“CAS gets stronger as tech gets better. The market’s expanding, not shrinking.”

This is a preview. The complete video episode, with commentary and transcript, is first available exclusively to PRO Members | Go PRO here

Sponsored by “It’s NOT Just the Numbers: How to Move Beyond the Numbers and Deliver REAL Value for Your Clients.”

by Penny Breslin and Damien Greathead. See Today’s Special Offer

Big 4 Transparency

By Dominic Piscopo, CPA

For CPA Trendlines

In this episode of Big 4 Transparency, Matthew May, former co-founder of Acuity and now CAS Leader at Sorren, pulls back the curtain on one of the most significant private equity-driven rollups in the accounting profession. Speaking with host Dominic Piscopo, May details how Acuity, alongside other firms, became part of a growing national platform backed by DFW Capital, and why he believes Client Accounting Services (CAS) will soon eclipse audit.

MORE Dominic Piscopo | MORE Pay & Compensation | MORE CAS

The seeds of the Sorren platform were planted in a BDO Alliance roundtable where six firms fantasized about joining forces. That vision crystallized when DFW Capital, with a thesis to invest $100M in the space, entered the picture. From there, May and his partners at Acuity ran a rigorous process, engaging investment bankers to evaluate 250 potential paths, leading to 11 indications of interest (IOIs), seven in-person meetings, and five formal offers. The decision to join Sorren wasn’t about cashing out – it was about autonomy, cultural fit, and the chance to help shape a future-focused firm from the ground up.

READ MORE →

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

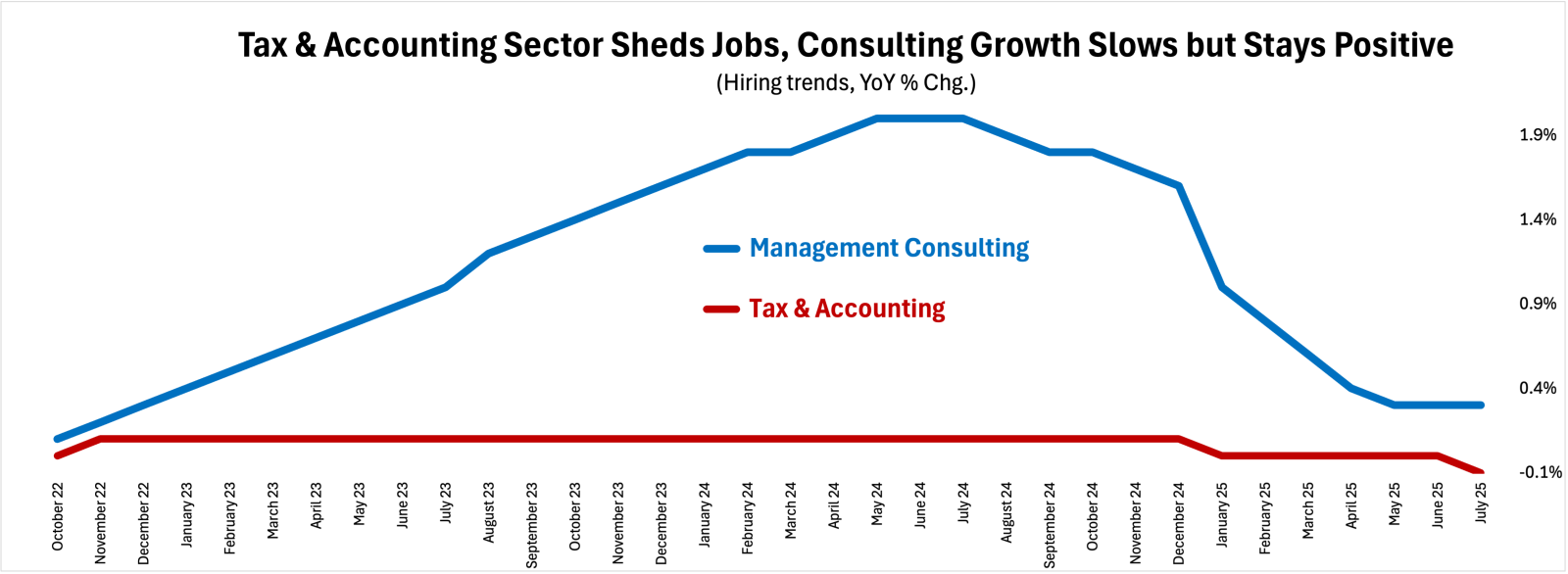

Hiring in the management consulting sector slows, but remains positive. Tax & accounting sector shrinks workforce.

Hiring in the management consulting sector slows, but remains positive. Tax & accounting sector shrinks workforce. By CPA Trendlines Research

By CPA Trendlines Research