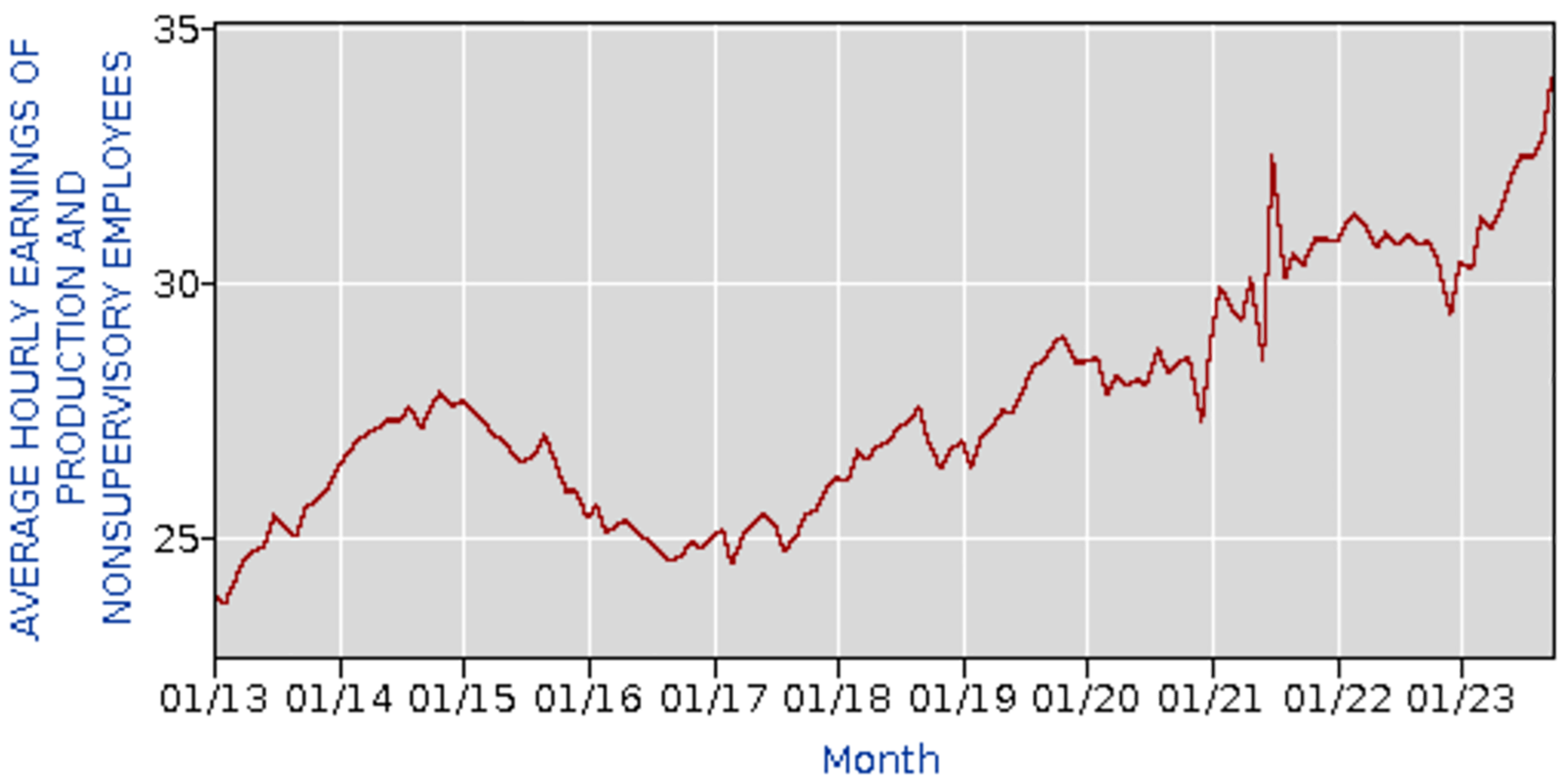

Compensation’s Up, but Up Enough to Retain Staff?

People are leaving the profession. More money is one solution.

By CPA Trendlines Research

The AICPA’s 2023 National Management of an Accounting Practice (MAP) Survey came up with an odd statistic. Kind of hard to believe until you get the context.

The finding: the median employee turnover rate across all CPA firms is … 0 percent.

Yes, that’s a zero.

MORE: Are Accountants Charging Too Little? | ChatGPT for the Reluctant Accountant | Survey Shows Challenges, Priorities Shifting | Can Big Data Spot Financial Fraud? | Accountants Torn Over 2024 Economy, Offer Advice | SURVEY: Are You Offering the Right Services? | SURVEY: 42% of Accountants Turn Away Work Over Staff Shortages | Talent Gap Widening: Be Very Scared | CPA Biz Is Booming, But for How Long? | The 7 Categories of Cybersecurity Solutions Firms Need

Exclusively for PRO Members. Log in here or upgrade to PRO today.

But wait. A median, as they say, is only half the story.

The bigger story – the broader context – is that more than half the responding practices had zero turnover, so the median fell at zero percent. But that goose egg doesn’t reflect the reality of firms at the other side of the spectrum.

READ MORE →

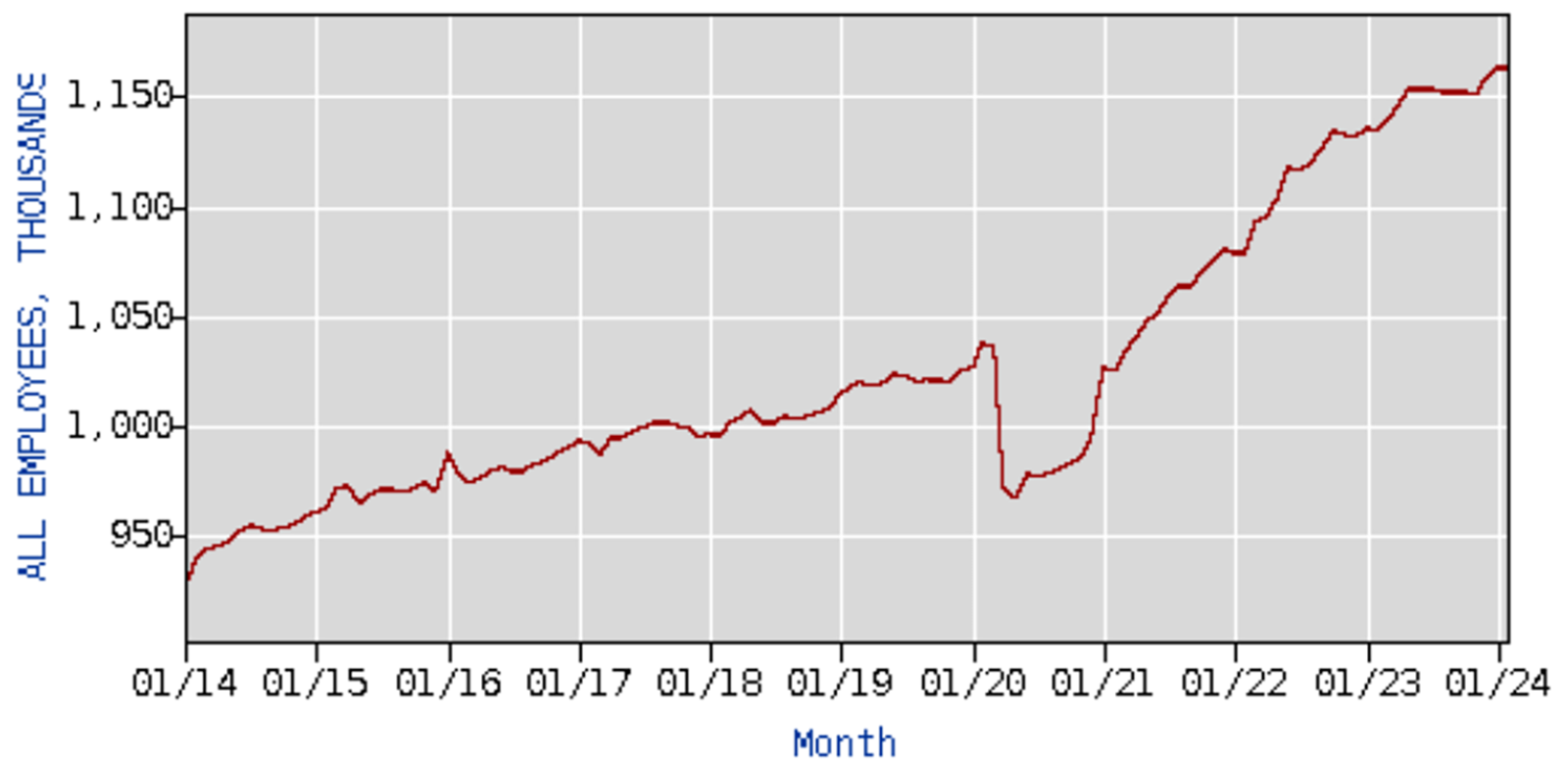

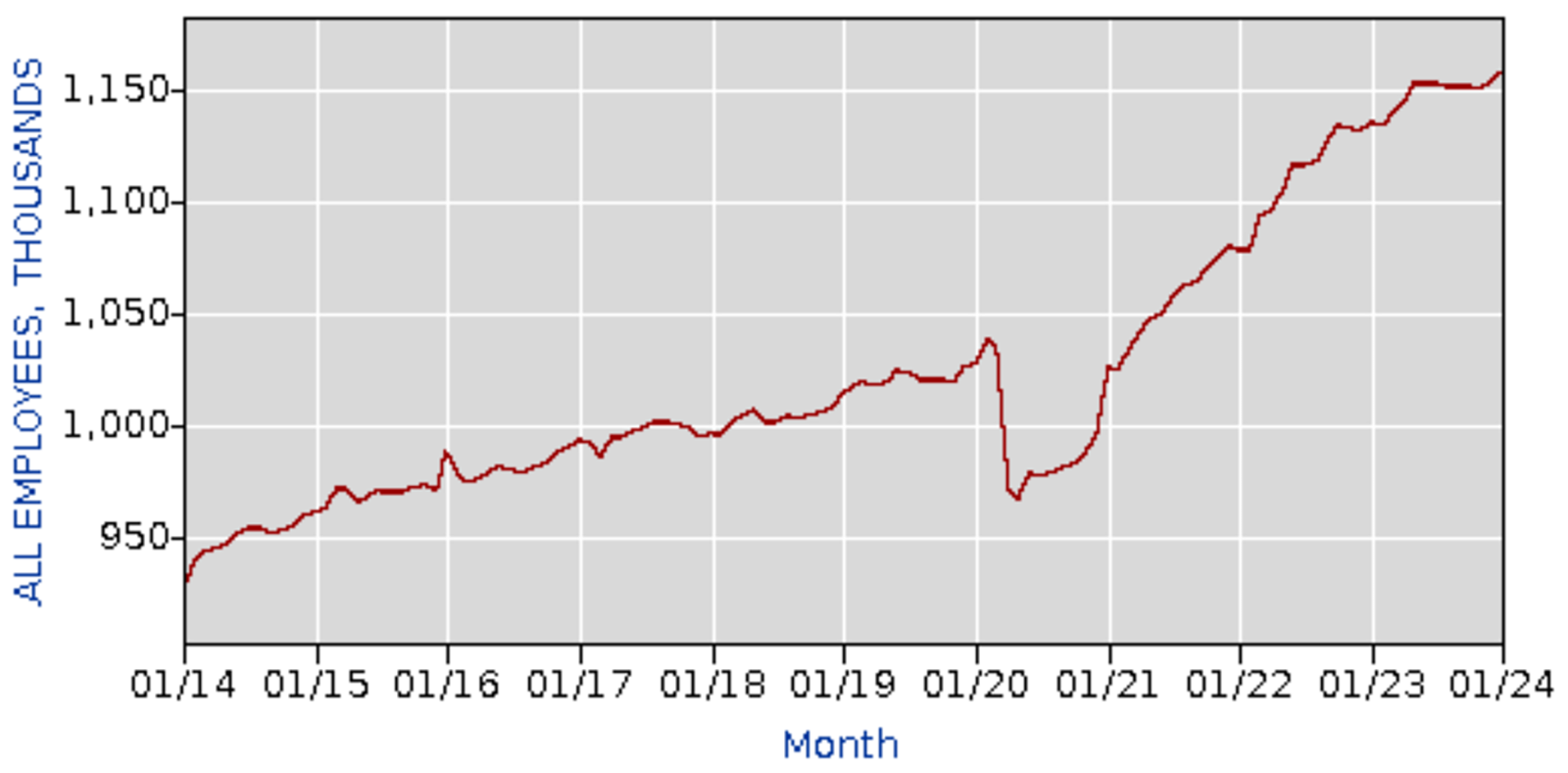

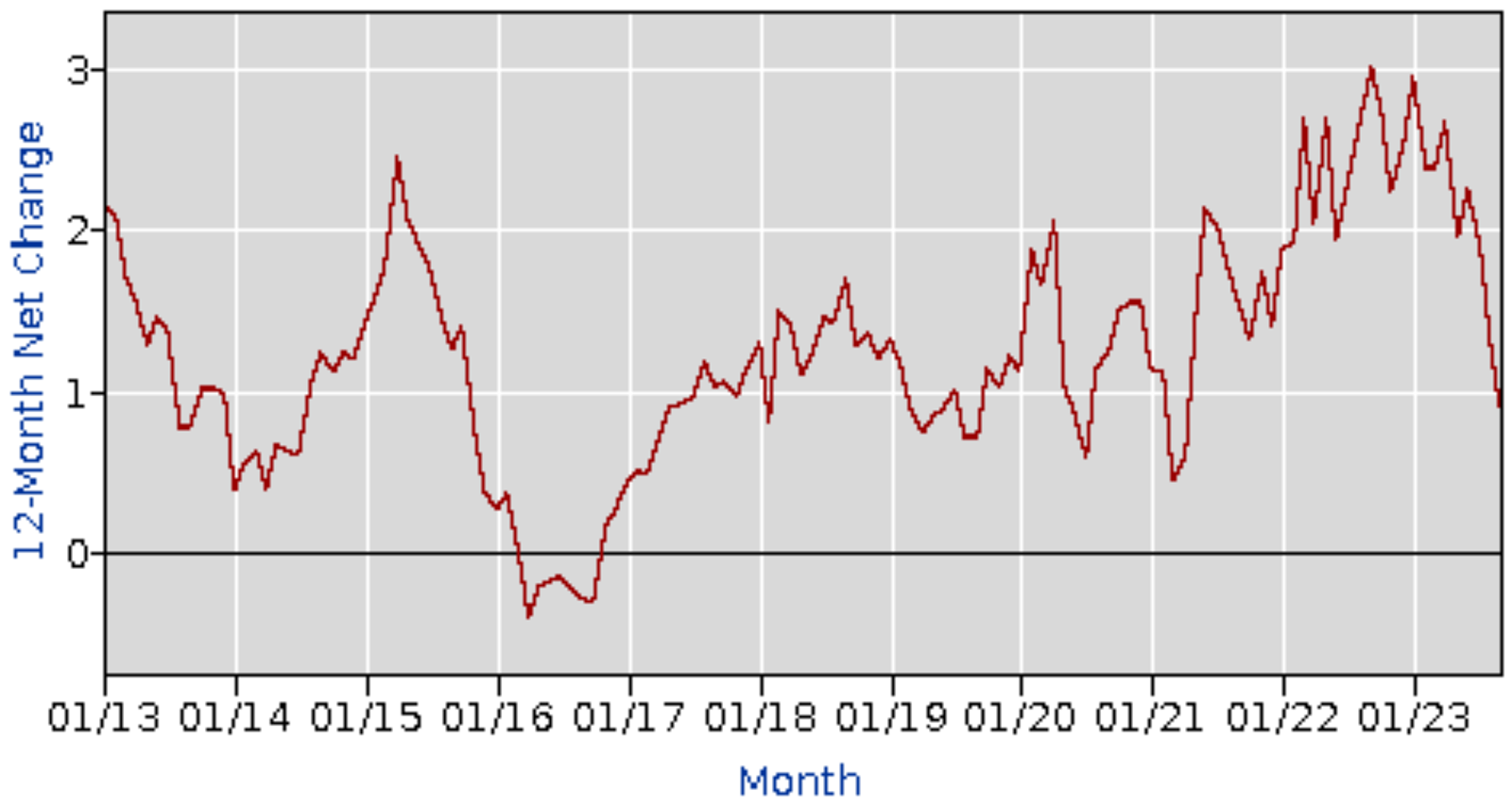

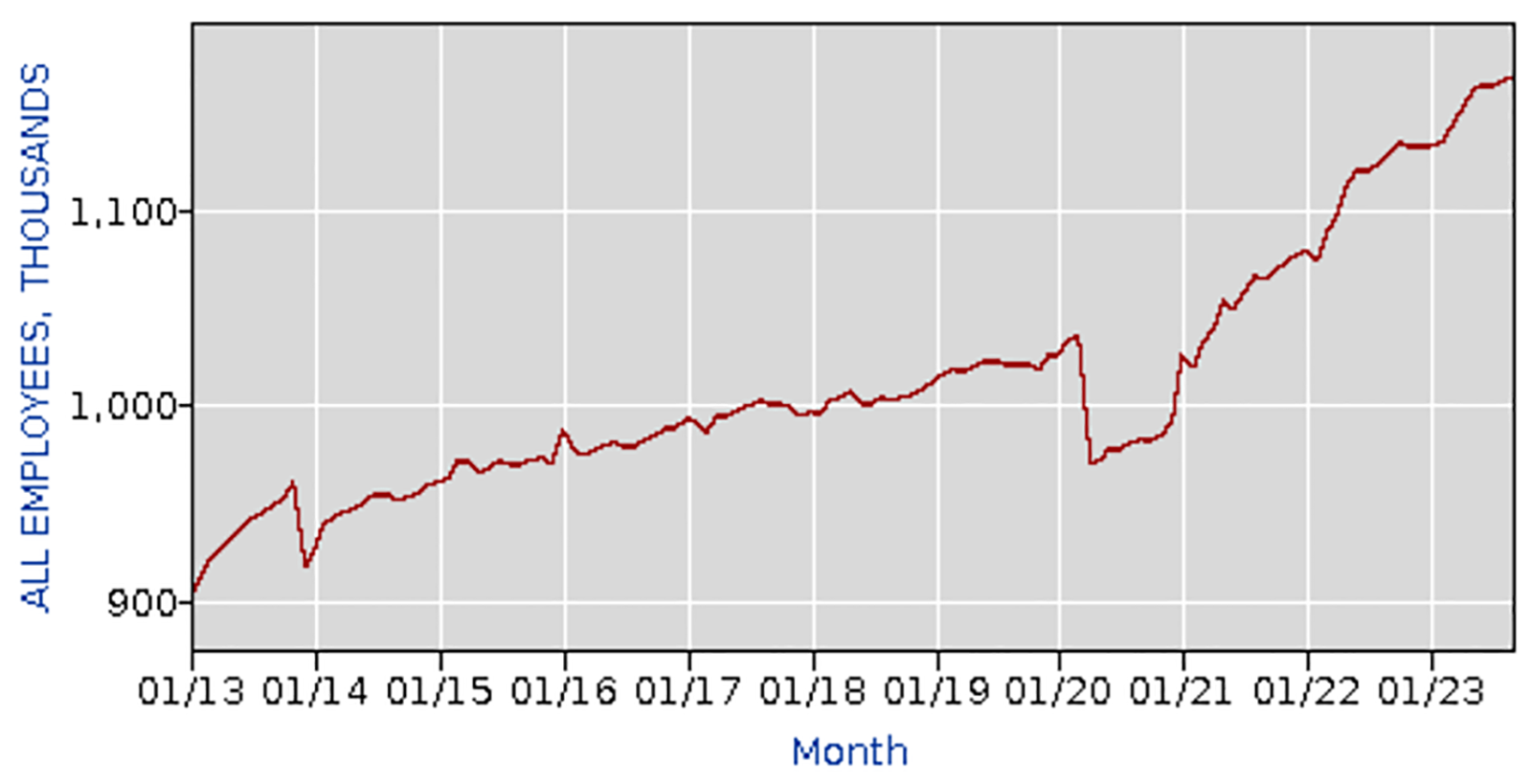

Bookkeeping is playing the tortoise game.

Bookkeeping is playing the tortoise game.