Tax Pros E-file 52% of Returns

By Beth Bellor

CPA Trendlines Research

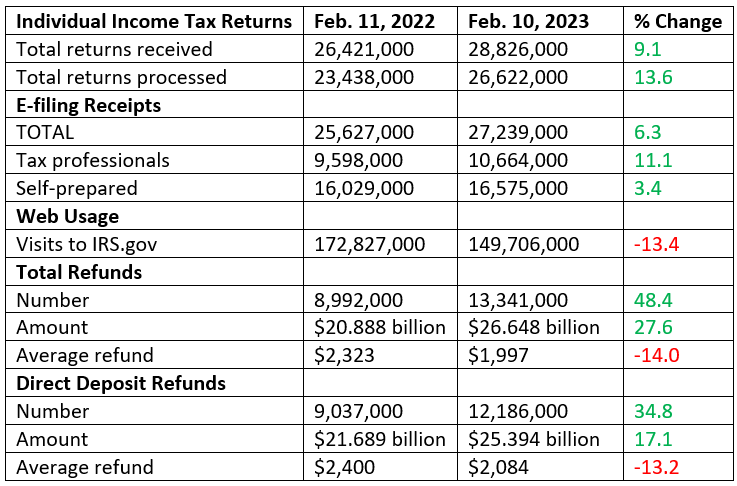

This tax season looks a lot like the last, at least from the viewpoint of the Internal Revenue Service, which is eyeing roughly the same workload.

MORE: Can’t IRS Tax Pro Accounts Do More? | Hello? IRS? Anybody Home? | Taxpayer Assistance Centers Need Upgrade | On Business Outlook, CPAs Are Confident … and Concerned | At the IRS, Short on Staff Means Short on Service | Tax Pros Offer Advice for Small Businesses

Exclusively for PRO Members. Log in here or upgrade to PRO today.

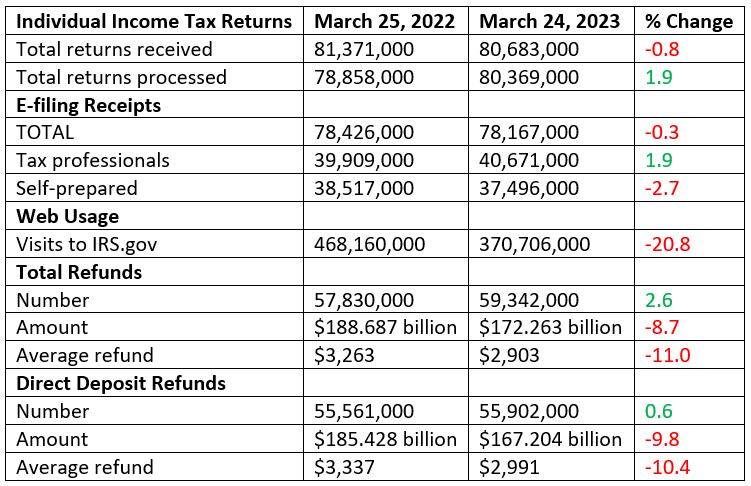

As of March 24, the latest data available, the agency has received 80.7 million returns, down 0.8 percent from the same period in 2022. It has processed 80.4 million returns, up 1.9 percent.

READ MORE →

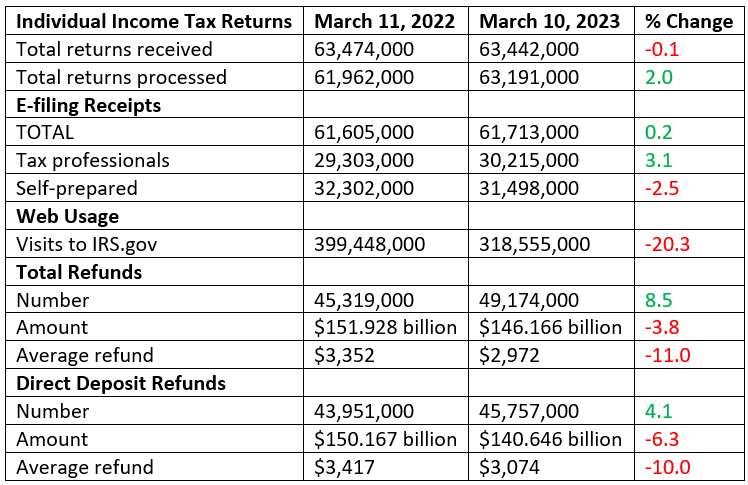

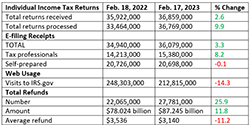

Average refunds are down by double digits.

Average refunds are down by double digits.

Refund amounts are down 14%.

Refund amounts are down 14%.