When Tax Meets AI, Savvy Tax Pros Turn to ‘Tax Platforms 2026’

Your 2026 Roadmap for the Tax Tech Transformation

By CPA Trendlines Research

DOWNLOAD: Get the free ebook here

Your 2026 Roadmap for the Tax Tech Transformation

By CPA Trendlines Research

DOWNLOAD: Get the free ebook here

CPA Trendlines announces a new strategic partnership with 4impactdata, citing their Business Guidance System that helps firms deliver 10X Advisory without adding headcount.

AI transforms tax planning, strategy, and client communication.

Logo |

Vendor |

Years in Market |

Flagship Features |

Pricing (Approx.) |

Fit |

|---|---|---|---|---|---|

|

TaxPlanIQ |

2019–present |

Bulk 1040 upload, AI-scored strategies, ROI pricing, client proposals |

From $397/month |

Firms moving into advisory |

|

Corvee |

2020–present |

1,500+ strategies, multi-entity modeling, annotated proposals |

Quoted ($499–$999/mo) |

Firms needing a broad catalog |

|

Bloomberg ITP |

Longstanding |

Scenario projections, statutory updates, and audit-defensible |

Enterprise license |

Midsized and large firms |

|

Holistiplan |

2019–present |

OCR return scan, advisor reports |

Subscription |

RIAs, small CPA and tax firms |

|

FP Alpha |

2019–present |

Multi-document AI, tax/estate/insurance scenarios |

Subscription |

Wealth + tax advisory |

|

Intuit Tax Advisor |

2025–present |

Embedded in ProConnect/Lacerte, generative AI plans |

Included in suite |

Small and midsize firms |

|

Blue J |

2015–present |

Predictive analytics, Ask Blue J generative research |

$1,198–$1,498/user |

Authoritative research |

|

CoCounsel (TR) |

2025–present |

Agentic AI integrated with Checkpoint |

$2,700/user |

Large firms |

|

TaxGPT |

2023–present |

AI co-pilot, 1040 review agent |

$1,600/user |

Assistant-style workflow |

|

Taxaroo |

2017–present |

Practice management + voice AI, client portal |

$790/yr or $99/mo |

Small practices |

|

ZeroTax.AI |

2024–present |

Consumer AI Q&A, optional CPA review |

Free / $50 per review |

Households, small business |

|

CPA Pilot |

2023–present |

Lightweight AI assistant, citations, draft comms |

$240–$2,388/yr |

Small firms; affordable AI |

By Rick Telberg

CPA Trendlines Research

Once an add-on service for high-net-worth clients, tax planning is moving to center stage, powered by artificial intelligence and the profession’s accelerating shift to advisory from compliance.

Fresh evidence comes from TaxPlanIQ’s new partnerships with Liberty Tax and Elite Resource Team, which extend TaxPlanIQ’s reach from boutique firms to thousands of retail outlets and nationwide advisory networks. The deals show artificial intelligence transforming accountants’ handling of tax planning, strategy, and client communication.

MORE Tax Planning | Disguised Tax Hikes Are Back on the Table | Haase, Radzinsky: Inside the TaxDome-Juno AI Alliance | Can DOGE and Palantir Fix the IRS with a ‘Mega API’? | Help Clients Envision Their Future Selves

“I can’t imagine a better thing to do than support accountants in that endeavor,” says Jackie Meyer, founder of TaxPlanIQ and CPA Trendlines contributor, positioning her company’s mission personally. TaxPlanIQ’s pitches ease of use. Just upload a 1040, surface strategies, and deliver a branded proposal that quantifies return on investment.

With Liberty Tax, the reach is in the mass market. With ERT, the audience is higher-value clients served by coordinated advisory teams. TaxPlanIQ claims $5 billion saved by clients identified through its system. More than 1,200 firms already use the platform, before the new partnerships,

Reaching for a $2.5 billion prize

The promise of the next evolution of tax planning is enticing, and the field is becoming more competitive by the month. The tax planning software market is projected to grow at a rate of 8% to 13% annually from 2026 to 2033, with the total market size expected to surpass $2.5 billion globally and $25 billion for the broader online tax software segment.

It starts with a conversation.

By Eric Eager

10X Advisory

For years, advisory services have been positioned as the future of the CPA profession. Conferences are filled with “moving up the value chain” sessions, and firm leaders are under growing pressure to make the shift. But here’s the hard truth: most firms are still trying to deliver tomorrow’s services using yesterday’s methods.

MORE Client Accounting Services here | MORE Tech and Fintech here | MORE: Steven Ladd: Start Advisory with Empathy | Woodard: Move Past Reports; Deliver Results | Advisory-CAS Ascending: What Research Reveals About the Future

Long discovery meetings. Manual analysis. Generic PowerPoint decks. Pricing models built on billable hours instead of business outcomes. These are the hallmarks of the old world of advisory—time-intensive, inconsistent, and hard to scale.

And they simply don’t hold up anymore. Today’s business owners are moving faster, expecting more, and looking to their advisors for real-time, relevant, and actionable guidance. But most firms are still operating with a rearview mirror—offering valuable insights that often arrive too late to act.

TaxDome unveils AI-driven workflow to Challenge Aiwyn, Canopy, Karbon.

By CPA Trendlines Research

TaxDome and Juno are launching the accounting industry’s first fully integrated, end-to-end tax workflow solution, an automation-powered platform uniting proposal to payment under a single login.

MORE in Tech | Aiwyn Enters Race for the All-in-One Practice Management Platform | Is Practice Management Having Its Moment?

The rollout lands at a pivotal moment in a fiercely competitive practice management software market, where venture capital, artificial intelligence and consolidation are redrawing the digital map for tax and accounting firms.

Sy Goldberg at his best: Frank. Outspoken. Unfiltered. Unreserved. Unvarnished. Unedited.

CPA Trendlines Research is pleased to present Sy Goldberg’s 112-minute program covering the new required beginning date for starting distributions from retirement accounts.

Why vendors need to start with “why.”

By Seth Fineberg

Unless you’ve been under a rock in the accounting profession, you know that Intuit—makers of some of the most widely used tax and accounting products on the U.S. market—has caused quite a stir within the profession in recent weeks, making some wonder where they stand with the software giant.

MORE: History Could Help Accountant-Vendor Relations | Accounting Needs a ‘Rethink’ Not a ‘Rebrand’ | Big Change Comes with Deep Reflection | Three Ways to Raise the Bar for Your Business

Exclusively for PRO Members. Log in here or upgrade to PRO today.

For quick review, a growing number of accountants that use of the company’s QuickBooks Online product have had to consider how to pass on rising costs of using the product, on top of where they stand with the company and its seemingly competing QuickBooks Live service. Then, more recently, Intuit began running national TV ads promoting its TurboTax Live service with the message of “break up with your accountant.”

Key appointment under new president Ross Tennenbaum.

Are you really sure how much ink you’re buying?

By Rick Richardson

Technology This Week

Those incredibly cheap entry-level printers you find when sorting your options by “price lowest” can be very alluring if you’re in the market for a new inkjet printer. However, don’t assume it shows you’re getting a good deal.

MORE: Bill Gates Behind Next-Generation Nuclear Plant | Your Boarding Pass Could Onboard Hackers | Generative AI Coming to Microsoft 365 | Electronic Skin That Can Sense Touch Will Transform Robotics | ChatGPT Passes CPA Exam on Second Try | Stanford Scientists 3D-Print Heart Tissue | Four of Today’s New Technologies That Will Be Tomorrow’s ‘Norm’ | Cyber Insurance Costs Rise in Health Care as Attacks Soar | Phishing Attack Hackers Have a New Trick

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Just as a drug dealer can offer a cheap initial “sample” to get you hooked before raising the price on all subsequent transactions, printer manufacturers use a similar business strategy. They can easily make up any loss from the printer’s discounted sale by offering its ink cartridges for exorbitantly high prices. The printer firms then keep you on the hook for paying these outrageous ink rates for the duration of the printer, which is a very lucrative revenue stream for them.

Let’s take a closer look …

READ MORE →

There must be a better way.

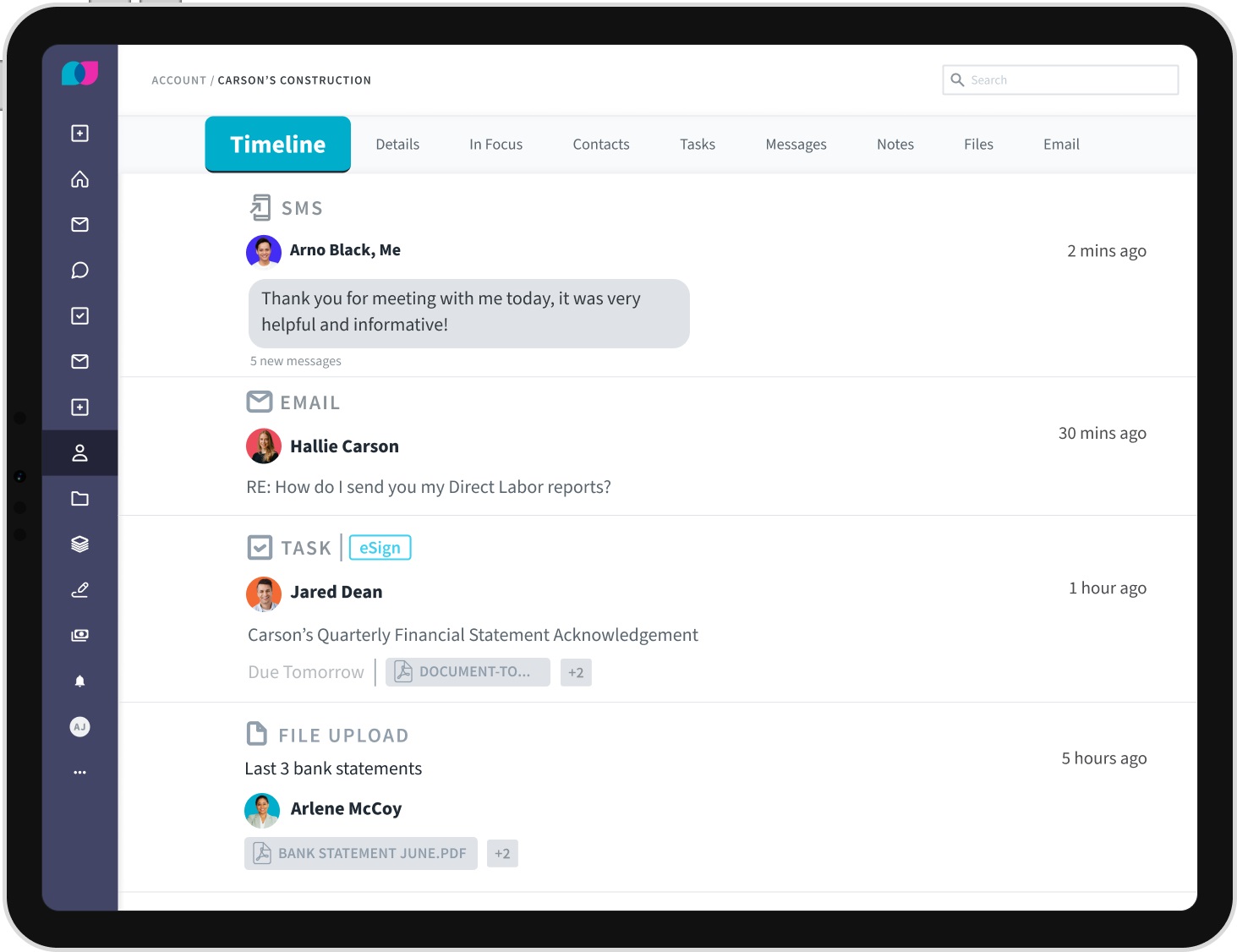

By Seth Fineberg

Email has always been an albatross of sorts for firms. Most firms use it as their primary source of communication and are under the belief that they are “secure” if they use encryption. Add the fact that having personally identifiable information on your machine is illegal, which equals one thing: You’re doing email wrong.

MORE FINEBERG: Careful… You May Be Advising! | When Live Events Fail | Getting Real: Accounting Tech Decisions You Need to Make Today | Who’s in Control? You? Or Your Clients? | Time Management Rule #1 for Accountants | Why VC Is a Bigger Threat Than AI

MORE on EMAIL & CYBERSECURITY: Why Business Email is Doomed | The 7 Categories of Cybersecurity Solutions Firms Need | The Why, What and How of Cybersecurity for Accountants | Top Tech Tools for Building Your New BOS Business | Yes, AI Writes Better Emails | SURVEY: Records Management Tops Email Challenges | Three Apps for ‘Inbox Zero’

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Email was never meant to be this nebulous communications zone. Nor was it intended to be a source of truth or document and communications exchange storage. And now, with new data security laws, there are strict controls on how to use email.

To drive the CPA and F&A outsourcing business globally.

To drive the CPA and F&A outsourcing business globally.

By CPA Trendlines Research

via Datamatics CPA

Datamatics Business Solutions, Inc., a Mumbai-based global provider of outsourced accounting, bookkeeping, finance, tax preparation, audit & assurance, payroll and demand generation & data services, is naming Hitendra Patil as president of its global finance and accounting and CPA outsourcing services.

MORE HITENDRA PATIL: Help Your Clients Run Their Businesses Better | Set Your Processes Apart in Nine Steps | Five Ways to Overcome CAS Staffing Challenges | Think CAS Isn’t for Your Firm? | Convince Your Firm of CAS Value | Ten Ways to Tell a Client Is Ready for CAS | Launch CAS in Just Eight Steps

SEE: Client Accounting Services: The Definitive Success Guide

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Hitendra Patil, a CPA Trendlines contributor and a top 100 influencer in the accounting profession, will drive the CPA and F&A outsourcing business growth for DBS Inc. The CPA business spans the United States, Canada, United Kingdom, Ireland, Australia and New Zealand and is poised for customer growth in other key geographical markets.

Getting unstuck on the tech stack and how to use AI today.

By Seth Fineberg

Analysis & Commentary

You’ve probably realized by now that the accounting profession has reached an inflection point. Professionals’ trust in the vendors that create and distribute the essential technology they use is strained at best. And with automation once again at the forefront, the very nature of accountant tasks is up for debate.

LIVE CHAT: Watch or listen to the entire Flash Briefing here.

In short, we needed a non-sponsored, real chat with actual practitioners who, by all accounts, know what it’s like to be a tech-forward accountant. Moreover, they know that’s not what the profession is comprised of and, despite being innovative, have struggled with tech adoption over the years. This is what our recent Flash Briefing, “Getting Real: The Accounting Tech Decisions You Need to Make Today,” was all about.