TAX SEASON

Ten Tax Prep Questions That People Forget to Ask

Your clients will appreciate the attention to detail.

By Ed Mendlowitz

Tax Season Opportunity Guide

Many professionals fail to systematically ask clients some basic and important questions. Here’s my top 10 list of key questions to ask this year. What would you add?

MORE ON TAX SEASON: Try This Clean Slate Exercise | Offer Your Tax Clients Other Services | Can Your Tax Reviewers Answer These 10 Questions? | The Top 12 Mistakes in Tax Return Preparation | Six Types of Person: Which Are You? | Answer These Two Questions First | Help Your Tax Clients, Help Yourself | What’s Your Value to Your Tax Clients? | Are You Excited About Tax Season?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

1. Foreign bank accounts: Make certain you ask every client if they have a foreign account and if they do, report the income and file the proper forms. The penalties are too great if it is wrong.

End Tax Season Meetings with Clients … Seriously

Clients who want to meet should be more than willing to pay for that meeting.

By Frank Stitely

The Relentless CPA

What did Dorothy and her friends fear in The Wizard of Oz? “Lions and tigers and bears, oh my!” Dorothy feared the wrong things if she was a partner in a CPA firm. We don’t see much wildlife in our offices during tax season unless you count fast-food delivery people and the occasional crazy client.

MORE: Get Clients to Understand Firm Processes … or Say Goodbye | Train Now Before It Costs You Down the Road | Keep Clients from “Balance Due” Shock | It’s OK to Say No to Clients (Even the Large Ones) | You Train Your Clients, Whether You Mean To or Not | Business Owners Face One of Three Exits | How Small Firms Can Win the Talent Wars | Do You Know Your Turnaround Time?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

We should fear the events that destroy our priorities and drain hours from productive work. Meetings and phone calls and emails, oh my! From a practice management standpoint, let’s look at why these communication methods are so destructive.

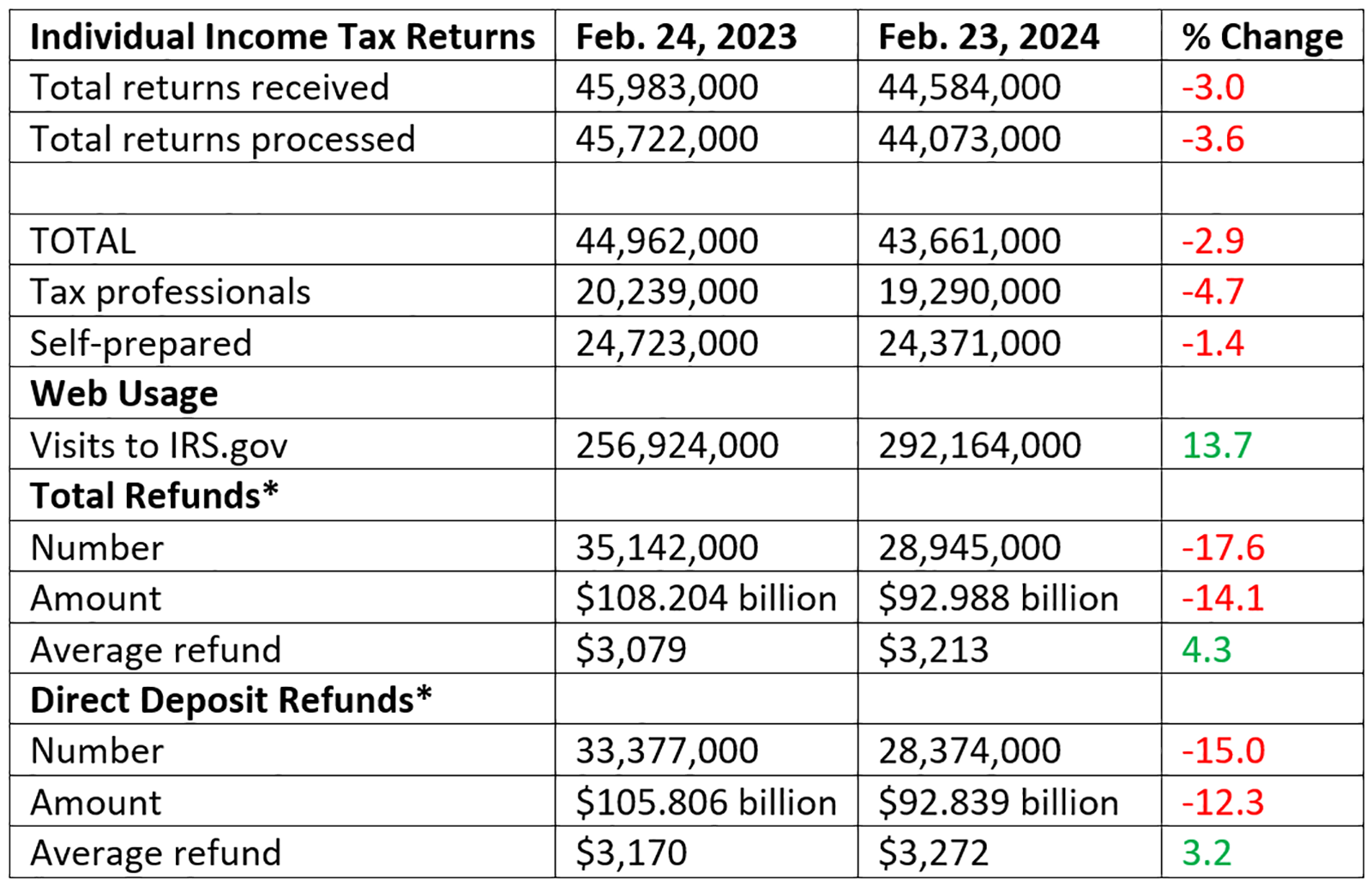

Tax Refunds, Tax Pro Market Share Trending Up

* Total refunds issued represents returns received and processed in 2024 – the current year only. The number of direct deposit refunds represents returns received in the current and prior year but processed in 2024.

How long before more figures flip positive … or might they not?

By Beth Bellor

The 2024 filing season has been seven days shorter than 2023’s, but that’s making less difference as individual income tax returns keep dropping into the Internal Revenue Service inbox, just 3 percent off last year’s pace.

MORE: Tax Pros Handle 37.7% of E-filings | Tax Pros File 33% of Early Returns

Exclusively for PRO Members. Log in here or upgrade to PRO today.

The IRS had received 44.6 million such returns as of Feb. 23, the last week for which data has been released. It had processed 44.1 million returns, down 3.6 percent.

READ MORE →

Make It ‘Productive Season’

Don’t be busy. Be productive.

By Seth Fineberg

At Large

At this time of year, most accountants are considered to be mired in an annual waterboarding-like ritual known as “busy season.” While the moniker has long stirred ire, one way to rally against its implication is to take a good look at what being “busy” means. Moreover, why not make it more productive?

MORE FINEBERG: It’s Time to Do the Uncomfortable | Jeremy Sulzmann: Can Intuit Mend Fences with Accountants at QB Connect? | Meet Basis, the New AI Bookkeeper on the Block | Is This When Accountants Start Taking Freshbooks Seriously? |You’re Doing Email Wrong | Careful … You May Be Advising! | When Live Events Fail | Getting Real: Accounting Tech Decisions You Need to Make Today | Accounting Tech Doesn’t Have to Be Daunting |Who’s in Control? You? Or Your Clients?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Perspective is everything. And while I’ve noticed more accounting professionals making concerted efforts to have more of a life/work balance, it is apparent that much of the work that contributes to being “busy” could evolve into productivity.

Eight Steps to Getting Started with AI: A Guide for Tax Professionals

Overcome the ChatGPT AI learning curve.

By Sandi Leyva and ChatGPT

In the fast-paced world of tax preparation and accounting, the adoption of artificial intelligence (AI) tools like ChatGPT can be a game-changer. However, the learning curve associated with these technologies can be a bit daunting, especially for technology immigrants in the Gen X, Boomer, and Silent generations (versus natives born after 1985).

Check out our courses on ChatGPT,

Check out our courses on ChatGPT,

offered as a deep discount bundle or separately.

Webinar Schedule:

March 19: Your Strategic Partner: Using ChatGPT for Strategy Work

March 22 Webinar: Deep Dive with ChatGPT and Zapier Interface

April 18: Your Advisory Assistant: Using ChatGPT to Provide Better Advisory Services to Clients

April 25: The AI Playoffs: ChatGPT, Bard, and Bing Compared

MORE ChaptGPT here

If you’re hesitant or short on time, here’s how to get started:

Try This Clean Slate Exercise

Spend a few minutes today to check your course.

By Ed Mendlowitz

Tax Season Opportunity Guide

We all get caught up with what we do. Sometimes so much that we lose sight of what we are doing and the purpose.

MORE ON TAX SEASON: Offer Your Tax Clients Other Services | Can Your Tax Reviewers Answer These 10 Questions? | The Top 12 Mistakes in Tax Return Preparation | Six Types of Person: Which Are You? | Answer These Two Questions First | Help Your Tax Clients, Help Yourself | What’s Your Value to Your Tax Clients? | Are You Excited About Tax Season?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Also, work happens. Many of us start out with lofty plans that go astray as the practice develops. Many things cause it – clients we get, availability or lack of availability of the right staff, how we choose to learn or not learn new things, and even where we locate.

READ MORE →

Refunds Up as Tax Pros Tackle 41.5% of E-filings

* Total refunds issued represent returns received and processed in 2024 – the current year only. The number of direct deposit refunds represents returns received in the current and prior year but processed in 2024.

Also: The IRS realizes a footnote is in order and we are shocked.

By Beth Bellor

Average tax refunds are on the rise, so the weekly filing data has one uptick besides the amount of traffic to the IRS website – an increase that perhaps isn’t a positive.

MORE: Tax Pros Handle 37.7% of E-filings | Tax Pros File 33% of Early Returns

Exclusively for PRO Members. Log in here or upgrade to PRO today.

The Internal Revenue Service had received 34.7 million returns, down 5.7 percent from the same period one year ago, as of the week ending Feb. 16, the latest data available. Lower numbers are no surprise, of course, because there had been only 19 days in the 2024 filing season, which opened Jan. 29, compared to the 26 days there had been in the 2023 season, which opened Jan. 23.

READ MORE →