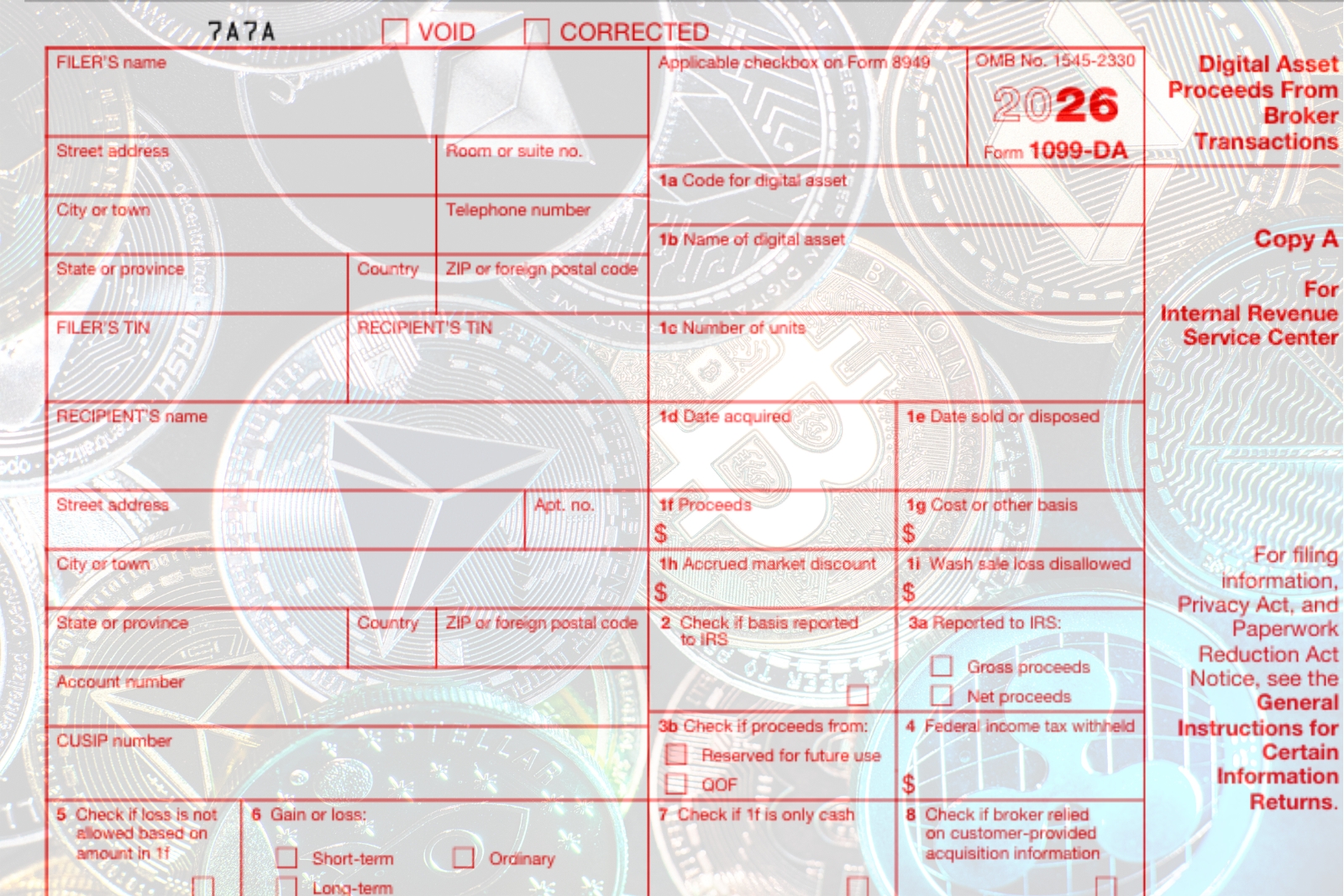

WEBINAR: IRS Tightens Crypto Reporting as 1099-DA Comes Online

New IRS Form 1099-DA raises the stakes for compliance—and tax professionals are racing to prepare.

By Center for Accounting Transformation

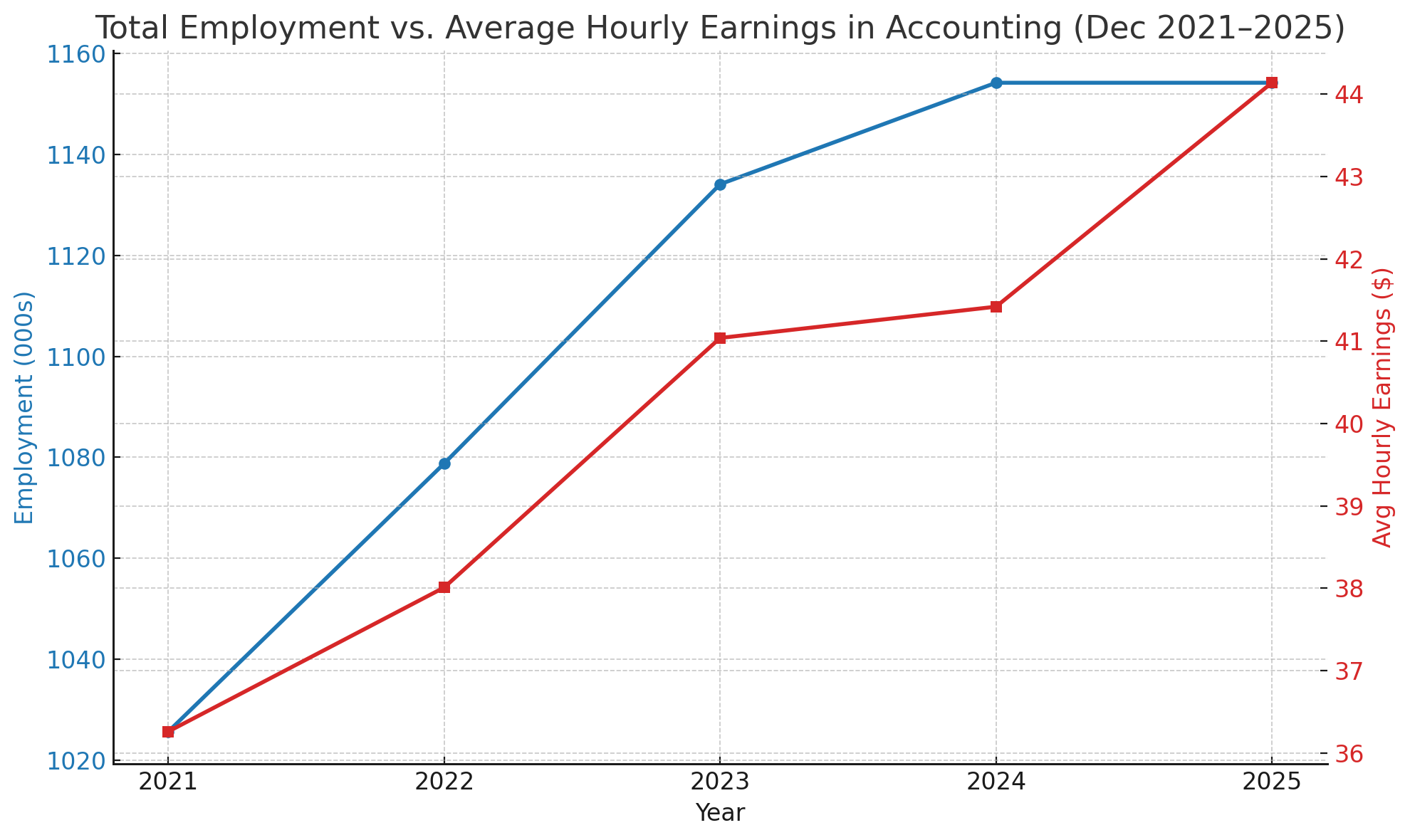

Cryptocurrency has evolved from a niche curiosity to a mainstream economic force — and U.S. tax authorities are finally catching up.

As digital assets, such as Bitcoin, Ethereum, NFTs, and stablecoins, become common investment choices for individuals and businesses alike, the IRS has quietly but significantly overhauled how crypto income must be reported and taxed. However, despite these changes, many taxpayers still fail to comply, and tax professionals are scrambling to keep up.

WEBINAR: Nuts & Bolts of Cryptocurrency Taxation & 1099-DAs | Jan. 27 |1 p.m. ET | 2 CPE

That’s the backdrop for “Nuts & Bolts of Cryptocurrency Taxation & 1099-DAs,” a live 2-hour webinar scheduled for Jan. 27, which will provide accountants and tax advisors with a practical roadmap to navigate this rapidly evolving terrain. READ MORE →

Expect strong demand for tax planning, business advisory and bookkeeping cleanup work.

Expect strong demand for tax planning, business advisory and bookkeeping cleanup work.