Tax Pros E-File 63 Million Returns through April 13

Average refunds remain positive even as totals are in the red.

Average refunds remain positive even as totals are in the red.

By Beth Bellor

CPA Trendlines

With less than a week to go, tax processing slowed slightly.

MORE ON TAX SEASON: DIYers Outpace Pros in E-Filing Growth Rate | Pros Filing 55% of E-Returns | IRS in Retreat from Communities | SURVEY: New Tax Law Roils Busy Season | David Bergstein on Tax Season | Tax Accountants Fill the Breach of a Failing IRS | Artificial Intelligence Gets a Boost with Tax Reforms

Exclusively for PRO Members. Log in here or upgrade to PRO today.

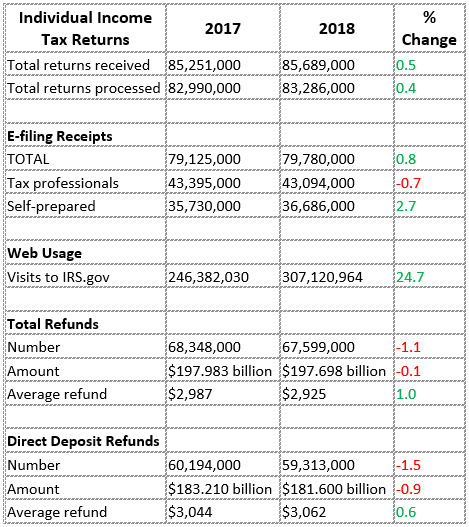

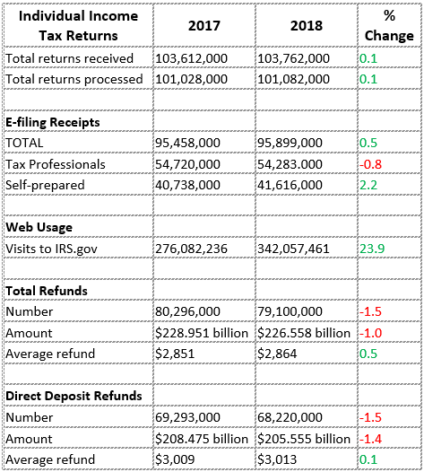

The IRS had received 118.6 million individual income tax returns as of April 13, the latest data available. That’s up 0.1 percent from the same week in 2017. It had processed 114.8 million of those, down 0.2 percent.

READ MORE →

Refunds remained down in number and total amount.

Refunds remained down in number and total amount.