OUTLOOK: A 40-Hour Workweek Is Feasible

Business development can be done remotely, but it can’t be skipped.

By Carl George

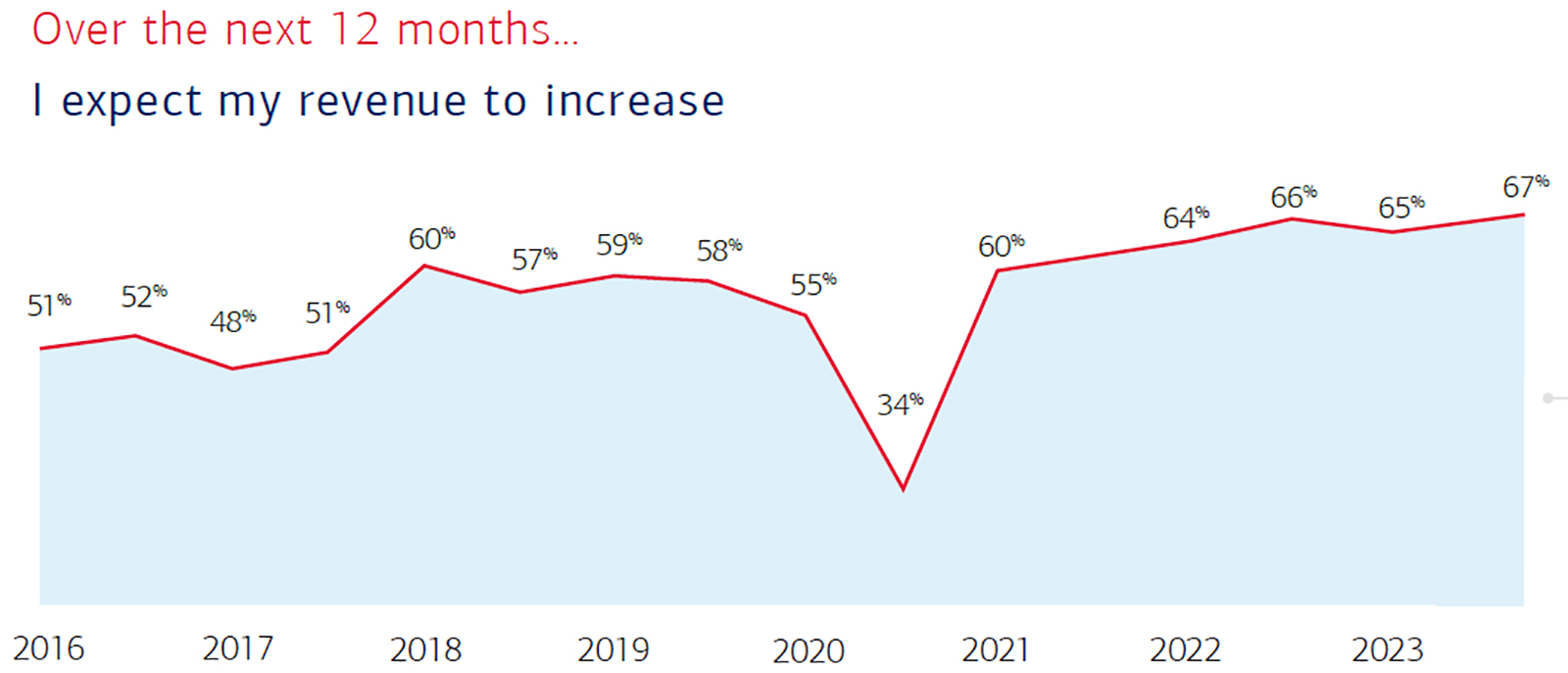

The Rosenberg MAP Survey

EDITOR’S NOTE: Every year, the Rosenberg MAP Survey asks the industry’s top consultants to share their observations from CPA firms across the country. How do you think the next 12 months will unfold? Also, how would you assess the last 12 months?

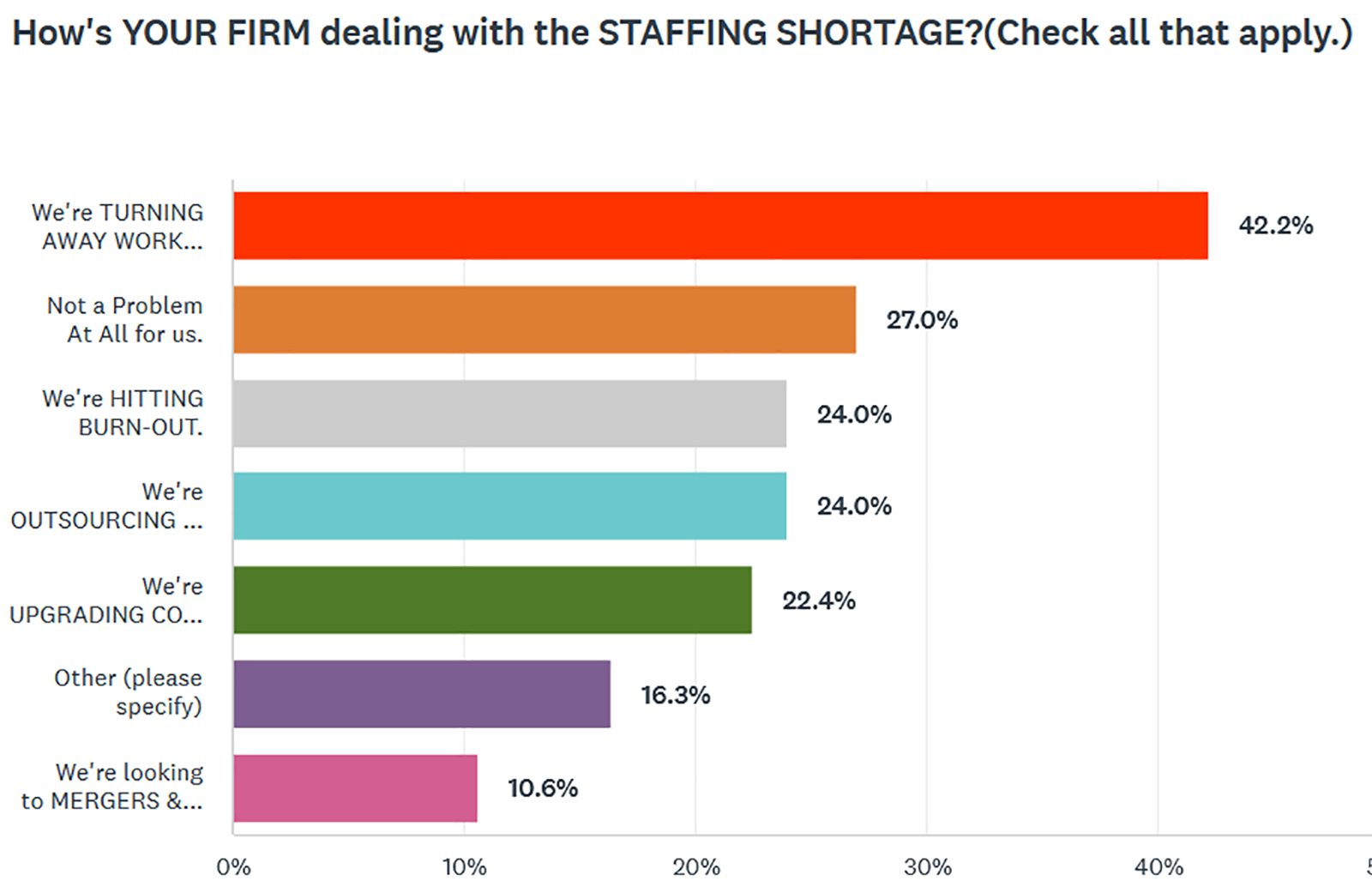

Firms will continue to upgrade their client profiles and disengage from clients that no longer fit. Disengagement is one of the major initiatives that must occur to meet the challenge of the “40-hour guarantee.”

MORE: Five Ways Staff Shortages Are Changing Firms Forever | OUTLOOK: Soft Skills Are Front and Center | OUTLOOK: It’s Time for a New Business Model | Rosenberg MAP: Partner Incomes Surge 11.4%

Exclusively for PRO Members. Log in here or upgrade to PRO today.

As it was explained so eloquently by a CEO of a large firm, “We do not have a staffing shortage, we have a ‘D’ client overage!” Well said. Traditionally difficult for us to do, but we do not have the option of not executing this critical strategy.

READ MORE →