Tax Practitioners Say Happy Days Are Here … Again

For most, anyway.

By CPA Trendlines Research

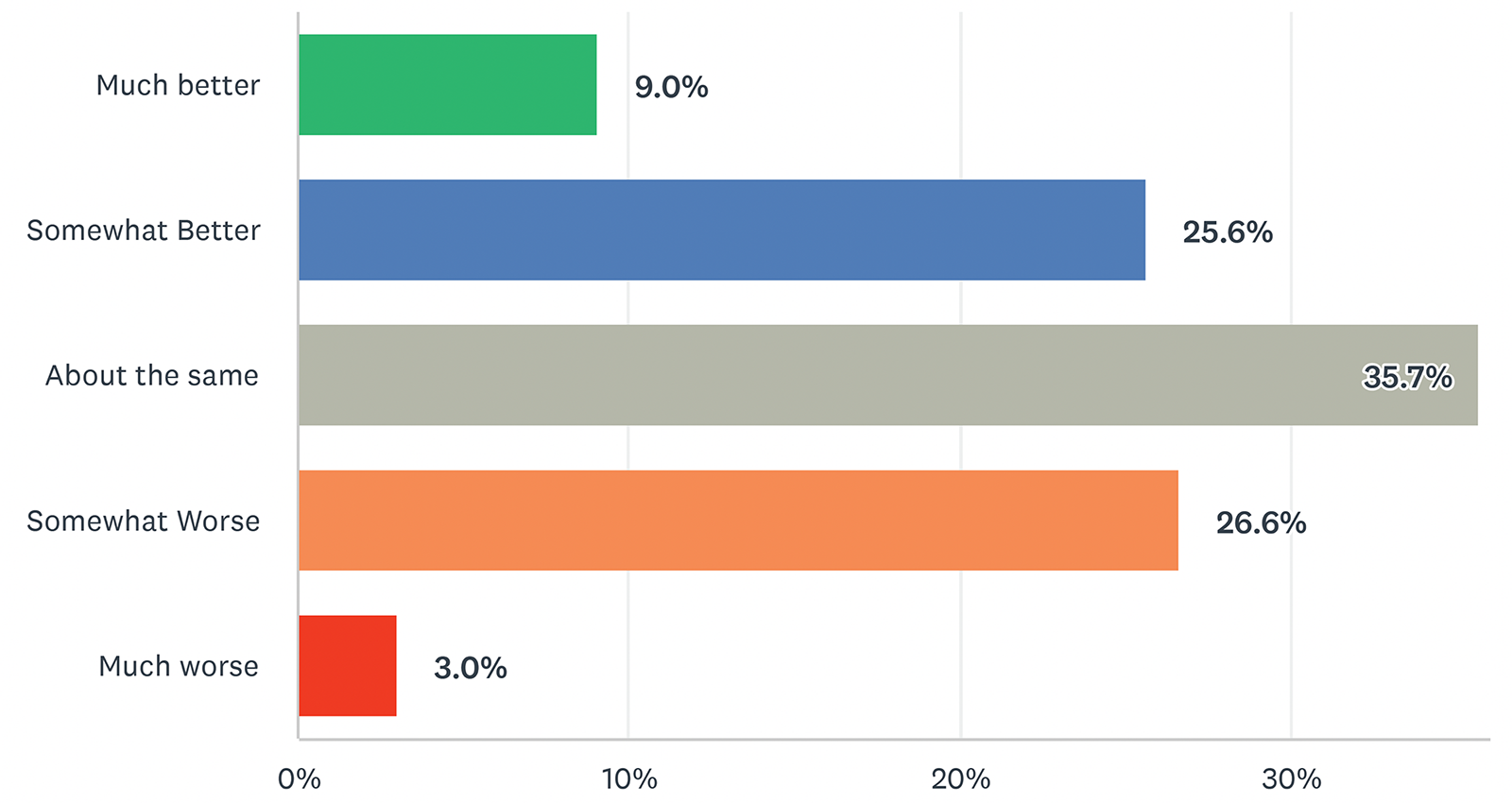

The first results of the 2024 Busy Season Barometer: Emerging Issues, Opportunities, and Trends are in, and so far, halfway into the tax season, accountants and tax practitioners are reporting another pretty good year.

That’s two in a row!

MORE: The IRS Is Coming! Get Your Clients into Compliance | End Tax Season Meetings with Clients … Seriously | Brandon Hall: Firms Try to Make Too Much on Tax Prep | Eight Steps to Getting Started with AI: A Guide for Tax Professionals | The Nightmare of Non-credentialed Tax Preparers | Tax Pros Are Expanding and Earning More

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Last year, 58 percent of survey respondents said their year was much better or somewhat better than 2022, which, as you may recall, had been a rather rotten year.

So when only 32 percent of this year’s contributors say this season is better than 2023, it doesn’t mean fewer are having a good year. It means almost a third are reporting a year better than a good year.

READ MORE →