Six Times to Pick Up the Phone This Tax Season

The personal touch goes a long way toward client retention.

By Ed Mendlowitz

Tax Season Opportunity Guide

Clients are not numbers on a list that needs to be reduced. They are all individuals and consider themselves very important people and want professionals who treat them accordingly.

MORE by Ed Mendlowitz

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

It is attitudinal and accountants must adopt that mindset and transmit that through to their culture. So you need to know when it’s essential to pick up the phone.

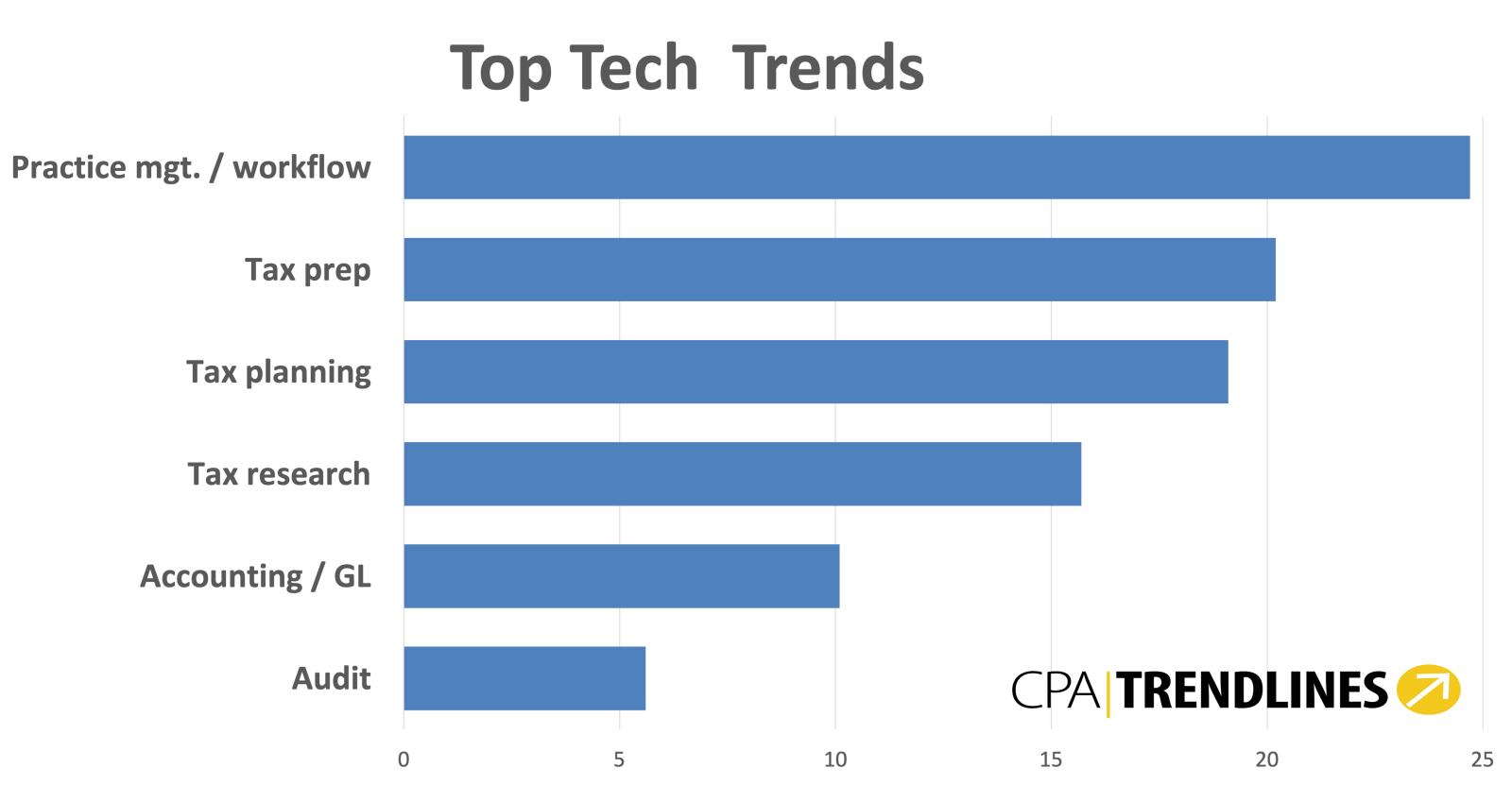

Expect strong demand for tax planning, business advisory and bookkeeping cleanup work.

Expect strong demand for tax planning, business advisory and bookkeeping cleanup work.