PE Deal Tracker: 118 Deals Build $30 Billion in New Value

Top Trends, Benchmarks, and Details for Every Reported Deal Since 2020.

By CPA Trendlines Research

Cornerstone Report

Top Trends, Benchmarks, and Details for Every Reported Deal Since 2020.

By CPA Trendlines Research

Cornerstone Report

By CPA Trendlines Research

Cornerstone Report

The accounting industry is undergoing a seismic technological shift as artificial intelligence transitions from a buzzword to a business imperative.

MORE Cornerstone Reports: Private Equity Update: Over 90 Deals, $200 Billion in Value | Intuit Fires Back with Agentic AI after Xero Nabs Melio | Xero Buys Melio for $3 Billion in Race for ‘The Active GL’ | Gen AI in Accounting: Epic Transformation, or Overheated Hype? | Gen Z Surges into Accounting for All the Reasons Your Mother Told You | Major Changes to Circular 230: Implications for Tax Professionals | Salary and Compensation Outlook for Small CPA Firms | Battling the Staffing Crisis: Is a Little-Known, But Controversial, Visa Program the Answer? | Twelve Years and Out: Seasoned Accountants Join the Exodus. | Jobs Outlook: Strong and Steady Growth in Hiring and Earnings for U.S. Accountants | Student Accounting Enrollment Shows Third Year of Recovery | CPA Billing Rates, Tax Return Fees, and Client Accounting Pricing at CPA Firms

MORE AI: 5 Ways to Stay Ahead of the AI Curve | Accounting Influencers | Strategic AI, Not Shiny Objects | Bot Wars: Wolters Kluwer, Intuit, Thomson Reuters Battle for AI Dominance in CPA Firms | Don’t Get Fired by Your Own Automation | Don’t Let AI Sound Smarter Than You | Farlee: AI and Outsourcing Shape Careers | TaxPlanIQ Escalates the Battle in Tax Planning Software | Why Advisory Is Broken. And What Comes Next | Haase, Radzinsky: Inside the TaxDome-Juno AI Alliance

In the past year, CPA firms across the U.S. have quietly begun deploying generative AI assistants, machine learning tools, and “agentic” AI platforms to automate audits, prepare taxes, and provide financial insights.

It’s astonishing: The profession has reached a tipping point where those not investing in AI risk being left behind.

In this CPA Trendlines Research Cornerstone Report:

How CPA Firms Are Embracing AI

AI Adoption Surges from Experimentation to Mainstream

The New Agentic AI Toolbox: Platforms and Solutions Leading the Charge

Measuring the Payoff: Efficiency, ROI, and Firm Economics in the AI Era

Talent in the Age of AI: How Roles and Skills Are Evolving

AI in Action: Use Cases and Success Stories from Firms

Navigating Risks, Regulation, and Ethical Challenges

Overcoming Implementation Hurdles: Change Management and Best Practices

The Road Ahead: Strategies for Firm Leaders

In an escalating arms race, the general ledger is the new gateway to advisory.

By Rick Telberg

CPA Trendlines Research

Cornerstone Report

Just a day or two after Xero shook the accounting world with its $3 billion acquisition of B2B payments platform Melio, Intuit is launching its strategic salvo: A new suite of generative AI agents built into QuickBooks.

SEE Xero Buys Melio for $3 Billion in Race for ‘The Active GL’ | MORE Tech and Fintech | MORE Artificial Intelligence | MORE Cornerstone Reports, in-depth data-driven analysis and commentary

The agents promise to automate payment reminders, reconcile bank transactions, forecast cash flow, and even draft client emails — all without human intervention.

The initiative is pivotal in the escalating arms race among accounting tech giants to dominate the general ledger. The general ledger is no longer just a recordkeeper in this rapidly transforming space. It’s becoming the operating system for every small business financial decision — and the battleground on which legacy players and startups are staking their futures.

By Rick Telberg

CPA Trendlines Research

Cornerstone Report

Xero is betting up to $3 billion that the future of accounting is more than recordkeeping.

The New Zealand-based cloud accounting firm is making its largest-ever acquisition: New York and Tel Aviv-based payments platform Melio. The all-cash deal, valued at $2.5 billion with a potential $500 million earn-out, aims to supercharge Xero’s push into the U.S. market by embedding B2B bill pay directly into its general ledger software. Xero is raising $1.23 billion in equity to help fund the acquisition.

MORE Tech and Fintech | MORE Cornerstone Reports, in-depth data-driven analysis and commentary

By acquiring Melio, Xero is accelerating a profound evolution in the general ledger’s role—from static bookkeeper to real-time financial operator. For accounting firms and their small business clients, the shift could mean fewer keystrokes, faster closes, and new frontiers for advisory services. Routine work—from data entry to expense classification—is increasingly automated. This frees up time but also demands new skills.

The CPA Trendlines overview of what accountants can expect regarding annual salary and bonuses at small CPA firms – and what small CPA firms can expect to budget.

By CPA Trendlines Research

A combination of a talent shortage and the general economic environment could push payroll budgets up by as much as 16.9% in 2025 at small CPA firms, according to CPA Trendlines Research. But partners and owners could make even more.

By CPA Trendlines Research

The H-1B visa program is vital for U.S. companies to hire highly skilled foreign workers in specialty occupations, including tax, finance, and accounting.

CPA Trendlines Research estimates that as many as 46,000 tax, accounting and finance professionals work at U.S. firms under the H-1B program. This figure has received scant attention in the profession but is critical to its infrastructure. To the extent that it has received attention, critics say the program holds down salaries for U.S. workers.

In 2024, the Biden administration eased restrictions on the H-1B visa program while clamping down on abuses. By 2025, with the Trump Administration, it had become a lightning rod of controversy.

The nation’s tech industry has a huge stake in the outcome. Despite fluctuations in the number of H-1B workers requested and approved, the demand for H-1B workers in computer-related occupations remains strong, and H-1B workers play a critical role in the workforce.

No longer a problem confined to just new talent or middle managers.

By CPA Trendlines Research

In a startling shift, thousands of highly experienced top-level accountants are leaving the field mid-career, challenging the long-held view that the staffing crisis is limited to new graduates or middle managers.

RELATED: Middle Managers Getting Squeezed | Explaining the Talent Shortage in One Big Chart | Salary and Compensation Outlook for Small CPA Firms | Gen AI in Accounting: Epic Transformation, or Overheated Hype? | MORE: The Talent Crisis | DOWNLOAD The National Pipeline Advisory Group Report

For many accountants on the edge of transition, the coming years will determine whether the profession can reinvent itself to retain the trust of its workforce or continue to lose ground as one of America’s fundamental professions.

But

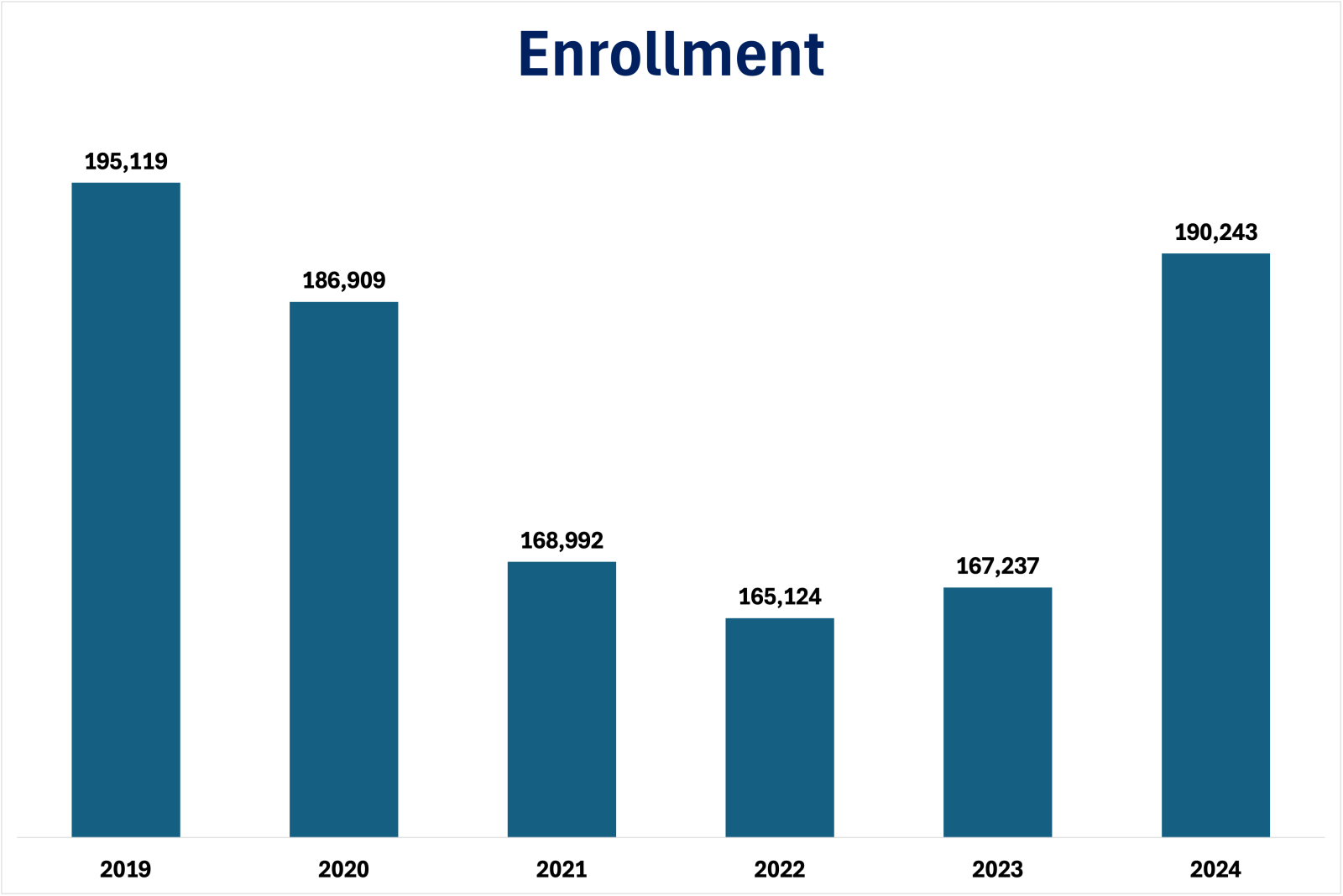

New data from the National Student Clearinghouse Research Center shows a 12 percent increase in fall 2024 accounting enrollment compared to fall 2023. The increase amounted to an additional 28,672 students.

Total undergraduate accounting enrollment for fall 2024 was 267,278 students, the highest accounting enrollment reported since fall 2020 (263,092 students) and just shy of the pre-pandemic fall 2019 enrollment (275,963 students).

CPA Trendlines Cornerstone Report

The key factors contributing to the ups and downs – mostly downs in the last three decades – of CPA exam candidates reflect broader trends in the economy, regulatory environment, and demographic landscape.

CPA Trendlines Research Cornerstone Reports deliver instant situational awareness on the day’s hottest topics.

By CPA Trendlines Research

The billing rates, fees, and pricing strategies at CPA firms are influenced by various factors, including the type of service, the CPA’s experience, geographic location, and the client’s financial complexity.

MORE on Pricing.

As the demand for specialized financial services grows and technology evolves, CPA firms adapt their pricing models to meet client needs and ensure sustainable business growth.