Will Unclogging the Accounting Pro Pipeline Kill Mobility?

Changing the 150-hour requirement could have unintended consequences.

By CPA Trendlines Research

The day-to-day of the CPA may be grueling at times, but one thing makes the day a little easier – the facility of mobility.

Not only can a CPA with a driver’s license in one state drive in other states, but in most cases, they can practice their profession in other states, too. If you’re licensed to practice in one state, you’re good to go in every other state except, coincidentally, the one you can’t drive to.

MORE: Accountants Cozy Up to Clients with CAS | Accountants Torn Over 2024 Economy, Offer Advice | Are You Offering the Right Services? | 42% of Accountants Turn Away Work Over Staff Shortages | Talent Gap Widening: Be Very Scared | Looking for Recent Grads? Good Luck

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Practice mobility is crucial in a business system that often as not transcends state borders, and it’s even more important as professionals work remotely, sitting in one state while practicing in another.

READ MORE →

Cornerstone Data Points

Cornerstone Data Points

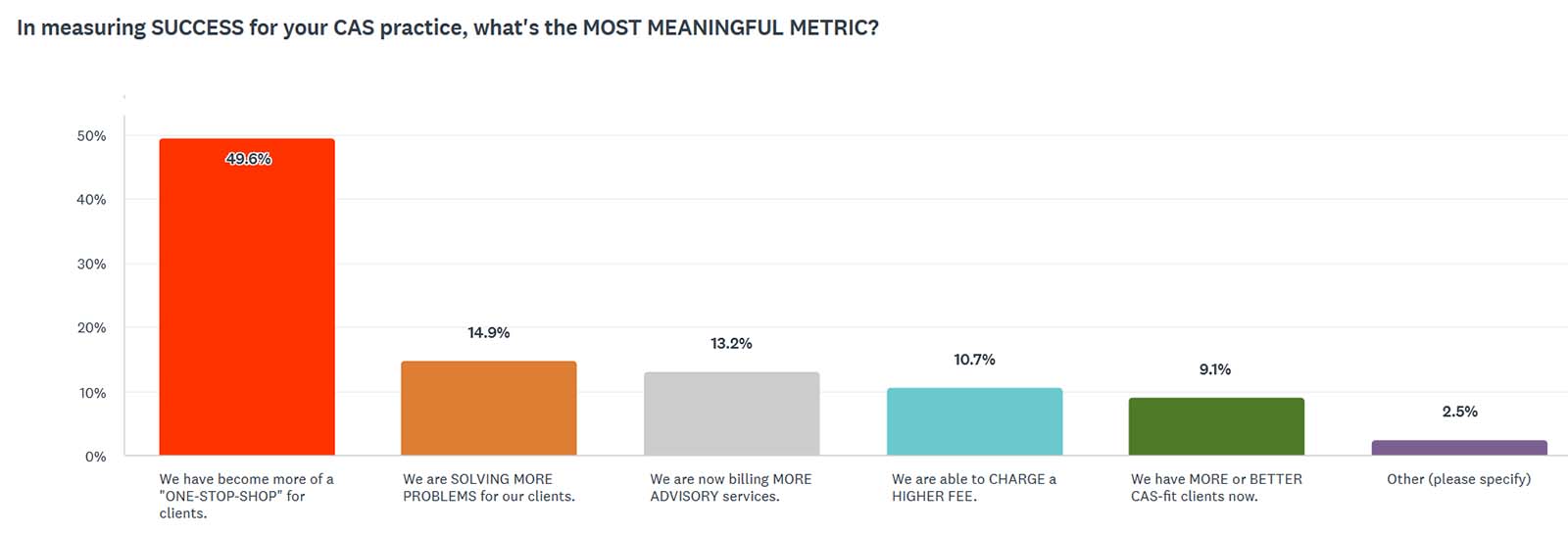

Accountants share which niches offer the best new opportunities.

Accountants share which niches offer the best new opportunities.