounting professionals who shared their challenges, strategies and technology use. You will also discover how to create a “Single Source of Truth” for client data. From AI adoption, cybersecurity readiness to real-time dashboards, this post aims to provide a blueprint for building a future-ready, tech-enabled CAS firm.

READ MORE →