Firms Culling Clients as Staffing Woes Persist

Others tap outsourcing, training clerical staff as solutions.

By CPA Trendlines Research

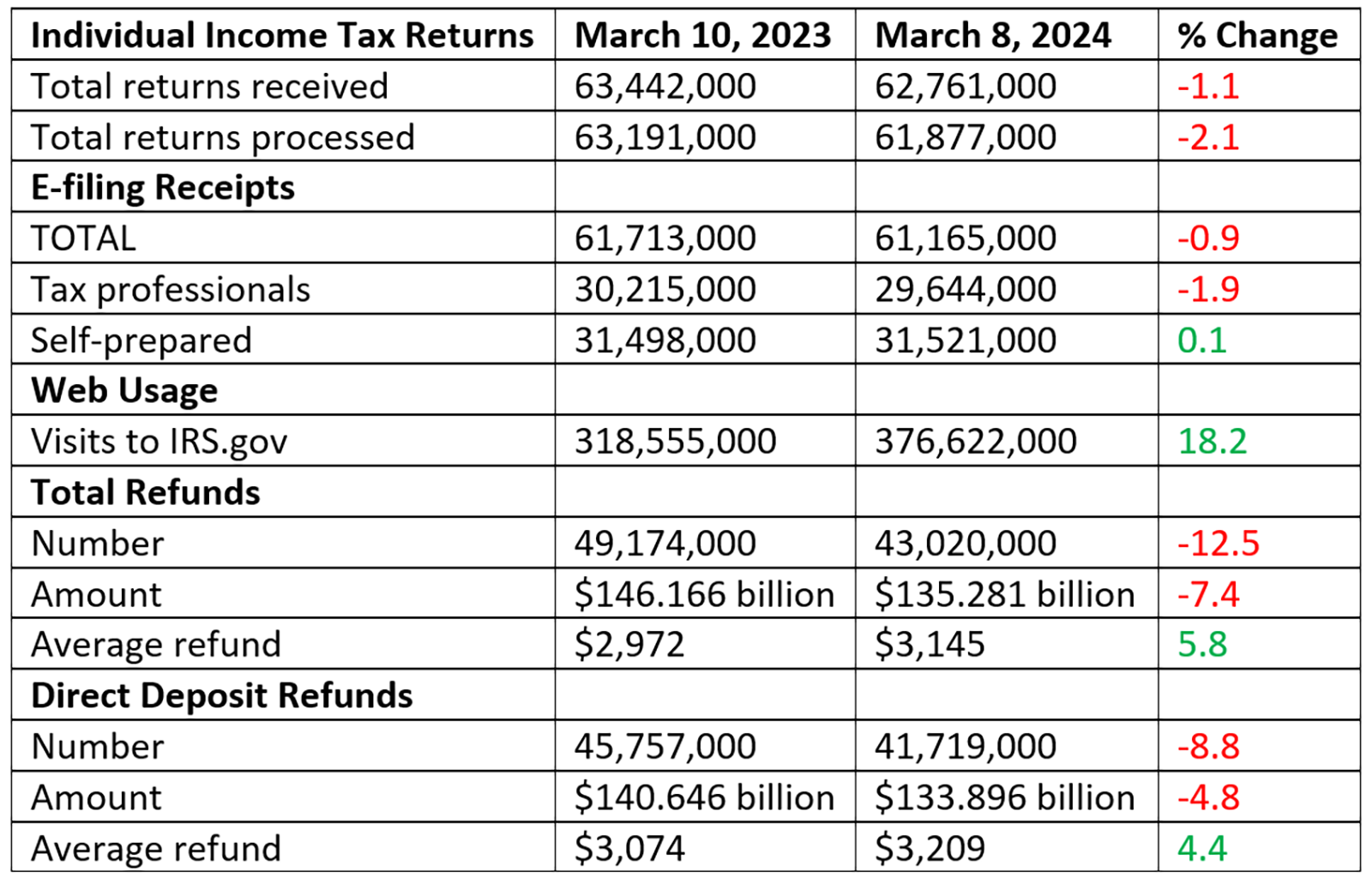

Early results from the CPA Trendlines 2024 Busy Season Barometer: Emerging Issues, Opportunities, and Trends are showing a painfully persistent problem with staff shortages, though it seems the hardship may have improved a bit since last year.

MORE: Revenue Up at 59% of Accounting Firms … and More Good News | Compensation’s Up, but Up Enough to Retain Staff? | Are Accountants Charging Too Little? | ChatGPT for the Reluctant Accountant | CPAs Needed to Help Small Biz Adopt AI | Revenue Growth Is Top Priority for Small Firms | Is the CPA Business Model the Clog in the Pipeline?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

This year, like last year, survey respondents are reporting staffing as the second most common concern. Last year, it was reported by 47 percent, almost tied with the main concern: late or unprepared clients.

This year, uncooperative clients still rank first, at 50 percent, but staffing concerns have dropped to 37 percent.

READ MORE →