TaxPlanIQ Escalates the Battle in Tax Planning Software

AI transforms tax planning, strategy, and client communication.

Logo |

Vendor |

Years in Market |

Flagship Features |

Pricing (Approx.) |

Fit |

|---|---|---|---|---|---|

|

TaxPlanIQ |

2019–present |

Bulk 1040 upload, AI-scored strategies, ROI pricing, client proposals |

From $397/month |

Firms moving into advisory |

|

Corvee |

2020–present |

1,500+ strategies, multi-entity modeling, annotated proposals |

Quoted ($499–$999/mo) |

Firms needing a broad catalog |

|

Bloomberg ITP |

Longstanding |

Scenario projections, statutory updates, and audit-defensible |

Enterprise license |

Midsized and large firms |

|

Holistiplan |

2019–present |

OCR return scan, advisor reports |

Subscription |

RIAs, small CPA and tax firms |

|

FP Alpha |

2019–present |

Multi-document AI, tax/estate/insurance scenarios |

Subscription |

Wealth + tax advisory |

|

Intuit Tax Advisor |

2025–present |

Embedded in ProConnect/Lacerte, generative AI plans |

Included in suite |

Small and midsize firms |

|

Blue J |

2015–present |

Predictive analytics, Ask Blue J generative research |

$1,198–$1,498/user |

Authoritative research |

|

CoCounsel (TR) |

2025–present |

Agentic AI integrated with Checkpoint |

$2,700/user |

Large firms |

|

TaxGPT |

2023–present |

AI co-pilot, 1040 review agent |

$1,600/user |

Assistant-style workflow |

|

Taxaroo |

2017–present |

Practice management + voice AI, client portal |

$790/yr or $99/mo |

Small practices |

|

ZeroTax.AI |

2024–present |

Consumer AI Q&A, optional CPA review |

Free / $50 per review |

Households, small business |

|

CPA Pilot |

2023–present |

Lightweight AI assistant, citations, draft comms |

$240–$2,388/yr |

Small firms; affordable AI |

Movers and shakers in tax planning automation

By Rick Telberg

CPA Trendlines Research

Once an add-on service for high-net-worth clients, tax planning is moving to center stage, powered by artificial intelligence and the profession’s accelerating shift to advisory from compliance.

Fresh evidence comes from TaxPlanIQ’s new partnerships with Liberty Tax and Elite Resource Team, which extend TaxPlanIQ’s reach from boutique firms to thousands of retail outlets and nationwide advisory networks. The deals show artificial intelligence transforming accountants’ handling of tax planning, strategy, and client communication.

MORE Tax Planning | Disguised Tax Hikes Are Back on the Table | Haase, Radzinsky: Inside the TaxDome-Juno AI Alliance | Can DOGE and Palantir Fix the IRS with a ‘Mega API’? | Help Clients Envision Their Future Selves

“I can’t imagine a better thing to do than support accountants in that endeavor,” says Jackie Meyer, founder of TaxPlanIQ and CPA Trendlines contributor, positioning her company’s mission personally. TaxPlanIQ’s pitches ease of use. Just upload a 1040, surface strategies, and deliver a branded proposal that quantifies return on investment.

With Liberty Tax, the reach is in the mass market. With ERT, the audience is higher-value clients served by coordinated advisory teams. TaxPlanIQ claims $5 billion saved by clients identified through its system. More than 1,200 firms already use the platform, before the new partnerships,

Reaching for a $2.5 billion prize

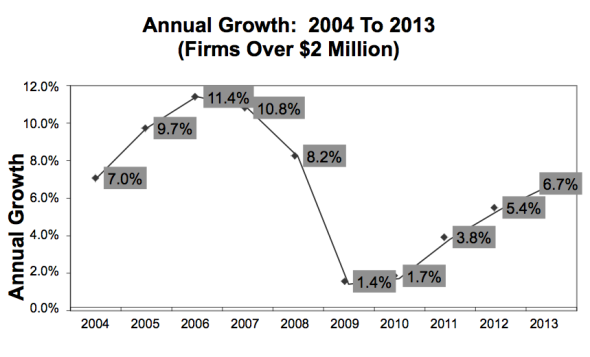

The promise of the next evolution of tax planning is enticing, and the field is becoming more competitive by the month. The tax planning software market is projected to grow at a rate of 8% to 13% annually from 2026 to 2033, with the total market size expected to surpass $2.5 billion globally and $25 billion for the broader online tax software segment.

One question leads to another.

One question leads to another.

16 ways to tweak your compensation systems to get and keep the right clients.

16 ways to tweak your compensation systems to get and keep the right clients. QUESTION: I am the managing partner of my accounting firm by default. No one else wanted to do it. I am trying to manage things but I have a full schedule, am shorthanded on staff and continue to do a reasonable amount of marketing. I am overwhelmed. How do others do it?

QUESTION: I am the managing partner of my accounting firm by default. No one else wanted to do it. I am trying to manage things but I have a full schedule, am shorthanded on staff and continue to do a reasonable amount of marketing. I am overwhelmed. How do others do it?