Five Areas to Make Inroads with WealthTech

It’s reshaping the future of holistic advice.

By David Knoch and Ryan George

The Holistic Guide to Wealth Management

It’s reshaping the future of holistic advice.

By David Knoch and Ryan George

The Holistic Guide to Wealth Management

Plus seven tech keys to a holistic service model.

By Randy Johnston

The Holistic Guide to Wealth Management

|

|

Rob Santos is CEO of Arrowroot Family Office, which he founded in 2013, and of Arrowroot Advisors, an investment bank focused on M&A for software-based companies. He works with affluent families providing bespoke family office services. |

Four paths, plus tips on clients.

By Rob Santos

The Holistic Guide to Wealth Management

At a California Society of CPAs conference our firm attended, a panelist said that before he made the transition to wealth management, he was very reluctant to register as an investment advisor. Why? Because he thought that registering would be too much trouble.

“Eventually I made the decision to set up a separate RIA firm,” he said “because as a CPA, we are regulated by the California Board of Accountancy. I didn’t want to also have another regulator, whether it was the state of California or the SEC, in my accounting firm.”

That CPA-turned-advisor hasn’t looked back since. He told us later that he only wished he had set up his registered investment advisor many years prior. By setting up a separate firm he must be “very careful” about which hat he is wearing. “I don’t want to be a registered investment advisor in my accounting firm,” he said, “and I don’t want to be an unregistered CPA in my advisory firm.” He also told me there are very clear lines that his colleagues follow when it comes to which firm does the services for their clients. “All things considered, the obstacles weren’t all that great,” he added.

READ MORE →

|

|

Michael Maksymiw, CPA CGMA MSA, is executive director, Aprio Firm Alliance at Aprio. He connects growing firms with resources to advance client relationships and provides access to subject matter experts in specialties that fall outside a firm’s wheelhouse. He holds a Master of Science in Accounting from University of Connecticut. |

Put your vision into practice.

By Michael Maksymiw, CPA CGMA MSA

The Holistic Guide to Wealth Management

A successful future firm has an abundance mindset and an adaptable leadership style. The abundance mindset is based on the belief that there is enough work for everyone. That means the firm can focus on what it wants to – it can pick its niche. And the firm will utilize its network of other firms who think similarly to completely service the client.

A generalist who tries to do everything for a client is the old model. A specialist who finds other specialists to ensure the client has the best team around them for their success is the model of the future.

READ MORE →

|

|

Susan Bryant is a Certified Public Accountant and Certified Tax Strategist. She has earned widespread recognition, including honors as a Woman of Empowerment, Enterprising Woman of the Year, and being named among the Top 50 Women in Accounting. |

Work toward a dynamic vision of a 21st-century CPA.

By Susan Bryant

The Holistic Guide to Wealth Management

As the old saying goes: “Everyone wants an accountant; no one wants to be an accountant.” Whether that saying is true or not, the future of our profession hinges upon casting a new vision.

Accounting has been many things over the years, but “exciting” is not an adjective you hear often to describe it. Reliable. Dependable. Necessary. Sure, but rarely exciting.

However, we live in fast-moving and volatile times. Everything is changing rapidly. The aftermath of the pandemic, and the seismic shifts it caused in the global and local economies, have upended nearly every aspect of business. Sector after sector is scrambling to adapt to our fast-changing world. It’s a world in which the stock market is volatile; inflation is high; war, recession and weather events loom; and millions of Boomers are exiting the work force and surging into retirement. With the world changing so fast, every aspect of business services needs to change with it, including accounting.

READ MORE →

The most dangerous day of retirement is a psychological challenge more than a financial one.

By Rory Henry CFP®, BFA™

For CPA Trendlines

When most people think about retirement planning, they picture spreadsheets and savings targets. But as Dan Haylett, author of The Retirement You Didn’t See Coming and host of the Humans vs. Retirement podcast, explains, the real challenge of retirement is not mathematical—it’s psychological.

“People focus on the numbers because they think that will solve all their challenges,” Haylett says. “But retirement is a complex human problem. Spreadsheets will not tell us who we are without a business card or what gets us out of bed in the morning.”

Plus how to factor in RIAs.

By Rory Henry

The Holistic Guide to Wealth Management

Why are accounting firms measured in revenue multiples while most other businesses are measured in EBITDA multiples?

According to Allan Koltin, accounting industry transaction guru, there is no better reason than because that’s how we’ve always done it in the accounting profession.

“Accounting firms have zero EBITDA; they clear out the register every year,” noted Koltin. “When I talk to firms about private equity, I have to walk them back and explain how you’re going to create your own EBITDA. And the biggest piece of it is what we call the ‘scrape of partner compensation.’ You’re making $1.2 million. Can you live on $800,000 if we move that extra $400,000 into an EBITDA category and put a multiple of 7x to 11x on that and get capital gain?” asked Koltin.

“Partners 55 and older love it. Partners who are 35 are not so sure.”

READ MORE →

Focus on return on relationship, not just ROI.

By Rory Henry

The Holistic Guide to Wealth Management.

There’s no question the pandemic accelerated the accounting profession’s transformation and the entry of private equity (PE) into the marketplace. In many ways the pandemic years were an inflection point. The old way of doing things – meeting clients face to face and providing tax and accounting services – is essentially over. The pandemic and private equity are propelling the profession forward as firms adopt new service offerings, change how they operate, and find innovative ways to recruit, retain and compensate talent.

PE is considered “smart money” because it has a track record of building better business models, increasing efficiencies and then selling the companies and firms they invest in for a profit. Smart money sees enormous potential by investing in accounting firms thanks to technology that makes it easier than ever to integrate professional services on a much larger scale.

READ MORE →

|

|

Blake Oliver is a CPA and the founder and CEO of Earmark, an app that offers NASBA-approved CPE and IRS-approved CE credits for listening to your favorite accounting and tax podcasts. He also co-hosts The Accounting Podcast, the world’s most popular podcast for accountants. |

Technology and AI make it easier.

By Blake Oliver

The Holistic Guide to Wealth Management.

“Isn’t it ironic? We ignore those who adore us and adore those who ignore us.” – Author Ellen Hopkins

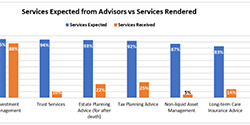

Every CPA I know wants to help clients make the best financial decisions. Study after study shows CPAs are their clients’ most trusted advisors because they have integrity, are prudent, and don’t engage in the hard sell, especially when it comes to financial services.

Most CPAs claim to do tax planning. But how can you do proper tax planning without knowing a client’s financial goals? You need to know much more about a client than merely their tax liability. Yet that’s often where the accountant’s relationship with their client stops every year. How many people have a great tax guy/tax gal whose only goal is to minimize their client’s tax liability? That’s their job, right?

READ MORE →

A one-two punch of value.

By Rory Henry

The Holistic Guide to Wealth Management

The accounting profession is evolving rapidly. New business models are emerging, and firms are uncoupling themselves from the constraints of a partnership structure, from outdated service offerings, and from time-based pricing practices.

You may be asking yourself: “What business am I truly in?” or perhaps, “What business should I be in?” Before answering these questions, consider that you may ultimately be in the relationship business more than you’re in the tax, accounting or bookkeeping business. It doesn’t matter which training, certifications or acronyms you have following your name. If you’re moving into financial planning – or thinking about doing so – you might want to ask yourself: “Am I really in the human business?”

READ MORE →

|

|

Rory Henry, a Behavioral Financial Advisor, is the director at Arrowroot Family Office and co-founder of AFO Wealth Management Forward. He has created a program to help accounting professionals incorporate holistic wealth management and proactive planning services into their practice. |

Think about a return on relationships.

By Rory Henry

The Holistic Guide to Wealth Management

In his iconic work, “Meditationes Sacrae” (1597), Sir Francis Bacon wrote that “knowledge itself is power.” Many scholars believe Bacon wanted to further the idea that having and sharing knowledge is the cornerstone of reputation and influence – and therefore power. All achievements emanate from this philosophy.

But in many areas such as business, finance, sports and the military, knowledge can be a competitive advantage. Therefore, many are reluctant to share their knowledge with others.

READ MORE →

|

|

Rory Henry, a Behavioral Financial Advisor, is the director at Arrowroot Family Office and co-founder of AFO Wealth Management Forward. He has created a program to help accounting professionals incorporate holistic wealth management and proactive planning services into their practice. |

What do you see when you envision your future?

By Rory Henry

The Holistic Guide to Wealth Management

I work at a virtual family office called Arrowroot Family Office. Over the course of my career I have learned that family (and family dynamics) significantly shapes who we are and how we form relationships in life.

Research shows that one of the biggest drivers of family dynamics is the order in which each child is born. Birth order theory, developed by Alfred Adler in the 20th century, suggests that the order in which children are born can have a significant impact on their development and personality.

READ MORE →

|

|

Seth Fineberg is an accounting industry consultant, content strategist, analyst and speaker. His current business is Accountants Forward. He has been a business editor and journalist for over 30 years, the vast majority of which has been spent overseeing the accounting profession’s evolution. |

Advisory begins with conversations.

By Seth Fineberg

The Holistic Guide to Wealth Management.

Today we are cresting the biggest waves of change that I’ve seen in my 20-plus years of covering the accounting profession. I’m talking about the need for CPAs to go beyond simply being the trusted tax guy (or girl) for their clients and to help them manage all aspects of their wealth. This movement has been building for the better part of a decade, but only recently has it gone from “I’ll think about it” to “Can I afford not to get on board?”

Not to sound the alarm bells here, but CPAs must soon choose between riding the financial planning wave or being swept under it.

READ MORE →