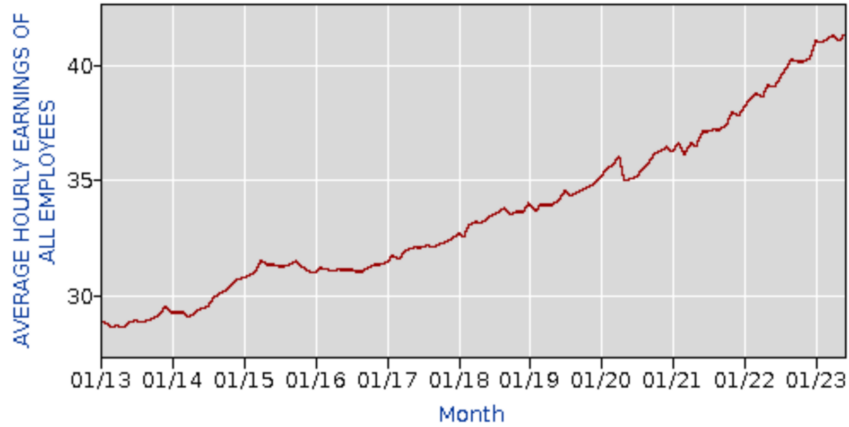

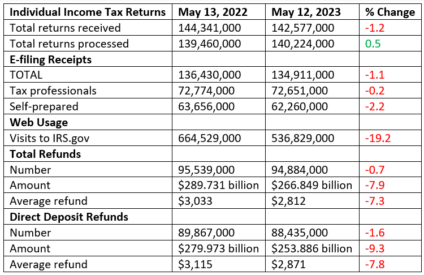

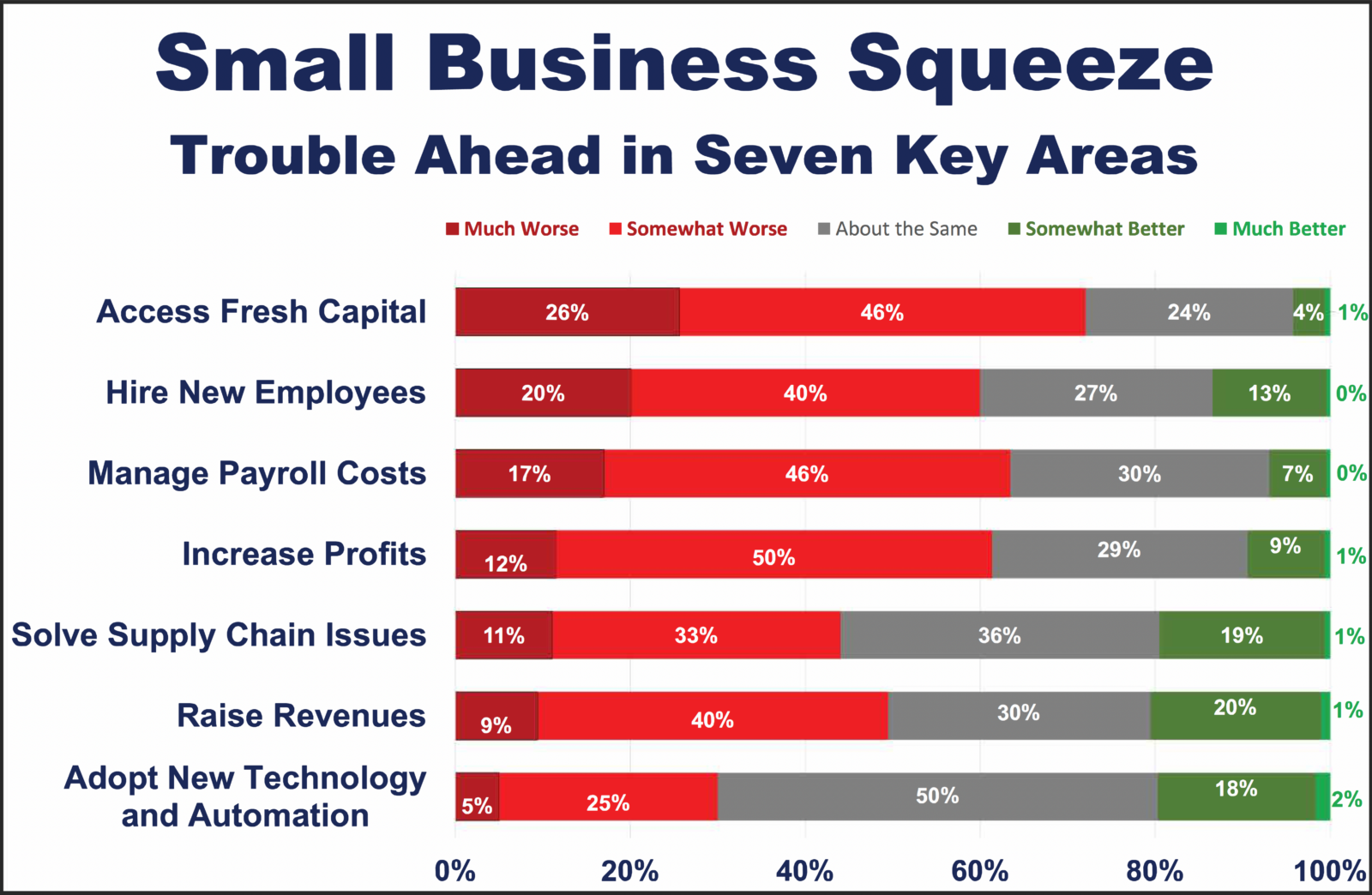

Tax & Accounting Profession Grows, but Wages Don’t

Tax preparation and payroll services are exceptions.

By Beth Bellor

Are there really staffing shortages? Employment numbers in the accounting profession keep rising.

MORE on STAFFING and COMP: Tax and Accounting Pay Advancing at 5.9% Pace | Bill Penczak: Stop Forcing Smart People to Do Stupid Work | Sandra Wiley: Staffing Problem? Check Your Culture | Firms Rev Up Expansion Plans | Accounting Jobs Up 4% for Year | Research: Accounting Pros Cautiously Optimistic about Generative AI | How Auditors Can Beat AI | How Tax Practitioners Became Cybersecurity Risks | Why the U.S. Must Act Now to Protect Our Online Privacy | Top Tax Vendors Caught Red-Handed Selling Private Taxpayer Data

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Perhaps they could be rising even faster if the right people met the right spots – or the right incentives, according to a new CPA Trendlines analysis.