AI Generates Revolutionary New Battery Design

Will lithium-ion batteries soon be relics of the past?

By Rick Richardson

Technology This Week

Researchers have now utilized artificial intelligence’s capacity to expedite the discovery and testing of novel materials to create a battery that is less reliant on the pricey and growingly scarce mineral lithium.

MORE: ChatGPT Is Getting Humanlike Memory | Lenovo Readies New ThinkBook Laptop with a Transparent Display | Microsoft Moves Further into Nuclear Development with New Director | Tack One Launches New Location Tracker for Children and Seniors | Windows Is Now an App for PCs, Apple Products | Bill Gates Says America Has a Math Problem | What Is an HEIC File? | Congress: Tax Prep Companies Shared Private Data with Google, Meta for Years | What an A.I.-Powered Workforce Means for Accountants

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Lithium-ion batteries power numerous everyday items, as well as electric cars. Additionally, batteries are needed to store renewable energy from solar panels and wind turbines. Therefore, they would be an essential component of a green electric grid.

READ MORE →

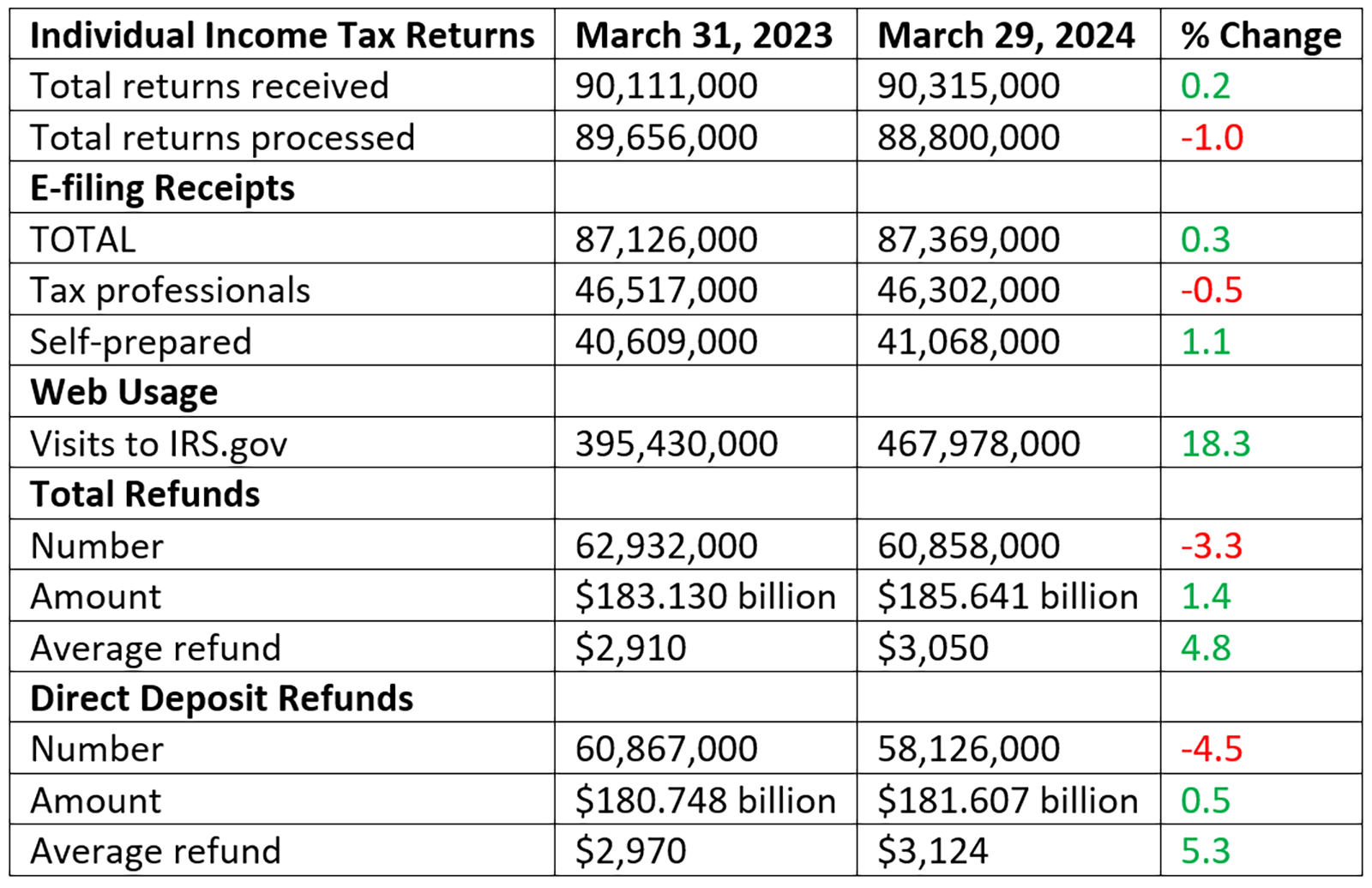

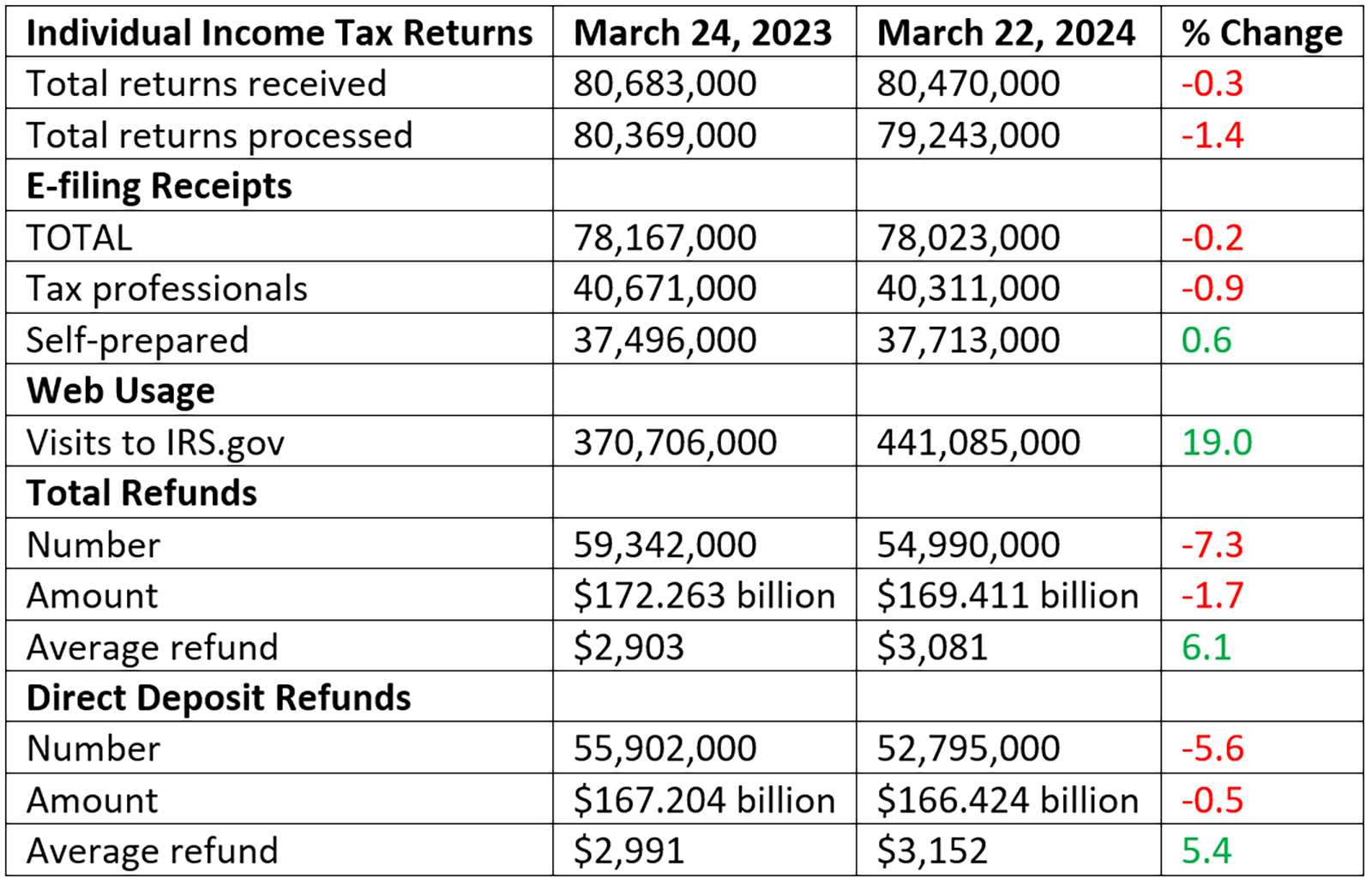

Refund numbers are down but amounts are up.

Refund numbers are down but amounts are up.