Fraud: It’s Where the Money Is

CPA firms have opportunities here. Bonus: infographics.

By CPA Trendlines

Covid-19 isn’t the only pandemic ravaging the world. There’s a financial virus going around, too.

MORE in RISK MANAGEMENT: In These Turbulent Times, Leaders Must Lead! | Indemnification Helps Partners Sleep Well | Tax Season Is Hacker Season | 2020 Outlook: Top 5 Emerging Risks for CPAs |

Exclusively for PRO Members. Log in here or upgrade to PRO today.

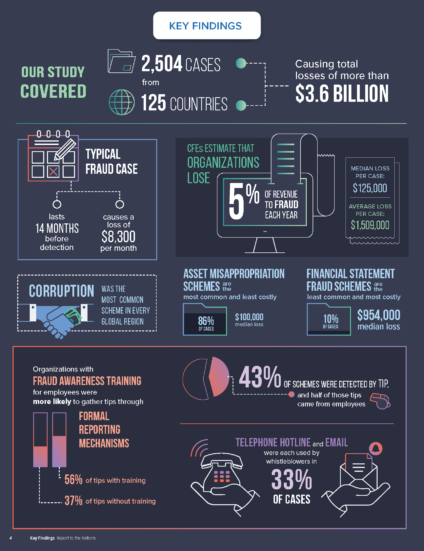

It’s called fraud – maybe not contagious, but it pops up everywhere. On average, an estimated 5 percent of the world’s revenue is lost to fraud each year, a median loss of $125,000, an average loss of $1,509,000.

The prevalence and seriousness of fraud is both opportunity and obligation for CPA practices, not to mention internal audit departments.

According to the 2020 Global Study on Occupational Fraud and Abuse, just issued by the Association of Certified Fraud Examiners, external audits were the source of detection in only 4 percent of 2,504 organizations analyzed in 125 countries. Internal audits accounted for 15 percent of detection, and internal controls seem almost not worthwhile, finding only 2 percent of cases of known fraud.

Despite increasingly sophisticated fraud detection techniques, tips are still by far the most common way fraud is discovered, responsible for 43 percent of detected cases. READ MORE →

And the top five emerging opportunities, if you handle them right.

And the top five emerging opportunities, if you handle them right. Auditors said the activity wasn’t profit-seeking.

Auditors said the activity wasn’t profit-seeking.