Where Is Your Next Money Coming From?

Five questions to help forecast your firm growth.

Five questions to help forecast your firm growth.

By Martin Bissett

Passport to Partnership

If I could give you one tip that would assure that you could predict your consistent practice growth, it would be to look at your calendar.

MORE: Forged in Fire: The Pains of Leadership | Perception Is Reality, Client Version | 10 Questions for Reconsidering Your Prices | Would You Make Yourself a Partner? | A List Is Not a Pipeline | Prepare the Next Generation Now | Are You Committed to Your Firm? | Nine Points to Check Before Hello | Why Clients Struggle with Growth

Exclusively for PRO Members. Log in here or upgrade to PRO today.

You need to look at what is on your calendar and to look at today’s date and ask, “Where is the money coming from this month?” Look at what recurring fees you have, look at the value of those fees and what they bring in. Then consider what would happen if any of those fees did not recur. Look at what would happen if those fees dropped out of the equation and think about how you would replace that income.

READ MORE →

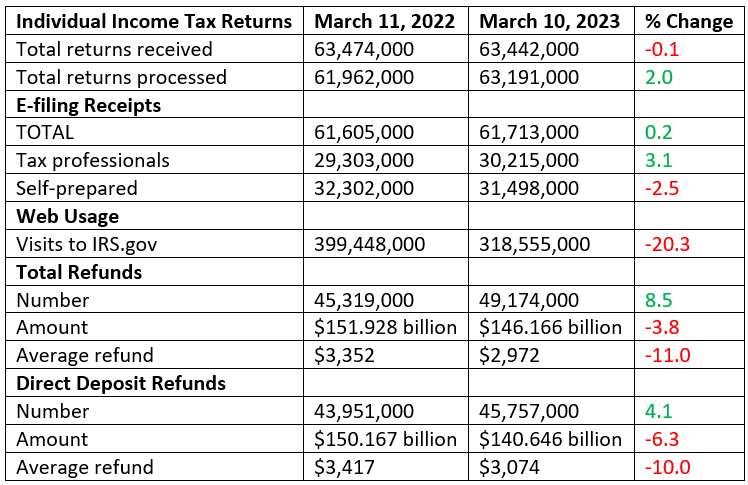

Average refunds are down by double digits.

Average refunds are down by double digits.