CPA Andrew Hunzicker Creates Course in Cannabis Accounting

“This industry is very underserved by accountants.”

By Liz Gold

cannabizcpa.pro

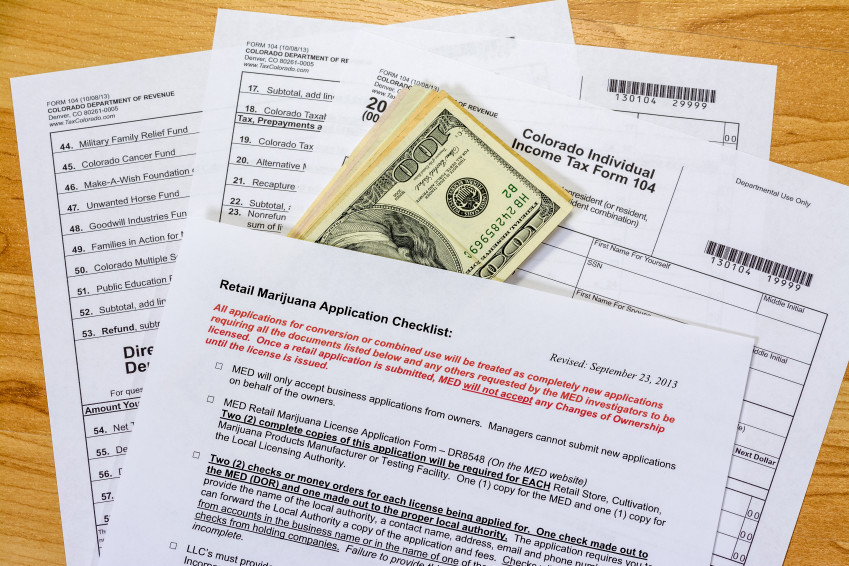

Andrew Hunzicker has created a course to teach other CPAs, accountants and bookkeepers what they need to know to break into the cannabis industry.

MORE ON CANNABIZ: Jim Marty: Building a National CPA Firm for the Cannabis Industry | CPA Kim Walker: ‘We Can’t Be Afraid of Diving into Marijuana’ | A CPA’s Unexpected Journey into the Cannabis Industry | Billion-Dollar Questions: Cannabis FAQ for Accountants | The Wild World of Weed: Tax Season Never Ends

Exclusively for PRO Members. Log in here or upgrade to PRO today.

The online six-week course, dubbed the Green Accounting Firm Startup Training Program, launched this month and participants will learn everything from the unique pain points facing cannabis CEOs to the basics of compliance and licensing. The idea is to help other accountants move into the industry.

READ MORE →