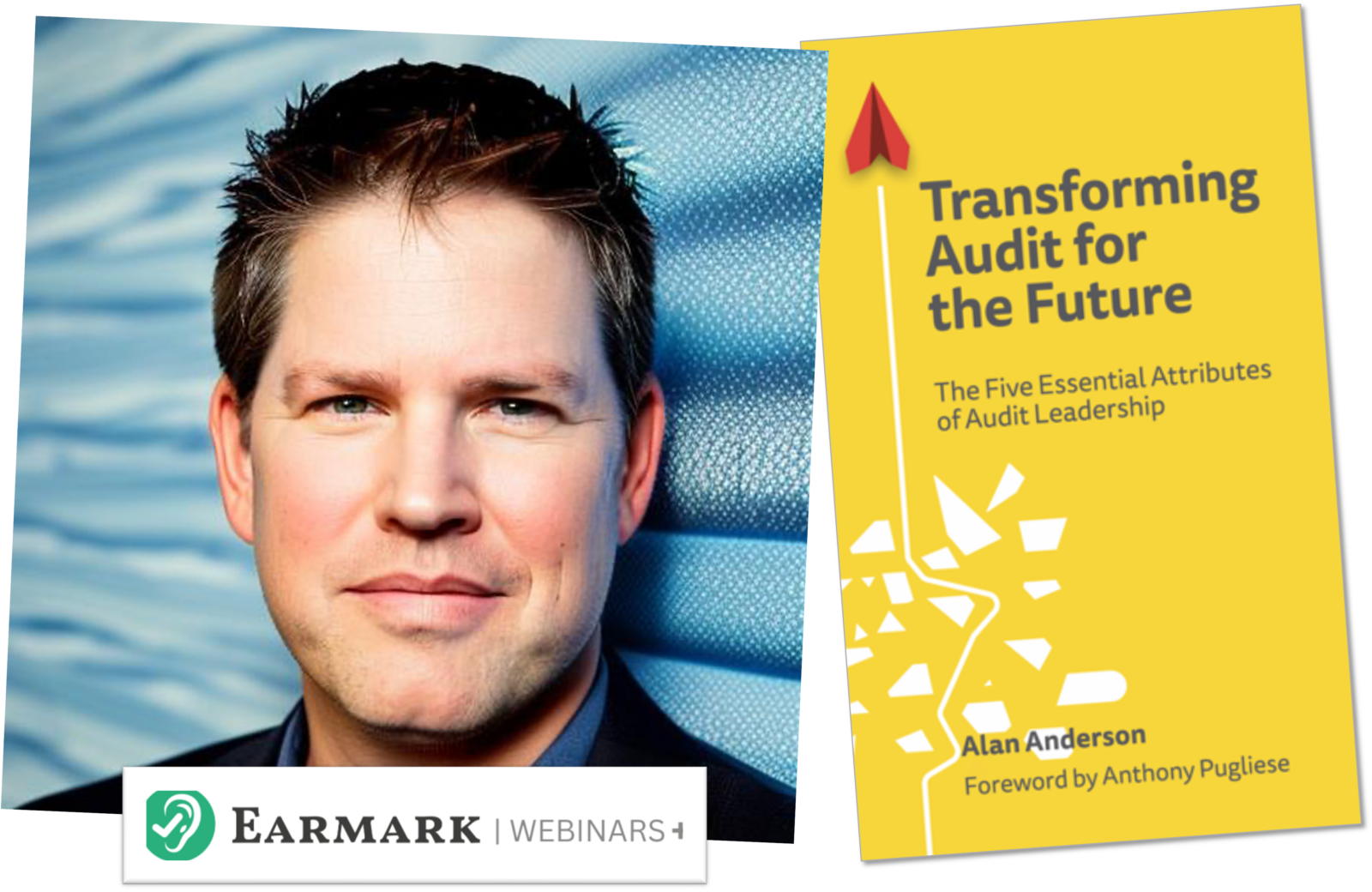

Make Audits Matter: Live CPE with Alan Anderson

Anderson joins host Blake Oliver at Earmark Webinars+.

Making Audit Matter Again: The Future of Assurance

Feb. 28, 12 PM ET, 9 AM PT

Learn more | Register

CPA Trendlines

The audit is at a crossroads. Commoditization and compliance mentalities have diminished its value. Now, auditors face an existential crisis.

How can assurance stay relevant?

Join Alan Anderson, author of the newly published “Transforming Audit for the Future,” and Blake Oliver as they tackle pressing questions on audit’s failure to innovate and chart a new direction focused on value-added assurance.