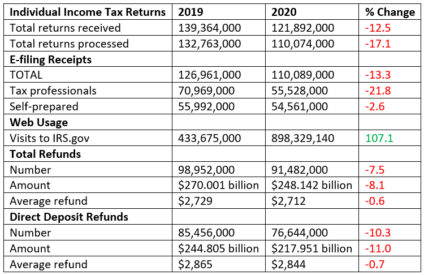

Tax Pro E-Filings Down 20 Percent

IRS.gov visits top 1 billion.

IRS.gov visits top 1 billion.

By Beth Bellor

With two long months to go in this pandemic-stretched tax season, all the key figures are down, down, down … except visits to the IRS website, of course, and a flat spot for DIYers.

Will business pick up as states reopen? Or are the clients waiting in the wings the ones no one wants?

MORE: IRS Web Traffic Doubles over Year-Ago | COVID Drowns IRS in New Filings | 2020 Tax Season Comes to a Screeching Halt | The Tax Season 2020 Dumpster Fire | Tax Pros Fall Behind 6.2% in Returns Filed | Tax Pros Trail by 908,000 Returns

Exclusively for PRO Members. Log in here or upgrade to PRO today.

The IRS had received 125.5 million individual income tax returns as of the week ending May 1, the latest data available, down 11 percent from the same period one year ago. It had processed 113.1 million returns, down 16.1 percent.

READ MORE →

Coronavirus crushes tax prep.

Coronavirus crushes tax prep.

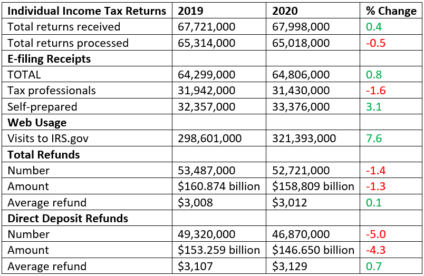

DIYs, refunds are up.

DIYs, refunds are up.