Show Us the Money! Accountants Are Making More

Want to retain employees? Here’s one way.

By Beth Bellor

More money. That’s what the latest data show for the accounting profession.

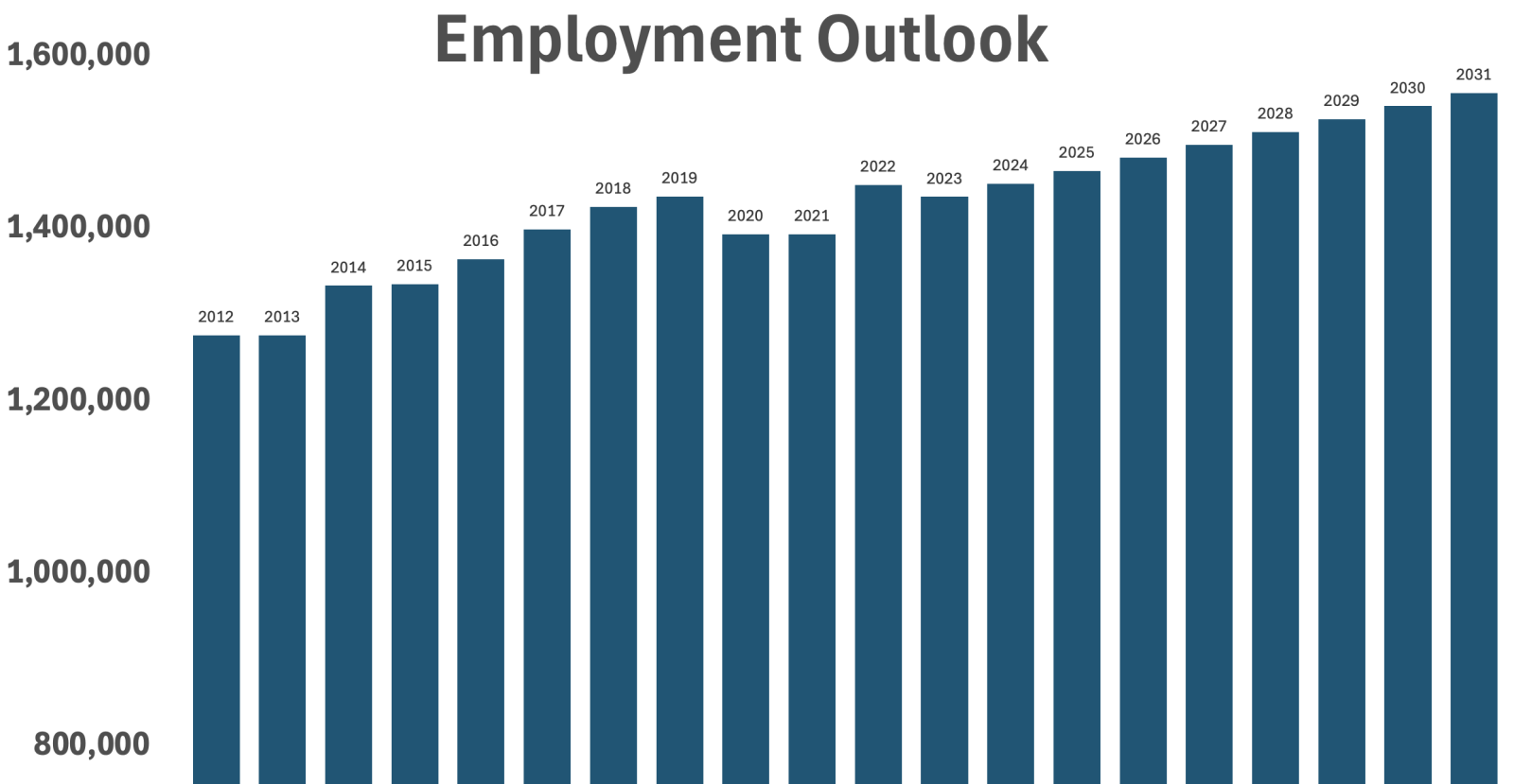

The final jobs report of 2024 saw the accounting profession’s numbers slip a bit, but the bodies in those seats were pulling down record earnings. Employees in the profession overall, at CPA firms and non-staff in payroll services saw their highest hourly wages ever.

MORE: Survey Says 57% of Firms Are Raising Prices Next Year | How Accounting Firms Are Handling the Staff Shortage | More Big Firms Shut Their Doors to New College Grads | Seven Enticements to Keep Talent On Board | Despite Staffing Crunch, Firms Freeze Pay Raises

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

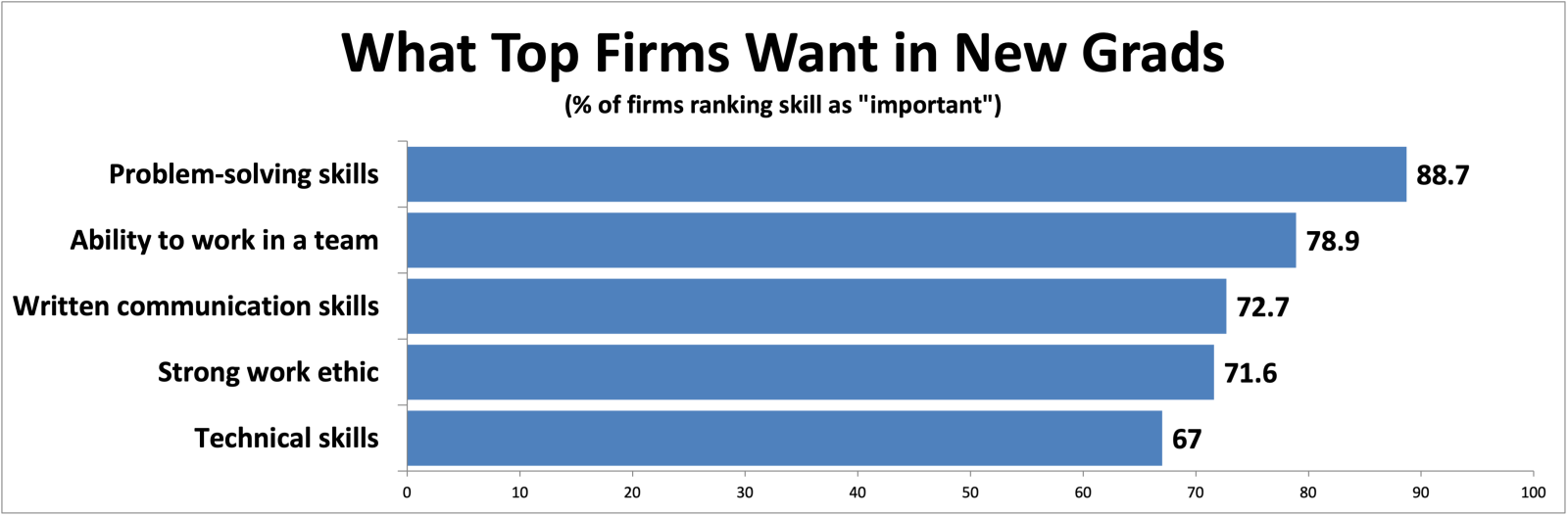

And about time! We heard the call for better compensation in the most recent Rosenberg National Survey of CPA Firm Statistics.

READ MORE →