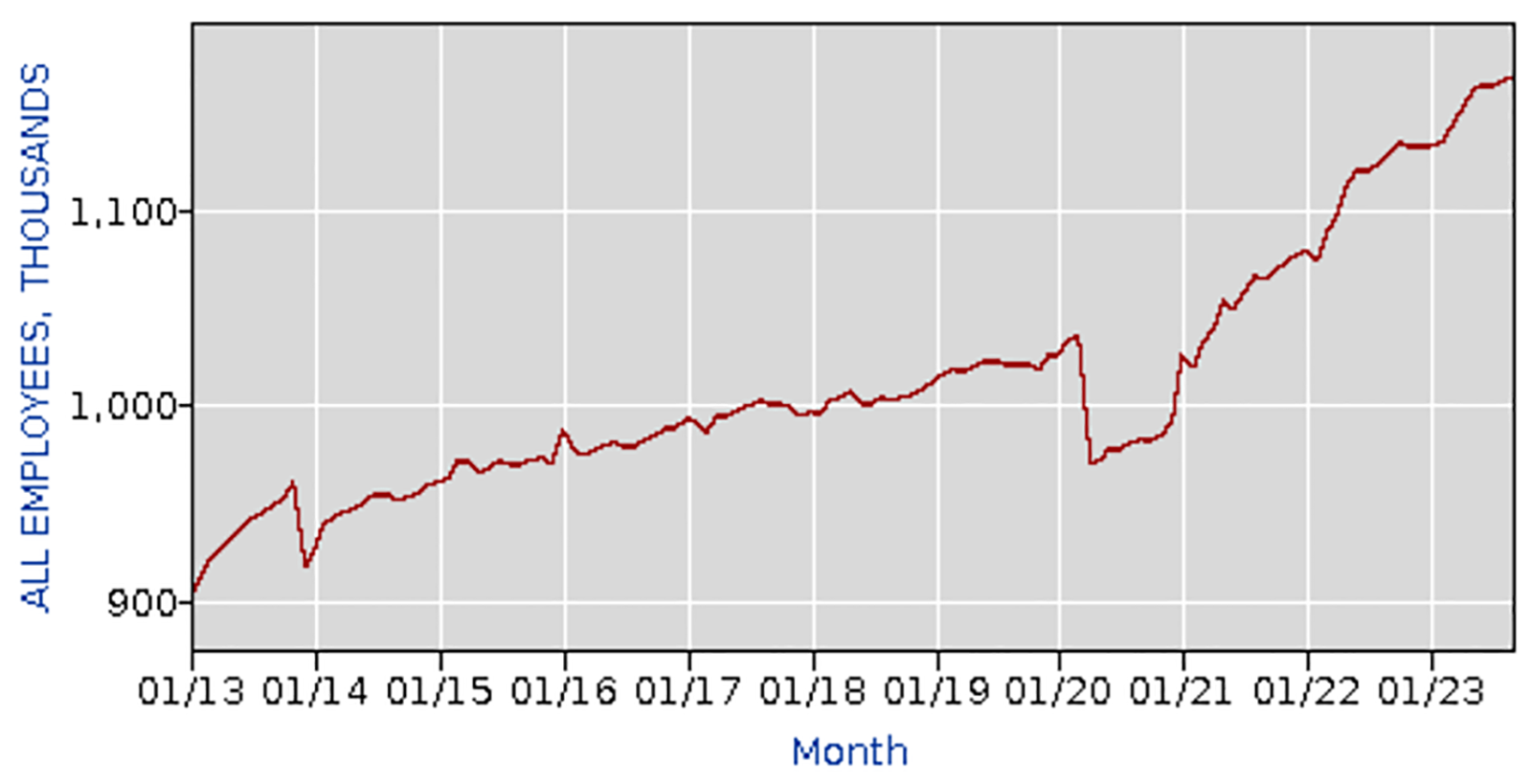

Tax & Accounting Firms Grow for 9th Straight Month

Bookkeeping is playing the tortoise game.

Bookkeeping is playing the tortoise game.

By Beth Bellor

Bit by bit, the accounting profession is growing. Despite a staffing shortage. Despite an uncertain economy. Despite everything, tax and accounting firms are steadily adding to headcounts.

MORE: Tax & Accounting Profession Grows, but Wages Don’t | Tax and Accounting Pay Advancing at 5.9% Pace | Accounting Jobs Up 4% for Year

Exclusively for PRO Members. Log in here or upgrade to PRO today.

As tax and accounting professionals begin planning for the year ahead, the CPA Trendlines Research team is fielding a new survey to check the pulse of the profession, detect emerging trends, and identify the best success strategies going into 2024.

Join the Survey. Get the Results.

Click here to launch the 10-minute survey.

According to the latest data mined by CPA Trendlines Research, new highs were reached in September in employment overall, staff, CPA firm staff, bookkeeping, women overall and women in CPA firms. Staff also hit a new mark for hourly earnings.