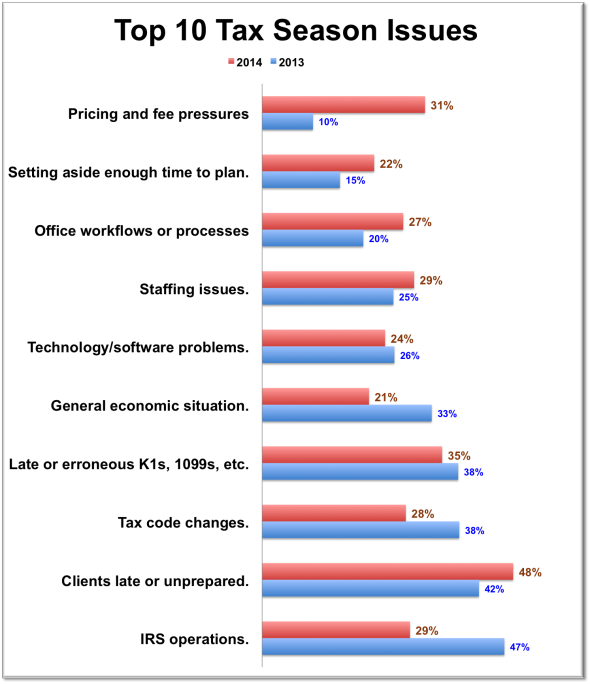

Tax Professionals Plagued by Tough Competition

Sound-Off: Busy Season ‘Much’ Worse than Last Year.

CPA Trendlines Research

The nation’s tax professionals are heading into the final days of the 2014 season brimming with optimism that all the hard work may be paying off. But the hard work isn’t over yet and it isn’t paying off for everyone.

Join the survey; get the results.

Today’s bonus question: Lessons learned

The tax and accounting industry is extending a two-year expansion by adding 2,500 new jobs in the latest month, according to CPA Trendlines research.

The tax and accounting industry is extending a two-year expansion by adding 2,500 new jobs in the latest month, according to CPA Trendlines research.